JetBlue's $3.8 billion buyout of Spirit Airlines was blocked by a judge, citing a threat to competition! After the news, SAVE went down, while JBLU surged from $4.54 to $5.45! However, today it continued the 6 month downtrend and closed at $4.68. This might seem like business as usual on Wall Street, except for the presence of some aggressive blocks of calls...

Yesterday, I observed some unusual blocks of calls in the options chain expiring on Feb 23, following the earnings release. One of the most substantial positions was in the $20 strike price call, with options traders paying $1.7 million in premium. Listening to analysts, some mentioned they expect a 'TSLA Model 3 moment' from RIVN as well. In addition to...

Analyzing the options chain and the chart patterns of CFG Citizens Financial Group prior to the earnings report this week, I would consider purchasing the $37.50usd strike price Calls with an expiration date of 2024-8-16, for a premium of approximately 1.20. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

If you haven`t sold KEY here: Then analyzing the options chain and the chart patterns of KEY KeyCorp prior to the earnings report this week, I would consider purchasing the 16usd strike price Calls with an expiration date of 2024-7-19, for a premium of approximately $0.78. If these options prove to be profitable prior to the earnings release, I would sell at...

Analyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week, I would consider purchasing the 31usd strike price Puts with an expiration date of 2024-2-16, for a premium of approximately $0.80. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ASTRA Protocol is positioning itself as the next generation of compliance, offering a decentralized Know Your Customer (KYC) platform tailored for the Web3 ecosystem. Former EU Commissioner for Trade, Phil Hogan, has taken on the role of Executive Advisor for ASTRA Protocol. Mick Mulvaney, former White House Chief of Staff is also in the team. ASTRA Market Cap...

If you haven`t bought SHIB before that big rally: Then you should know that the price of SHIB Shiba Inu will be affected by the approval of the Bitcoin ETF this week. Some of the biggest asset managers on the entire planet are going to release a BTC ETF: Blackrock $9.3 Trillion Fidelity $4.5 Trillion Franklin Templeton $1.53 trillion Invesco $1.5...

The price of Ethereum (ETH) will be affected by the approval of the Bitcoin ETF this week. Some of the biggest asset managers on the entire planet are going to release a BTC ETF: Blackrock $9.3 Trillion Fidelity $4.5 Trillion Franklin Templeton $1.53 trillion Invesco $1.5 Trillion. BlackRock expects Bitcoin ETF approval on Wednesday, in-line with Bloomberg's...

Some of the biggest asset managers on the entire planet are going to release a BTC ETF: Blackrock $9.3 Trillion Fidelity $4.5 Trillion Franklin Templeton $1.53 trillion Invesco $1.5 Trillion. BlackRock expects Bitcoin ETF approval on Wednesday, in-line with Bloomberg's January 10 deadline. I expect the approval to a buy the rumor, sell the news...

Analyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week, I would consider purchasing the 2.50usd strike price Calls with an expiration date of 2024-1-26, for a premium of approximately $0.22. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

If you haven`t sold the Double top on AEHR: Then analyzing the options chain and the chart patterns of AEHR Test Systems prior to the earnings report this week, I would consider purchasing the 22.50usd strike price at the money Calls with an expiration date of 2024-6-21, for a premium of approximately $5.30. If these options prove to be profitable prior to the...

Analyzing the options chain and the chart patterns of ACI Albertsons Companies prior to the earnings report this week, I would consider purchasing the 23usd strike price at the money Calls with an expiration date of 2024-2-16, for a premium of approximately $0.92. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

If you haven`t sold WDFC prior to previous earnings: Then analyzing the options chain and the chart patterns of WDFC WD-40 Company prior to the earnings report this week, I would consider purchasing the 230usd strike price the money Puts with an expiration date of 2024-1-19, for a premium of approximately $7.55. If these options prove to be profitable prior to...

If you haven`t sold KBH before the previous earnings: Then analyzing the options chain and the chart patterns of KBH KB Home prior to the earnings report this week, I would consider purchasing the 65usd strike price in the money Puts with an expiration date of 2024-6-21, for a premium of approximately $7.60. If these options prove to be profitable prior to the...

If you haven`t bought the dip on BAC here: Then analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week, I would consider purchasing the 34usd strike price at the money Calls with an expiration date of 2024-2-16, for a premium of approximately $1.54. If these options prove to be profitable...

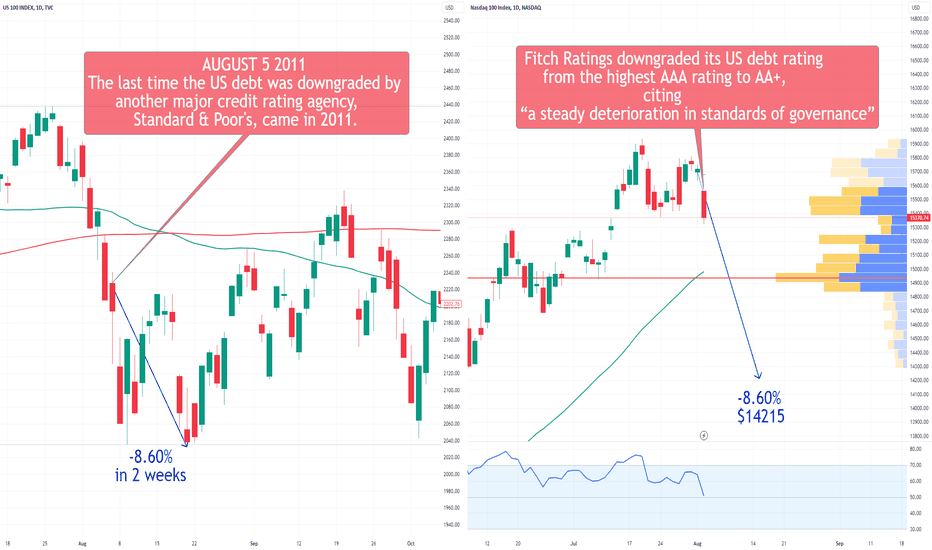

On Tuesday, Fitch Ratings downgraded the US debt rating from the highest AAA rating to AA+, citing concerns over "a steady deterioration in standards of governance." This downgrade occurred in the wake of last-minute negotiations among lawmakers to secure a debt ceiling deal earlier this year, which posed a risk of the nation's first default. Following a similar...

If you haven`t bought the RUT 2K regional Double Bottom here: On Tuesday, Fitch Ratings downgraded the US debt rating from the highest AAA rating to AA+, citing "a steady deterioration in standards of governance." This downgrade occurred following last-minute negotiations among lawmakers to secure a debt ceiling deal earlier this year, which put the nation at...

itch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance." This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default. In the past, a...