Hello traders, In today’s analysis we’re focusing on the open CME futures gap left behind by Bitcoin between $79,610 and $83,925. Historically, these gaps have a strong tendency to be filled — not always immediately, but eventually. This gap now acts as a magnet for price and should be considered in any short- to mid-term trading strategy. Key Points: • The...

Hello Traders, The price of SUI-USDT has been locked in a consistent downtrend, marked by a series of lower highs and lower lows. However, the asset is now testing a critical support level that could determine whether we see a relief bounce or a continuation of the decline. Key Highlights: • Price is approaching $1.75, a major support zone with confluence from...

Hello Traders, In today’s Bitcoin update we are focusing on the weekly timeframe, specifically the high time frame trading channel that has played a key role in guiding price action. We previously had a bullish wave count that pushed price above the channel, completing a wave 5 impulse to the upside. However, that breakout has now failed with price closing back...

Hello traders, In today’s altcoin update we’re looking at FunUSDT on the weekly timeframe. Price action is showing signs of strength, currently respecting the point of control and trading above the value area low, which is providing a strong technical base. Key Technical Points: • Break Above Value Area High: Price impulsively moved through the value area high...

Hello traders, Taking a closer look at the SPX500 and discussing whether the market has found a bottom or if there’s further downside ahead. From a technical perspective, price action is still showing signs of weakness, with critical support levels yet to be tested. Key Technical Points: • Bearish Expansion: A key swing high formed before price broke structure...

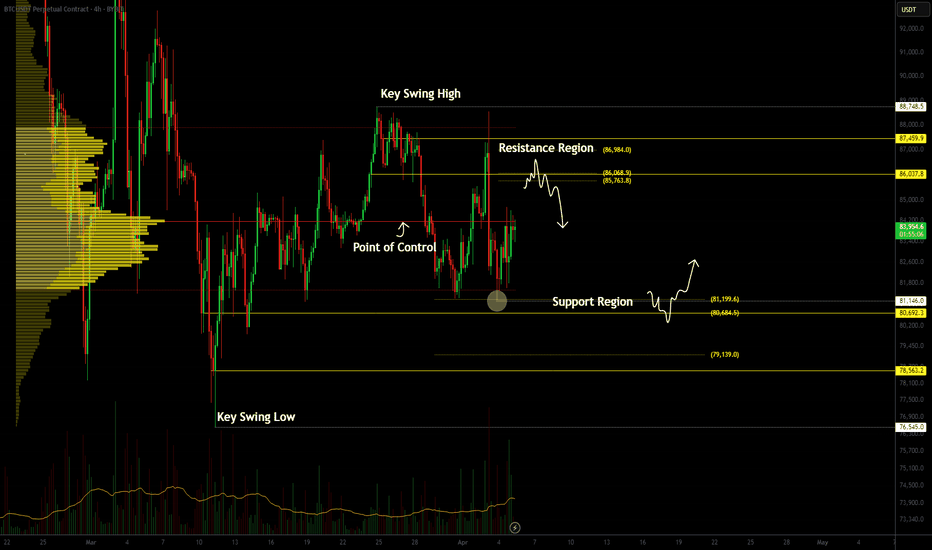

Hello traders, Today we’re focusing on Bitcoin’s intraday timeframe to identify potential trade setups and key price levels. Over the past week, BTC has been moving sideways, forming a defined intraday range. Understanding this structure can help us anticipate likely rotations and plan trades accordingly. Key Technical Points: • Established Range: High at...

Hello traders, In today’s altcoin analysis, we’re taking a closer look at Ripple (XRP) on the daily timeframe. XRP is currently sitting at a crucial support level, and the technical structure is showing signs of potential weakness if this level breaks. Key Technical Points: • Head & Shoulders Pattern: Price is forming a textbook head and shoulders with price...

Hello Traders, Bitcoin’s price action is currently respecting key volume levels, aligning with market auction theory. This concept suggests that price tends to rotate between value area high (VAH) and value area low (VAL), using the point of control (POC) as a midpoint. With price recently rejecting the VAH, the probability of a move lower has increased. Key...

Hello traders, in today’s Bitcoin analysis, we are going to look at recent price action developments and the rejection that occurred in the past 12 hours. Bitcoin remains within a descending triangle, printing consecutive lower lows and lower highs. The latest move saw an impulse pump into the 0.618 Fibonacci level, aligning perfectly with the descending channel...

Hello traders, in today’s analysis we are going to discuss Solana on the monthly timeframe. Solana is approaching a key area of support where multiple technical factors align. This level could provide a strong base for a potential swing trade setup, targeting a move back toward the previous highs. If buyers step in and defend this zone, it may confirm a broader...

Hello Traders, Today, we’re analyzing SUSDT (SonicCoin), which is currently trading within a descending channel—a bearish pattern where price tends to gravitate toward key boundary points. Recently, price action was rejected at channel resistance, an area that confluences with the value area high at 0.6185. This rejection has shifted the previous uptrend into a...

Hello Traders, In today’s analysis, we are focusing on Bitcoin’s intraday price action and discussing Elliott Wave theory to evaluate the possibility of a correction from the current region. After a bullish expansion, Bitcoin has now completed a full 1-2-3-4-5 Elliott Wave cycle. The recent pullback suggests that price action is entering an ABC correction phase,...

Hello Traders, in our second update for today, we are taking a closer look at Ethereum (ETH) on the higher time frame following the recent monthly close. The price has seen a strong bearish expansion from the $3,700 resistance level, pushing ETH into the 0.618 Fibonacci retracement zone, with the Value Area Low (VAL) of the high time frame range sitting just...

Hello Traders, in this update, we are analyzing a new potential harmonic pattern forming on Bitcoin—the Shark Harmonic. This pattern is developing based on the recent rejection from the 0.618 Fibonacci retracement, which signals a possible move toward the 0.618 Fibonacci support. If this level holds, it will confirm the C-leg of the pattern, setting up a potential...

Hello traders, welcome to another Bitcoin update. In previous analyses, we discussed the potential for an equilibrium-style price action forming on the intraday time frame. This pattern is now taking shape in the form of a triangle formation, where price is expected to test the lower boundary for an intraday bounce. However, this test has not yet occurred, and...

Hello traders, In today’s analysis, we are focusing on HYPE USDT, which is currently testing a critical support level. If this level holds, it could increase the probability of a rotation back toward the highs. However, if price fails to hold and breaks lower, further downside could be expected. The key swing low and range low are aligning with the Value Area...

Hello traders, In today’s analysis, we will explore a potential trade opportunity on Hyper Liquid USDT, focusing on key technical levels and entry conditions. Current Market Structure & Trade Setup • Price action has been trending toward lower support following a strong bearish rejection from the key swing high. • Currently, Bitcoin is testing the Value Area...

Hello traders, Today’s analysis focuses on the CME futures chart, providing an update on the latest price action. Since our last update, the gap has been filled, but notably, Bitcoin has failed to show any significant bounce that would indicate buyer strength. Instead, price has closed through the gap and is now trading below this level, signaling continued...