The_STA

PremiumToday we’re focusing on the euro versus the US dollar, which has recently experienced a sharp sell-off. The move appears directional and is now approaching a key support zone, defined by: • The April high at 1.1573 • The June low at 1.1556 • The 55-day moving average at 1.1536 A daily close below 1.1536 would be required to confirm further downside momentum. At...

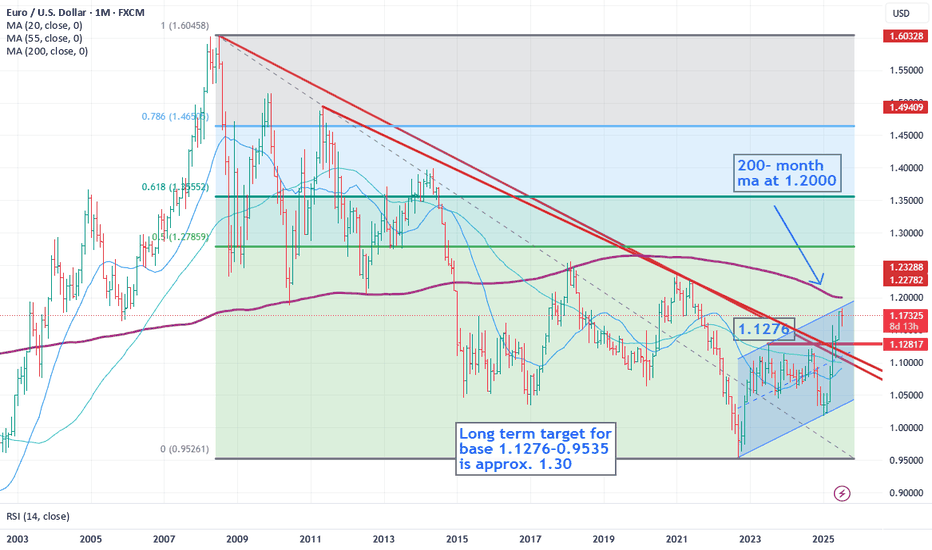

The euro just popped above $1.17 as optimism grows around a potential US-EU trade deal, following the recent US-Japan agreement. 📊 From a technical perspective: • The euro found support at the April high of 1.1573, rebounding sharply — a strong sign that the bull trend is still intact. 🚀 • Next resistance levels to watch: o 1.1830 – July’s high 📅 o 1.1850 – Top of...

We’re taking another look at #Bitcoin, which has surged higher and broken above its long-term channel — a move that’s caught the attention of many market watchers. 🔍 Key technical insights: ✅ The recent consolidation appears to be a midway pause in the uptrend. By measuring the preceding flagpole and projecting from the breakout, we derive an overall target near...

Bitcoin has just broken out above its recent consolidation pattern, staying firmly in an uptrend and finding solid short-term support at its 55-day moving average. We're now pushing toward the previous high at 112,345, chipping away at that level. Once cleared, our eyes turn to the weekly chart, which reveals a 4-year ascending channel — with the top sitting...

Technical analysis is not your decision-making process — it’s a tool to help you structure better trading decisions by studying past price movements to anticipate likely future moves. 👉 Every time you look at a chart, you should decide: ✅ Do I want to trade at all? ✅ What’s my entry? ✅ Where’s my stop (when does my thesis fail)? ✅ What’s my target (where will I...

We’re back looking at the #Bitcoin chart. While BTC stays above the 55-day MA (currently at 101,116), we remain overall bullish. But here’s the catch: 🔍 What I’m watching: • The MACD is still below zero — no clear buy signal yet. • The RSI is encouraging (above 50), but… • 📉 No surge in volume = caution. • DMI also not giving a strong green light. 👉 So, we might...

Mastering Bitcoin Trends with the 55-Week Moving Average: A KISS Approach to Trading I want to emphasize the KISS principle—and provide an example of using the 55-week moving average (MA) on the Bitcoin chart. This is a great demonstration of how simple tools, when applied with consistency and insight, can be incredibly powerful. Here’s a breakdown of how and why...

