EURUSD didn’t give us any trade setups yesterday and is still respecting the short-term bearish trendline. Price has remained below 1.17500, acting as resistance, and hasn’t given confirmation for buys. We’re still watching the same key zones: ✅ Safe buys: Above 1.17500 if we get a solid break and bullish close. ✅ HRHR buys: Retest of 1.16898 (Wednesday's low)...

USDCAD’s high-risk, high-reward (HRHR) sells from Wednesday are still in play with price currently up 35 pips. Price action remains within the structure as we continue to respect the March trendline, but are now stalling in a tight 4H range. 📍 Key Observations: 1.36647 is acting as strong intraday support Possible retest of yesterday’s or Wednesday’s high could...

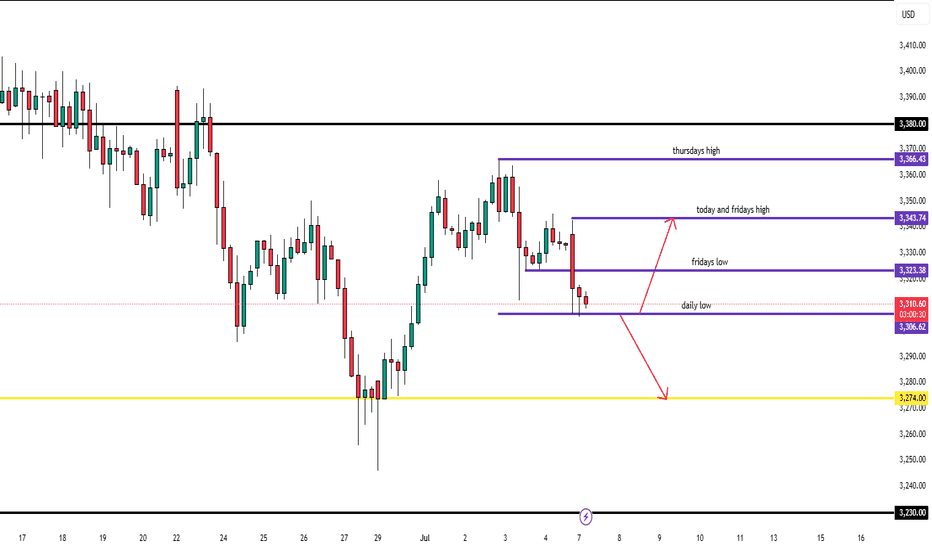

Yesterday’s price action gave us a clean 200 pip run from the break and retest of 3308, and today we’ve already caught 140 pips using yesterday’s high (3317.17) as intraday support. But now we’re sitting at a critical inflection point. 📍 Key levels: Safe Buys: Only looking to buy above Tuesday’s high of 3345.74, which gives room for a clean 200-pip move up...

The 4H trendline held again yesterday, and today’s daily candle continues to form within a bullish flag, giving added confluence to our overall bullish bias. I no longer expect a deeper pullback to 1.16299 — price action suggests momentum is building. Here’s the game plan: 🔹 For Scalpers: Break of current high → 1.17500 (~20 pips) Break of 1.17500 → 1.17657...

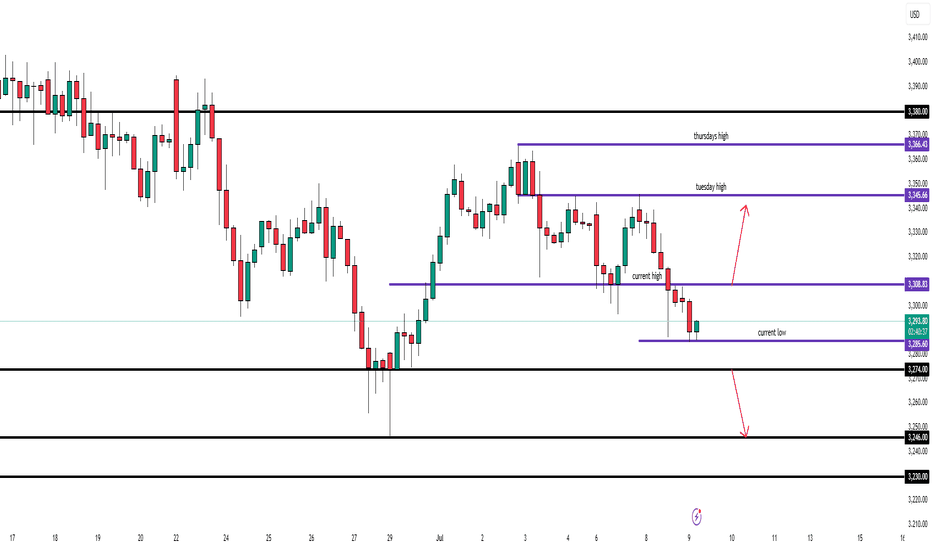

Yesterday’s clean rejection from 3328.76 gave us a profitable 300+ pip move down to 3298. Today, we’re seeing a potential double bottom near 3284.61 — the same level price held during yesterday’s drop. 📌 What I’m Watching: 🔼 Buy Setup: Break above today’s high → bullish continuation to 3345.66 ➤ Estimated 300+ pips upside 🔽 Sell Setup: Break of today’s low =...

