TogamiTrader

Let's be honest, the chances of congress not figuring out this debt ceiling problem are low, we should be positioning ourselves for the higher probability event. Disclaimer: I am not your financial advisor

The USDCAD has made a significant jump on inflation news + the FED seemingly changing their speech. However, if read the FED statements closely, they are really saying the same thing. Yes, inflation is more than they expected (big shocker...), but they still believe it is transitory/temporary. If you look at the other asset classes correlated w/ the USD/CAD, they...

With the recent rise in commodities, there has been optimism in the CAD (due to its association w/ oil), but I believe this is a false signal. Canada is in a recession at the moment (shown by job numbers and retail sales). Lockdowns are incoming. As a result, I think this is a bull trap. I expect a huge selloff when exuberance is replaced by fear. Remember I am...

NZD/USD has slightly overshot its PPP implied exchange rate and the RSI(14) is at yearly highs (so is the price as well). I expect at least a small correction as traders wait for more economic data to justify a further move to the upside as this is a riskier asset. Disclaimer: As always, I am not your financial advisor.

The FED is projecting we need to write off this quarter as well with the surge of covid cases and at the same time, they are not contemplating an easing of Monetary Policy. Plus Biden is less likely to give stimulus to big businesses. Not only that Trump is most likely going to be dormant for the last 2 months of his presidency, so signs of stimulus seem bleak. ...

With the recent lookdowns, I suspect the OPEC announcement will be overshadowed. The price has started to approach a major price zone and I don't see it holding. Remember, I am not your financial advisor.

Let's think about this. The Australian Dollar is considered a risk-on asset who has high trade tensions with its biggest trade partner. Risk-on Equities are falling, so why shouldn't the AUD fall too. Well, the market is short-sightedly buying over the good CPI numbers which are front-loaded. I expect to see the AUD fall more in line with other risk assets. Of...

As we come closer to the election date, I expect volatility to ramp up, spiking the VIX which will set off a DXY bull rally. I also expect this current CAD oil rally to end as the hurricane news goes away. Note: I am not your financial advisor

This is a preposterous rally considering all the fundamental weight on the Aussie + the ramped-up global risk. This is due for immediate correction, if not now definitely if it goes back to all-time highs. Remember: I am not your financial advisor.

If Tesla is positive ==> they become eligible for inclusion into the S&P500 ==> a more exciting stock in the index + more attention to that already exciting stock ==> increase in the price of Tesla and S&P. Despite the target on the chart, aggressive profit-taking seems like the best approach. Remember I am not your financial advisor.

Australia is still standing after all the fundamental garbage thrown at them. This indicates a strong economic foundation. Now in an area of demand against a relatively weak currency implies a huge recovery. Disclaimer: I am not your financial advisor.

The Swiss Franc is expected to put more pressure on the USD with its monetary policy experiment finally being over. Disclaimer: I am not your financial advisor. Caution: GDP ahead

NZD's newfound strength is artificial for the most part. Let's analyze: New Zealand's GDP report showed to be better than expected, but let's put that into perspective. In Q2, their GDP was revised down and you want to convince me that this 0.7% quarter growth is significant. The yearly GDP growth is still on a convincing downtrend. Many Banks still have the RBNZ...

Just as expected, Australian investors are crying foul on the low-interest rate policy adopted by my least favorite reserve bank leader, Lowe Phillips. He is utilizing the same policy that lead the ECB into a never-ending bear market. When there is uncertainty in the global economy and you are not one of the "majors" then don't throw oil on the fire by creating an...

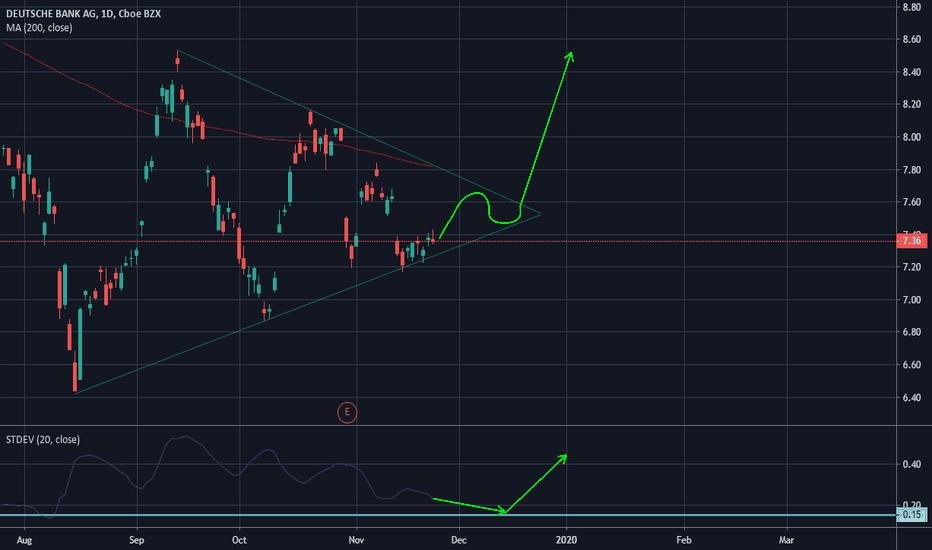

Hmm, I am interested to see how this idea is received. I do think there is a possibility it moves back down, but what I know for sure is that there is going to a decent move as volatility is low. It has spent an extensive time below the 200-day avg, but the fundamentals aren't completely in its favor so that is for good reason. If it does move Long, I think that...

Earning Report on the way and Intel will be boosted by the demand produced by the gaming season. Highest Earning of the year expected. Is it a coincidence for a cup and handle to appear to support our predictions for the season. Expected to approach or even beat high experienced earlier in the year. Trade relies on their investments in their R & D department to be...

The CAD has experienced a long bullish run and it is approaching a known supply area. There is some weary news coming up for Canada in the near future ( I think we all know what that is). In combination with that, Canada has a minority government when fiscal policy intervention is heavily needed. The CHF has been struggling, but I think this isn't due to medium to...

Japan is set to have an impressive week of news. This pair is obviously overvalued based on how bad the US has been doing. This would fall regardless of whether we found a cliche Ichimoku breakout (haha). Not the biggest fan of the Ichimoku indicator; however, you should be trading at your own risk.