The Bank of England is widely expected to hold interest rates steady, with markets pricing in nearly two cuts by year-end, according to LSEG. ING’s Pesole notes the BOE may endorse this outlook — but warns risks lean toward signalling even more cuts, thanks to soft UK data lately. 📈 FX Check: • EUR/GBP flat at 0.8548 • GBP/USD steady at $1.3417 📊 Tech View on...

Global markets tread cautiously today amid rising Middle East tensions and investor jitters ahead of the Fed’s policy decision. Israel’s continued airstrikes on Iran, now in their 6th day, are weighing heavily on sentiment, with European stocks and oil prices lacking direction. 📊 US Dollar Watch: Traders are closely eyeing the U.S. Dollar Index (DXY) weekly...

U.S. stock index futures rose Monday, buoyed by easing oil prices, even as geopolitical tensions between Israel and Iran simmer in the background. All eyes are now on the upcoming Federal Reserve meeting. 👀💼 But here’s the catch on the S&P 500 👇 🔹 Price is stalling at a resistance line, tracing back to March highs 🔹 Daily RSI shows major divergence, signalling a...

On Friday, the platinum market printed a key day reversal — a classic signal that a short-term correction may be underway. 🔍 In our analysis posted Thursday, we highlighted the 55-hour moving average as good place to place a stop level in a runaway market. Fast forward to now: that level has been decisively broken, along with a drop below the cloud on the hourly...

Any disruption to Iranian oil supply could prompt OPEC to boost output quickly, says ING's Warren Patterson. But there's a limit to how much the cartel can buffer the market—especially if tensions escalate in the Persian Gulf, where most of OPEC's 5M bbl/day spare capacity sits. 🛢️ The Strait of Hormuz is critical—any supply shock here could trigger a global...

Today we’re diving into what to do with your stops in a runaway market 🚀📈 Just 4 days ago, we talked about the platinum market breaking higher — and wow, what a move it’s made since then. So, the big question is: 👉 Where do you place your stops now? Here’s my approach: 🔍 First, I check the long-term time frame. We're heading toward 1348 — that’s the 2021 high, and...

Today, we're analysing Platinum Futures – and the market is showing some major technical shifts. On the weekly chart, we’ve seen a sharp rise, pushing prices to new 3-year highs. Switching to the monthly chart, the picture gets even more compelling: 🔹 We've broken above two significant long-term downtrends — one dating back to 2008, and another from 2011. 🔹 The...

Spotted a textbook bullish setup on the weekly Gold chart using the Ichimoku Cloud 👇 ✅ Price is above the cloud – indicating a strong bullish trend. ✅ Chikou Span (Lagging Line) is above the cloud and the price – confirming upward momentum and price strength. This alignment suggests a high-probability buy opportunity according to classic Ichimoku...

Looking at the daily chart of the S&P 500 with the 200-day moving average (turquoise line), you could build a very basic—but often effective—trend-following system: ✅ Price above the 200-day MA = Bull trend ❌ Price below the 200-day MA = Bear trend 🔄 Price oscillating around it = Possible trend change ________________________________________ 📊 Current Setup: We’ve...

Top or Consolidation? Here's My Take... It's not crystal clear — I can see the case for both. But after years of chart-watching, this doesn't quite look like a top to me: • Lacks symmetry • Had chances to break down, but no real follow-through 🧭 Where are we headed? I think pressure remains, and we could dip toward the 50% retracement of the 2023 move — that’s...

The Bitcoin chart continues to look constructive, showing strength within a long-term uptrend that’s been in place since 2021. 🔍 While the daily chart may not tell the full story, a look at the weekly chart reveals the bigger picture: ✅ Price recently bounced off the 55-week moving average ✅ Structure remains intact and bullish ✅ The market looks well-positioned...