Tr8dingN3rd

PremiumPrice retests the L-MLH. VI. - Price breaks upward, target is the centerline VII. - Price reverses again, then the target is the 1/4 line, with a subsequent extended target at the red centerline, and possibly even lower at the white dashed warning line. On a personal note: I was once again told that the price didn’t do what I had projected. ...yeah, really,...

In 2020, we had the action, and since 2024 the market's reaction. Just as Newton describes the universal law of Action/Reaction. However, we see that USFD has reached the centerline of the white Fork, which coincides with the reaction high and the upper median line (U-MLH) of the yellow fork! There is not much more to say about it. It's a clear Short to me, and...

WD-40 changed direction to the south after the 5/0 count. Soon it will become clear whether the support from (4) holds or not. But what is already apparent is that WDFC is struggling significantly at the trend barrier. No surprise, since this price level coincides with the natural resistance. To me, this seems like a cheap short, even though a new, true low...

To places where no stock price has ever gone before.. What makes VISA so special? The credit industry is currently staring into the abyss due to massively rising payment defaults. Why is VISA skyrocketing in price, breaking through every barrier as if they were made of butter? I don't know, and I'm very puzzled. What will happen if economic conditions become...

Price is still in upward mode. Why am I bearish? 1. Rejection in the Resistance Zone 2. Second Hagopian 3. Close below the Red Forks 1/4 Line PTG1 is the Center-Line. Potential further PTG's below at the 1/4 Line and then of course the L-MLH. Playing it with Options which give me much more leeway. For a hard Stop I would put it right behind the last high above the TB.

This long-term chart shows how the USD Index is trading within the boundaries of the Median Line set. We see the lower extreme, solid support around the Center Line, and the upper extreme acting as resistance. What’s next? Well—if it’s not heading higher, it’s likely heading lower—and the rejection at the Upper Median Line (U-MLH) supports that view. If we...

The 0-5 count is not over yet. Sudo 4 and 5 are still lurking. It's good to see how the Medianline-Set cought the Highs of the swings. Likewise we can see the subborn rejection at the Center-Line at P3. I will not trade CL to the short side, until it's clear that P4 is engraved in this Chart. Until then, I maybe shoot for some intraday or dayli trades in...

After reaching WL2, we saw a sharp pullback followed by an immediate double top. Price failed to reach the centerline of the yellow fork, instead stalling at the 1/4 line. Then came the break of the lower median line (L-MLH), a pullback to the white WL1—then the drop began. If this market can’t push to new highs, we’ll likely fall back into the median line set....

The first time, we saw the DAX poke the 1/4 line. This was followed by several attempts (distribution by the big players), and from that point on, it headed south and the DAX rolled down the hill. Currently, it looks very similar. I’m watching and observing the break of the trend barrier very closely, even on smaller timeframes than the daily. The profit...

Looking at the market's behavior using the orange median line/fork, one can clearly see how the market reacts when it touches one of the lines. Median lines/forks are not an oracle. They simply project the highest probable path of the price based on a mathematical calculation inherent to the tool. If you follow the rule set, money management, and risk...

In 2022, before the bear market began, we saw the same pattern that we're seeing now: 1. Sine wave pattern 2. Fake recovery 3. Break above the sine wave top 4. Sharp decline Last week, right after the sine wave top was broken, U.S. bonds were downgraded AFTER OFFICIAL MARKET SESSION! It’s no surprise that rating agencies are losing confidence in the U.S....

I stand by my posts about CVNA. It's fishiy and it stinks! Chart wise, price is at the upper extreme again. A nice short is setting up, and this time for a much larger move...I think, feel, expect. "...but, isn't there more to say? You MUST explain WHY and WHEN...", I have people saying. No, it's not a joke. I leave it with that §8-)

We see the 3 tiny arrows—proof that price was rejected by those who knew. The Trend Barrier, once solid support, cracked without resistance. Price dropped right back into the Medianline set. The small pullback? Totally expected—just like the Medianline rules suggest. Then came the brutal drop, textbook-style, straight to the Centerline. The springboard move...

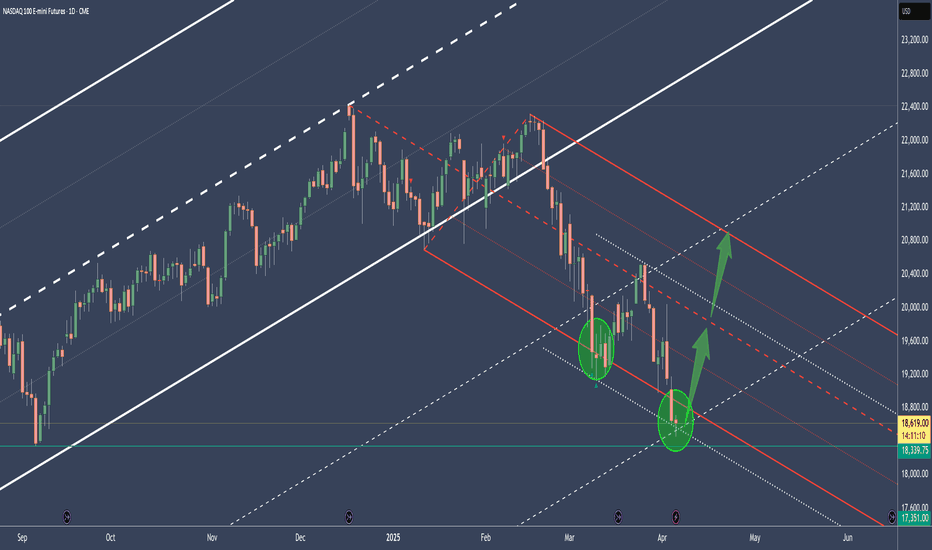

After the breakdown below the last support on March 11th, the price pulled back and formed P2. A frightening drop followed, reaching P3, then a sharp V-shaped recovery up to point (4)—just a few points shy of the Center Line. If P2 doesn’t get taken out, things could turn ugly again. Because in that case, my new target lies below the white Lower Median Line...

The Median or Centerline: The Median (Centerline) Line is the central element of the Pitchfork and acts as the equilibrium point. Price tends to oscillate around this line, and it often serves as a strong reference for potential reversals or price targets. A price move back toward the Median Line is common after significant moves away from it. Pitchfork (Red):...

Sir Isaac Newton stated the Third Law of Motion in his landmark work, Philosophiæ Naturalis Principia Mathematica (commonly called the Principia), which was first published in 1687. This law appears in Book I, in the section titled Axioms, or Laws of Motion. (Axiom: A self-evident truth) Newton did explicitly present it as an axiom. In fact, it's Axiom III (or...

If ADBE is able to jump above the Centerline, it probably will retest it, and then take off to the upside. If ADBE is not able to crack the CL to the upside, then it's new projection is to the downside. The natural target is the L-MLH. But let's not forget the 1/4 lines! These often act as good support. Specially with a catalyst like good News around the same...

There it is, at the U-MLH, stretched again. Confluence with the 1/4 line of the white Fork. Cheap short down to the CL and beyond, if it's able to crack it. Long term, my view is, that it's going to zero, because it's a Scam in plain sight, accepted by the big rulers.