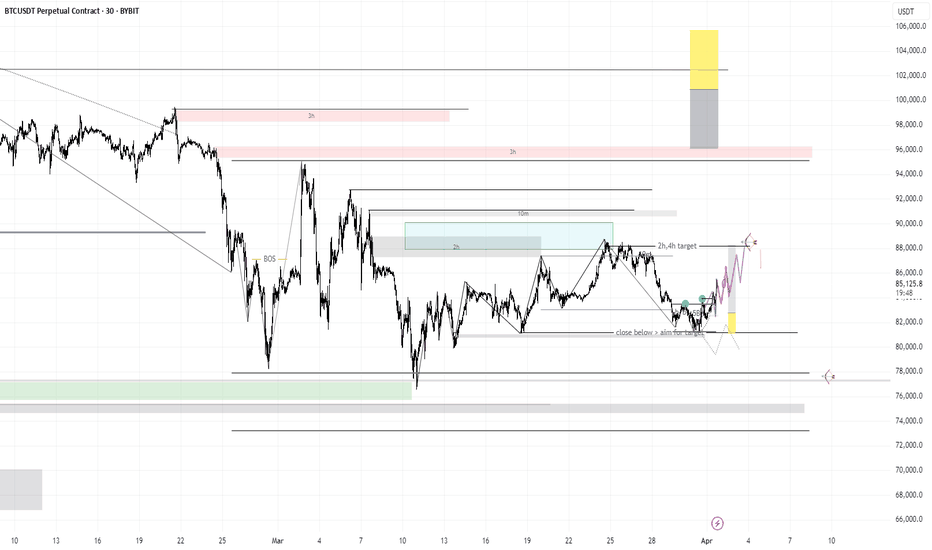

Trade 1 is a potential scalp long of we break structure on the 10m bullish. I will be watching the 30m block for resistance , if we flip bearish here with confirmation I will try a short but if not, I will hope my long up until the distribution range above. Unlikely to have a video today or tomorrow. Potentially one on Friday.

🚨 I know I haven’t been posting our usual videos lately, but along with the daily morning update, here’s a trade breakdown of what’s been happening in the world of Bitcoin! 🟠📉📈 At this point, we should be 2 for 2—both setups came to fruition. However, in my honest opinion, neither gave us that clear-as-day confirmation. If you went for the riskier approach and...

Here are the levels for today's trades. Mainly range deviation plays and bear continuation plays. The last 3 weeks have been extremely busy I am committed to doing more video posts to talk through these ideas.

Thursday’s Update These are the only levels I’m watching for the rest of the week. We got a nice deviation from the range low, which we were prepared for—unfortunately, I was asleep and didn’t enter. We’ve been consolidating in this range for some time now, and I’m looking to get involved on the second BOS on the way up to the range high. Key Levels & Trade...

Potential power of 3 play here. A range deviation at the range high will confirm this. If this takes place I will consider taking profit on the long from 81k

Tuesday's Update Hello guys, These are the scalp zones I’m watching today. I’ve officially de-risked my long trade from 81K, so no matter the outcome, I’m playing with house money. We have a few ideas here, so I’ll do my best to explain the logic behind them. Key Levels & Trade Setups Bearish Outlook We’ve seen a reaction from the 2H supply at 88.9K, with an...

📊 Monday Market Update 📊 Here are the key levels I am watching at the start of this week. Notably, last week saw limited entries as the market mostly ranged. Hopefully, this week will offer more opportunities. 📈 🚀 Bullish Case If we break bullish from the current range, I will be looking for a range continuation play. However, a range deviation is possible....

Bitcoin Morning Update – Wednesday 🚀 Yesterday, we saw a bearish flush, and that questionable SFP ended up confirming a notable break of structure. We’ve broken down from this internal bearish range, but remember—this is just an internal move within a larger range. Today’s Setup – Bulls & Bears in Play 📉 Bearish Plan: I’ll be shorting any 15M flip in structure...

Bitcoin Morning Update – Tuesday Congratulations if you managed to catch both the long and short setups from yesterday! I say “magically” because, truthfully, we didn’t get the best confirmation from market structure—so I won’t pretend we did. However, if you were eyeing indicator-based entries or a divergence-based model, you may have been able to snatch both...

🚀 New Week, New Trades These are the key levels I’m watching for potential plays this week. 📈 The first trades are simple range deviations—from the high of the day so far and the daily open. We’ve seen SFPs on the 1H ⏳, but price was unable to close below the demand at 81K 🏗️. After breaking structure internally, we’re making an attempt at the range high 🎯. ⚖️...

🚀 Did You Miss Out on FREE Money? Let’s Find Out! 💰 In today’s video, we break down every trade setup shared over the past two weeks! 📈✅ We’ll review how well we’ve done as a community and calculate exactly how much profit you’ve made—or could have made! 😱💵 🔎 Trade-by-trade analysis of all our key levels, shared in advance during London Open (8 AM on weekdays)....

Thursday Bitcoin Update These are the local plays I'm watching today: Two range deviation plays Premium: Potential Trinity Model 1 setup Discount: A range deviation into demand We have reasons for both upside and downside moves, depending on how price continues to develop. Locally, price looks bearish, so if we get another bearish continuation pattern, I’ll be...

🚀 Bitcoin Morning Plays – Wednesday Update 🚀 🔹 Recap: Tuesday gave us some solid long scalps—one of which I’m still holding. But let’s talk about that 3H supply zone distribution play. It had potential, but let’s be real… it wasn’t as sensational as it could have been. Why? No market structure confirmation on the second tap after the SFP. Risk-to-reward wasn’t...

Bitcoin Morning Update – Tuesday Market Overview: We are in an interesting place in the market right now. Following the recent bear action, we have had a reaction off the old demand range that caused the big move all the way back in November. This is the last support before we get accepted back into the 230+ day range that we created for most of 2024. The...

Monday Bitcoin Update 🚀 We had a great week last week, but this week brings fresh opportunities. As we trend toward the 78K target, Bitcoin is currently sitting at 80K support—a critical level to watch. If we fail to transition market structure (MS) on the 15m and above, the likelihood increases that we head to the 78K decisional point, where we found support...

Friday Bitcoin Update 🎯 Congrats to everyone in the Inner Circle who took yesterday’s short—you should be in great profit by now! Make sure you have de-risked. I know some of you also caught the long from the 30m supply zone, so big well done. As Friday looms, we must exercise caution heading into the weekend, which is usually marked by lower volume and sideways...

🚀 Bitcoin Morning Update 🚀 Yesterday, we kept pushing up towards $95K, with a solid reaction at the 2-hour supply zone we were watching. While it didn’t give us the follow-through needed for a big swing trade, some traders could have caught a 2x or 3x move on lower timeframes just from that reaction. Right now, the fractal structure is bullish, and as we kick...

Bitcoin Morning Update - London Open 📉 We got a nice move from the level we were watching on Tuesday morning—congrats if you snatched that trade! It wasn’t an easy one, and I’ll discuss why in the next lesson. Bullish Scenario 🟢 We’ve seen an aggressive internal BOS, and ideally, we get a retracement into one of our 30m demand zones 📈 If that holds, we could...