After breaking Thursday’s low, EURUSD gave us 30 pips then started ranging right at that level. Today’s price action is mildly bullish, but likely just a retest of the 4hr bearish structure that’s formed. 📌 Key Levels: 🔼 Safe Buys: Above 1.18075 (strong resistance) → Breakout = ~70 pip opportunity 🔽 Sells / Deeper Pullback: Below 1.16869 → Potential 60 pip drop...

Yesterday USDCAD closed strong bullish (+100 pips) into the March 2024 trendline, which it’s respected multiple times this year. But there’s a key detail: ➡️ Today’s high is a pip away from yesterday’s — and there’s no upper wick. That makes this a liquidity risk zone. 📌 What I’m watching: 🔻 Break of 1.36383 = potential shift to bearish intraday structure →...

Price action confirms resistance at 1.17905, now tapped on both Friday and today. Current View: Bullish bias remains intact long-term Short-term: Expecting a deeper pullback Range forming between 1.17170 – 1.17905 Scenarios: Break below 1.17170 = Likely move to 1.16020 (previous swing low) Break + close above 1.17905 = Clean continuation to 1.18791 While...

Gold is sitting on a knife’s edge as we enter the NY session. Current price action: Rejected twice at 3307 on the 4hr Broke Friday’s low Now approaching today’s low Scenario 1 – Bearish: Clean break below current 4hr low → target: 3274 (323 pips) This is a key higher timeframe swing level, last tested in May Scenario 2 – Bullish: If we reject current lows...

Bias: Still bullish Liquidity zone pullback: 1.16853 held as expected Next move: Watching for break of Friday's high at 1.17342 → possible retest of 1.17311 → continuation upward HRHR Setup: If price returns to 1.16853 today, it's a high risk play due to end-of-month volatility Caution: If we break below the previous 4H candle, we could range between 1.17342...

Weekly: Gold opens bullish while still respecting the Dec 2024 trendline, despite the last two weekly candles closing bearish. Daily: Currently at 3295, approaching key intraday bearish structure at 3310. Last Week’s Bounce: From 3274 delivered 220+ pips, now becoming a pivotal reaction zone. If 3310 Breaks: Expect continuation to 3344 – a 350-pip swing. If...

USDCAD played beautifully to our bias, breaking the 1.36647 safe sell level and delivering 46 pips clean before pulling back. If you weren’t already in, the pullback offered a decent re-entry window — but at this point I’m not looking for new trades today. 📌 Still Bearish Here’s what I’m watching now: Retest of 1.36647 → possible add-on entry Break and close...

Gold (XAUUSD) is slowly climbing back toward our previously broken structure around 3344, which we identified as a key retest zone. I’ll be looking for rejections here to confirm a short-term pullback before a continuation of the broader bullish trend. What I’m Watching: 🔻 Short-term sells from 3344 to 3274 ✅ HRHR Buys: From 3274 if we form support there ✅ Safe...

EURUSD has officially broken above the key 1.16020 resistance level on the 4hr chart, but price action has since gone stagnant. No strong bullish momentum has followed the break so far — a sign we may be due for a deeper pullback. I remain bullish overall, but I'm watching for two potential scenarios: ✅ Safe Buy: Clean 4hr bullish close above 1.16020 🎯 HRHR...

Sunday’s open saw Gold gap nearly 200 pips due to rising US-Iran tensions, but the move was quickly filled as headlines cooled off. Despite the initial volatility, Gold has now broken its intraday bullish trend, closing below 3344.03. I’m now expecting a potential test of the higher timeframe bullish trendline that has held since December 2024. If price taps into...

Yesterday saw a deeper-than-expected pullback after price broke above the 1.14149 zone. Despite the retrace, structure remains bullish with price staying inside the ascending 4H channel. We’re now reapproaching 1.14149 again — a critical level for direction. To play it safe, I will only look for buys above yesterday’s high at 1.14443. Overall target remains...

🔹 Overview: EURUSD has now broken above 1.14149, confirming the next bullish leg. The daily chart shows clear momentum with a possibility of a clean retest before continuation. 🔹 Current Structure: Daily bullish breakout confirmed Previous high at 1.14149 now flips to potential support Bullish channel forming with room to expand toward next resistance 🔹 Key...

🔹 Overview: Price respected our HRHR level of 2.08585, bouncing perfectly and offering a clean 97+ pip rally. Momentum remains bullish, and structure is intact. 🔹 Current Structure: Strong bullish continuation No sign of pullback to retest entry zone Clean break above intraday resistance now opens door for safe continuation buys 🔹 Key Levels: ✅ HRHR Buy...