Trade-Technique

Mandatory 0.786 retracement of the XA leg (approximately B retraced) & AB = CD to be a valid signature. The most critical number in the pattern is the 1.27 XA leg for BC project Exactly, we have seen a reversal from the D point. I've pre-projected Triangle which is only my expectation without any confirmation nor verification. This is my internal feeling and &...

Let me reveal out the Wave Counting from Basic and then, we will move to lower TimeFrame to determine actual trading levels. The primary wave of motive cycle has-been started since 2000 and completed in 2008 on the weekly chart. The primary W. 1 + W.5 is equal to W. 3 approximately, therefore, you can say the impulsive W.3 is extensive. It was clearly...

Triple Zigzag correction is a combination or series of three zigzag corrections (three “ABC” cycles) connected by a link wave “x” between every “ABC” cycle and its internal structure is (ABC-x-ABC-x-ABC). Triple Zigzag correction always forms a wedge pattern and that wedge may be triangle or parallel. This Elliott Wave pattern can give huge profit with minimum...

As per all of historical records with counting of the wave, we concluded that the price move 34707 and 33200 or 38700. 5+3 = 8 Waves counting is not hard if you close chart closely. Longer view for counting waves: Complete Waves:

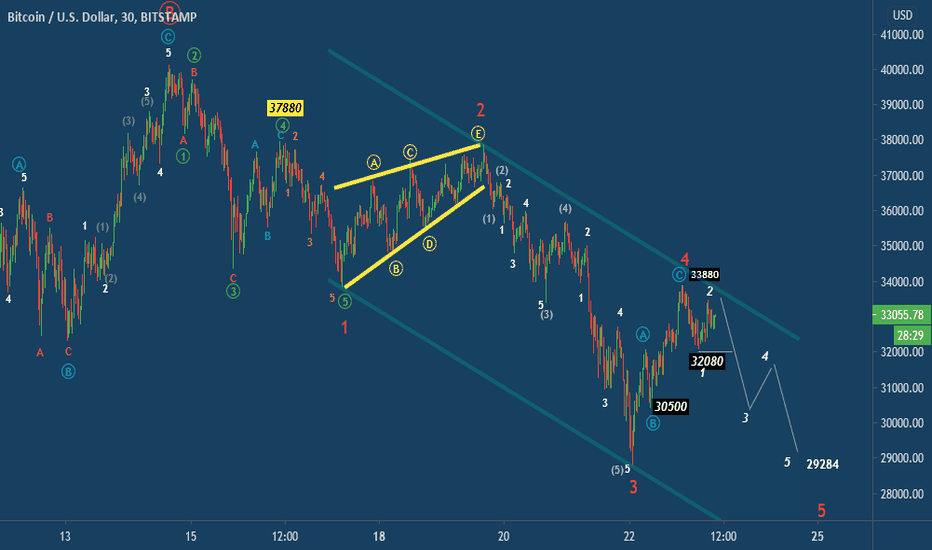

I hope you remember the exact prediction of my last research. You should look it: ------------------------------------------------ This is to look like a downward motive cycle. Let's make a trade condition : If the price is traveling toward the 5th sub-wave, the price will not cross 32774. Right now, Bitcoin progress under the 4rth wave and then the price can...

4rth Wave in down direction: The projection of A flat correction (W), (X), and (Y) zigzag pattern of Elliott Wave. Expected A, B, and C correction after the 5th minor sub-wave. Suppose, the price can travel for primary(C) wave(red color) then, 29480 extremely ready for the target. (INCASE OF THIS IS LONGER CORRECTION, THEN THE PRICE TAKE CREATE NEW HIGHER HIGH...

The price is looking for sub-wave 5 and then ABC correction. If you have any question or request, kindly comment. 4 Hrs chart : 30min chart for ETH:

Sub-wave of 5th wave targets 30500 and 29284 if the price breaks 32080 below sell & sell. We can assume only if the price breaks 32080. Risky traders can sell 33700-32300 with stoploss above 33900+ for the same target.

We can see AB=CD Pattern in Bitcoin 30min Time Frame chart. As per this pattern we can Find, Reversal Zone : 31150 T1 - 32960 T2 -33950. AB=CD is a reversal pattern that helps you identify when the price is about to change direction. The idea is that you can buy when prices are low and about to rise or sell when they are high but about to fall.

As an analogy, when we drive a car on the road, we must constantly abide by traffic rules in order to harmonize certain behaviors for every situation we are faced with. From stopping at a red traffic light, slowing down when at a pedestrian crossing, use snow chains in certain weather conditions, etc. On top of that, since trading is such a mind game that...

There are no EMOTIONAL PROBLEM in reality. The problem, you are facing is you do not have any back-tested STRATEGY/SKIL L of identifying what if I do will I get the trades. Another words, you are trying to search a fallen needle in entire city in a limited time. You don’t know what to trade? Which stock(trade) to go for shorting? Should I have to select...

This was the extremely came the fall but I already predicted it for you, isn't it? Let me show you what I have told you: (clearly written about Monday fall )

A TimeCycle is an event, such as a price high or low, which repeats itself on a regular basis. The Bottom-Out over the Bitcoin, The chart below shows a cycle with a length of 66bars.462days. => Let's just assume logically, where is the TOP-OUT? The TimeCycle started from Dec2017 to June 2019 which has a length of 80bars, 560days, and the respect of this...

its easy to understand the concept of this wave. The question is only where is the correction? We have to go more close(lower) in a timeframe to find clues.

If you know basic of EW, then you can under this chart easy. I've project future move.

Mid point (B) - 0.618 The pattern requires a very small stop loss and usually volatile price action in the Potential Reversal Zone. In this case, we need confirmation to sell BTC from lower TF. Reversal zone is not far away. But, Due to the extremity of the projections utilized in the completion of the pattern, the Crab frequently experiences sharp price...

Elliott Wave on 4hrs TimeFrame The 4rth Wave can not less than 1.14204 in this case, Weekly Timeframe for Longer View The Primary Trend: UP Up-Breakout (Trend changing Pivot point): 1.20500 TimeCycle : not clear vision Important Numbers to be remembered on weekly chart Paramount Underline(i): Selling is valid with using a stop to loss 1.21225...

There are 3 Types of Triangle, Triangle forms in Corrective waves, Triangle occurs in wave 2, 4 & B, 1) Contracting Triangle + Always Subdivides Into Five waves + at least four waves among wave A, B, C, D, each subdivide into a Zigzag or Zigzag Combination. +wave C never moves Beyond the end of wave A, wave D never moves beyond the end of waves b and D...