The_dumpster_diver

acb i see it as a non-correlated asset play. great growth business. hands off fed is exactly the kind of environment these kind of assets out perform in. im bullish

things have been pretty blah here. but now we're beginning to break to the upside. silver is wanting a dovish powell. i agree with silver, lets find out how dovish powell is

part of my studies into hacking order flow. WPM makes up roughly 20% of the sil etf and comprises a major holding in other major metals etfs. that being said money flow is not equally distributed and is based on a certain weighting. this is the same concept of how i played BA from december melt down. the idea is to capture the uneven distribution based on the...

I'm expecting Ba to stay in consolidation around those two points. The more it clips resistance the more likely it is to break it. The float on BA is extremely small and competition in it's field is beyond minimal. Long term I'm very bullish but am taking advantage of this range bound action. With uncertainty high. I suggest premium strategies until IV percentile...

Punched through long standing resistance months in the making. Looks like snap is about to snap back

not much to say on this one except awe yea

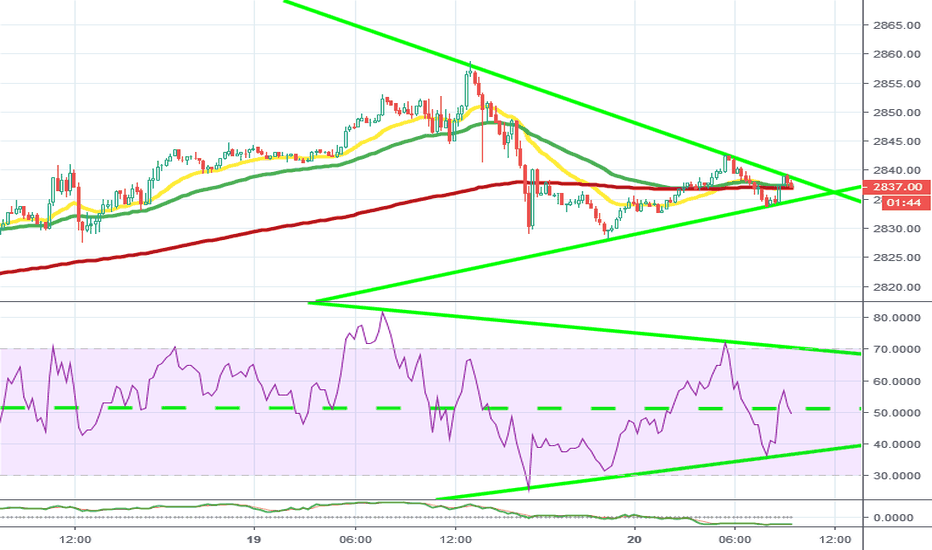

Gold bonds equities and commodities are wanting to hear j Powell say uncle this coming fomc rate rise decision. There's a 100% chance of a rate rise. Prepare for awesomeness

IV in tesla has always been very generous. if you want to play i suggest premium selling strategies like bear puts or possibly buying wide bull calls this is a similar setup to oct 8th. im waiting til next month open. this consolidation may take a few weeks but looks monsterous taking in account how small tsla's float is

gold, silver, and bonds want to hear powell say uncle. rather playing any i prefer to choose the biggest holdings within those sectors. one stands out to me option wise, asset allocation wise, and pattern wise. wpm is about to make itself at home in ranges not seen for some time.

bought 5 8.50 puts for .05 a piece. hedged to long a cgc call. lets see what happens

watching rates and bonds duke it out. gold will be an unfortunate victim

currently we're outside the expected range for spx. so i suspect after fridays round of dividend dates we're likely to fall back into the expected 1 stand deviation. no need to worry. we've hit a technical milestone. the 50 ma has crossed above the 200ma. todays news out of the energy sector should make longs feel extremely comfortable with the melt up we're...

todays crude reports offically are putting to bed most if not all global growth concerns i previously had. if anything seeing demand-following supply growth i feel more optimistic that the "reflationary period" mentioned in past posts is working. although there are some divergences (nobs and equities) we avoided a big boo boo. things that can revert us back are on...

volatility is very rich in mu both on a IV percentile and IV rank. best way to take advantage is by raking it in. via credit spreads. in this play obvious trend support. im wanting to make an iron condor, but i feel its fairly obvious there will be a bounce based on net skew. so here are my targets. since the skew is equally weighted but near a major trend...

ba has hit a bottom in my opinion. this is a $500 stock as simple as that. it is a duopoly and its main competitor is being handicapped at the moment. although there's uncertainty i suggest keeping in mind the moat that BA has built around itself. how do we play like buffett. 2 ways. if you've got the caps and arent affraid of owning the stock i suggest a cash...

Skew is the difference in spx iv of equal Delta. like call Delta 30 iv minus put Delta 30 iv. It shows how the oi chain is balanced and underlying psychology. Current rating of 132 I would deem caution. One of the things I look for when playing bearish is a rising skew but falling vvix. Rising skew= odds of an outstated move increase. Falling vvix premium of...

brexit=global growth scare.entered short on slight OVX pop. feel oil imports (our need for heavy crude due to venezuala) may make oil prime real estate for the brexit trade