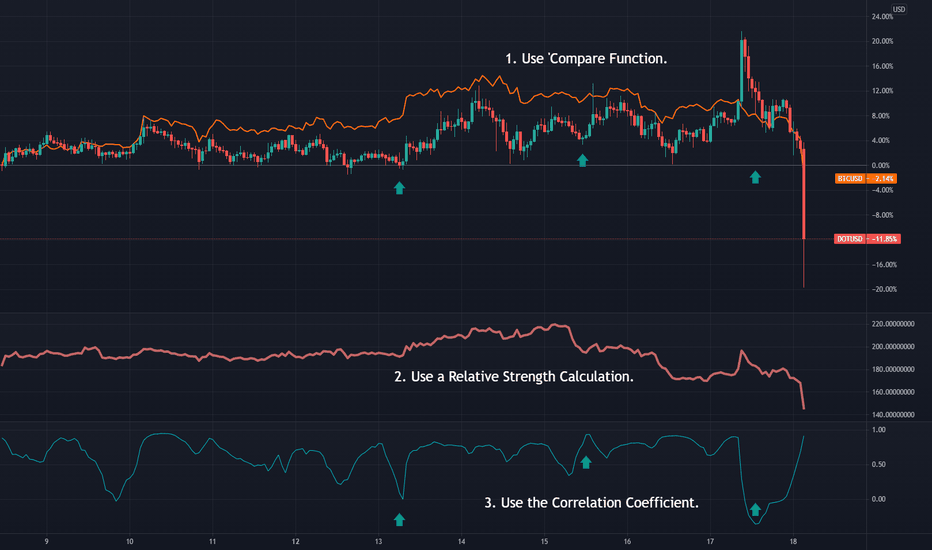

All trading requires an understanding of how markets are related. Understanding these relationships will put you ahead of others that don’t get it. Mean reversion and spread trades require a deeper understanding of how markets move together and how these relationships change. Like the weather, the degree of correlations, lag, convergence/divergence change all...

Beware of sharp moves that happen in low volume periods (weekends). Reversals are easily triggered.

Could Cardano (ADA) be playing out a pennant or a flag? It's very old school TA, but both are continuation patterns (bullish). Just keep an eye on that ATR. You really want to see volatility come in before betting on a big move. It's not a rule set in stone, but a greater fall in volatility suggests a bigger move can follow.

There's a nice picture forming on the 2hr chart showing $60k to be pivotal for the short term. The bearish measured move from H&S top is about $60,000. 50% retracement from recent low to recent high is about $60,000. And $60,000 level was previous significant resistance. Remember, technical levels need not be exact. It can be an area or tight range -...