We may be witnessing the formation of a W-shaped recovery on the SPY (S&P 500 ETF) – a classic double-bottom structure that often signals a strong reversal after a period of correction or volatility. Let’s dive into the technicals and what this could mean in the sessions ahead. 🔍 The Technical Setup: SPY recently tested key support around the $485-$500 zone,...

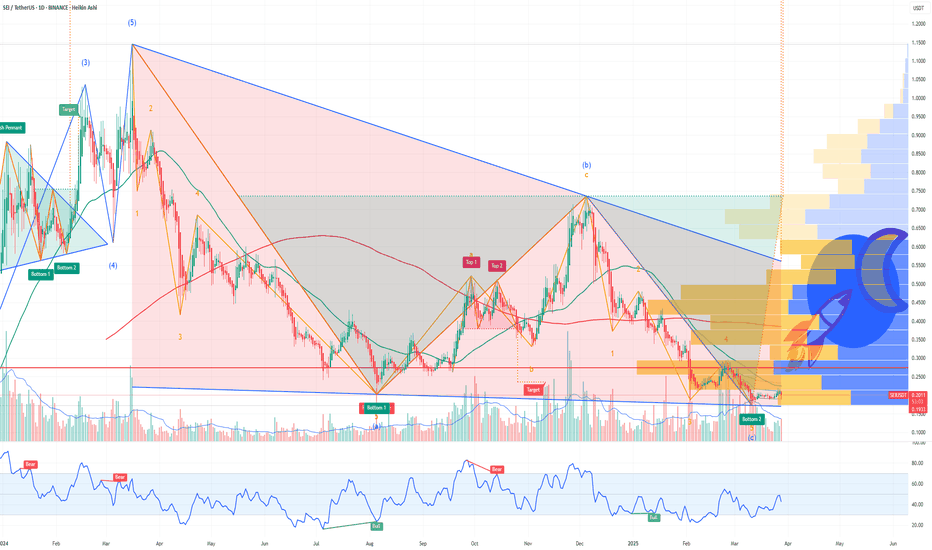

Sei (SEI), the innovative layer-1 blockchain designed for high-speed trading and decentralized finance (DeFi), is flashing strong bullish signals both fundamentally and technically. The recent news that the Sei Foundation is exploring the acquisition of 23andMe, the leading personal genomics company, has sparked excitement in the market. If successful, this...

The relationship between decentralized finance (DeFi), the Trump family, and Kevin O’Leary in 2025 centers around their public involvement in the crypto and blockchain space, particularly highlighted by their participation in events like DeFi World 2025 and specific DeFi projects tied to their names or influence. The Trump family, notably Donald Trump Jr. and...

Several factors support a bullish outlook for Bitcoin (BTC) to reach $97,500 by the end of the year: Institutional Adoption and Treasury Investments: Companies like GameStop are incorporating Bitcoin into their treasury reserves, following the lead of firms such as MicroStrategy. GameStop plans to raise $1.3 billion for Bitcoin purchases, indicating growing...

NVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position. NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud...

Intel Corporation (INTC) has been trading near a key technical support level, forming a triple bottom on the chart—a bullish reversal pattern that suggests a potential upside move. The stock currently trades with a forward price-to-earnings (P/E) ratio of 20.44, which reflects moderate valuation levels compared to industry peers. Intel’s turnaround strategy,...

Advanced Micro Devices (AMD) has positioned itself as a major player in the semiconductor industry, capitalizing on growing demand for high-performance computing, artificial intelligence (AI), and data center solutions. As of now, AMD’s forward price-to-earnings (P/E) ratio stands at 17.12, indicating that the stock is trading at a reasonable valuation compared to...

Analyzing the options chain and the chart patterns of FFAI Faraday Future Intelligent Electric prior to the earnings report this week, I would consider purchasing the 1.50usd strike price Puts with an expiration date of 2025-4-17, for a premium of approximately $0.20. If these options prove to be profitable prior to the earnings release, I would sell at least...

Analyzing the options chain and the chart patterns of KULR Technology Group prior to the earnings report this week, I would consider purchasing the 1.50usd strike price Calls with an expiration date of 2025-5-2, for a premium of approximately $0.35. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

If you haven`t bought the dip on TMC: Now analyzing the options chain and the chart patterns of TMC the metals company prior to the earnings report this week, I would consider purchasing the 2.00usd strike price Calls with an expiration date of 2025-5-16, for a premium of approximately $0.20. If these options prove to be profitable prior to the earnings release,...

If you haven`t bought HUMA before the previous rally: Now analyzing the options chain and the chart patterns of HUMA Humacyte prior to the earnings report this week, I would consider purchasing the 2.5usd strike price Puts with an expiration date of 2025-4-17, for a premium of approximately $0.62. If these options prove to be profitable prior to the earnings...

If you haven`t bought LULU before the previous rally: Now analyzing the options chain and the chart patterns of LULU Lululemon Athletica prior to the earnings report this week, I would consider purchasing the 337.5usd strike price Calls with an expiration date of 2025-4-17, for a premium of approximately $20.75. If these options prove to be profitable prior to...

If you haven`t sold this recent top on BTC: Now Bitcoin (BTC) has recently pulled back, but signs are emerging that a technical rebound could be imminent. A large crypto investor, or whale, has reportedly opened a 40x leveraged short position for over 4,442 BTC (valued at over $368 million), effectively betting on a near-term price drop. However, this appears...

If you haven`t bought the previous oversold area on QQQ: Now the Nasdaq-100 ETF (QQQ), which tracks the performance of the largest non-financial companies in the Nasdaq, has recently entered oversold territory, suggesting that a technical rebound may be imminent. Similar to the Russell 2000, QQQ has experienced significant selling pressure, driving key technical...

If you ahven`t bought the Double Bottom on RUT 2K: Now the Russell 2000 Index (RUT), which tracks small-cap stocks, has recently entered oversold territory, signaling that a potential technical rebound could be on the horizon. Oversold conditions typically occur when selling pressure becomes excessive, driving the index below its fundamental value and creating...

If you haven`t bought TIGR before the previous earnings: Now analyzing the options chain and the chart patterns of TIGR UP Fintech Holding Limited prior to the earnings report this week, I would consider purchasing the 8usd strike price Calls with an expiration date of 2025-4-17, for a premium of approximately $0.76. If these options prove to be profitable prior...

If you haven`t sold NKE before the previous earnings: Now analyzing the options chain and the chart patterns of NKE NIKE prior to the earnings report this week, I would consider purchasing the 73usd strike price Puts with an expiration date of 2025-3-21, for a premium of approximately $3.35. If these options prove to be profitable prior to the earnings release,...

Analyzing the options chain and the chart patterns of LAZR Luminar Technologies prior to the earnings report this week, I would consider purchasing the 7usd strike price Calls with an expiration date of 2026-1-16, for a premium of approximately $1.40. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.