Trade_Navigator

PremiumIt looks like bitcoin might be in bullish wedge formation. Will gold be the beneficiary of potential more gold downside?

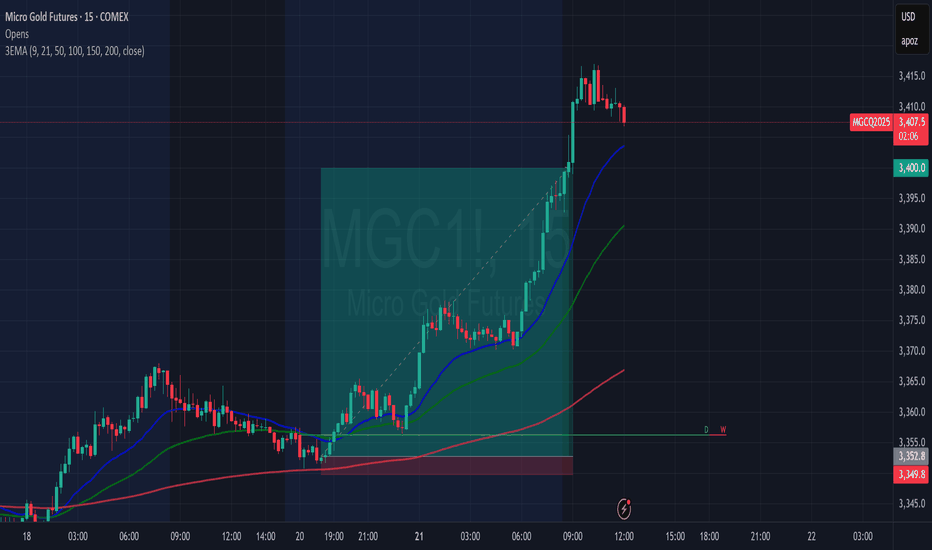

The three bearish days in a row could be a potential near term bearish development on Gold. If a retest somewhere between 3370 and 3400 happens relatively soon and rejects it could potentially be in for a bearish extension. 3373 would be the 0.618 and 3388 would be the 0.5 retracement area. With a potential target down toward 3248 area

Took profits on 2/3 of the position at 3400. The monthly was holding above all three last monthly closes which suggested Bulls were in play

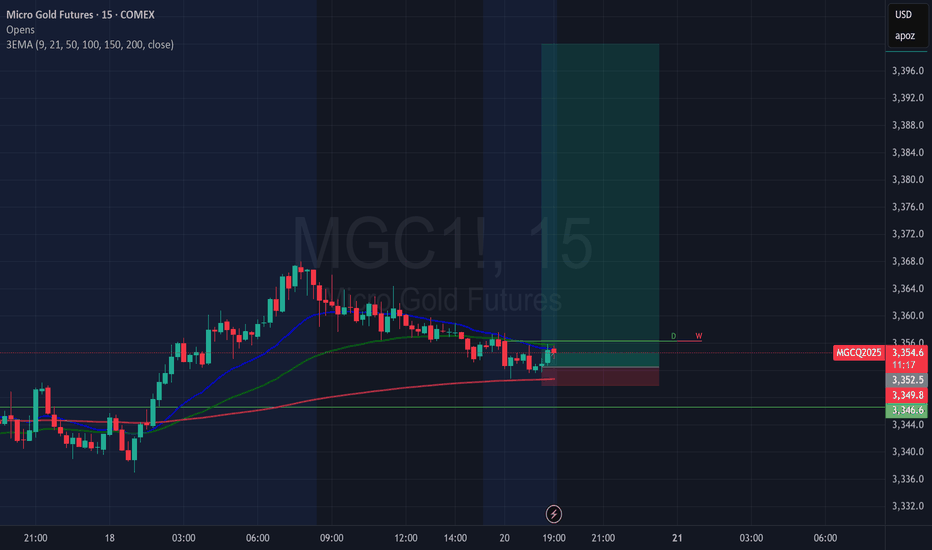

Since Bulls are holding above the last 3 monthly closes. Looking good for Bulls to 3400 and possibly higher given enough time

Turned out to be a decent long side trade on Gold for a 3:1

An interesting pattern developed on Gold for the monthly that could indicate 2 months of Bullish order flow to 3600 - 3800 area followed by 3 months of bearishness to 3000 - 3100 area.

Platinum has a golden cross on the weekly time frame

Due to US bombing Iran looking for a gold buy this week. Target is 3500

Bullish Pennant or Bearish Weekly close for next week on Gold. Coinflip on the chart patterns. If Trump decides to bomb Iran definitely Gold Moon job. Trump said he will make that decision within 2 weeks.

Might be a bullish close below the yearly open on corn futures. Tariffs can negatively impact prices but maybe some seasonality will drive some higher prices to make a fresh yearly high at some point this summer. There have only been seven years since 1981 that have not seen a summer corn price rally, while several years have seen multiple. Last year was one of...

My educated guess is that the dollar is moving similar to the first time trump was elected. I am expecting dollar weakness to abate early next year. A major swing low formed in early 2018 one year after Trump was elected first round. Let us see if a similar situation forms next year. For now with DXY structured bearish caution is warranted with Oil up and 10 yr...

The pattern on Bitcoin since 2023 seems to be 2 quarters of up following a quarter of down. Will bulls target 141K area after next quarter finds a low?

target either yesterdays high or some where between that and 6100 area

Since price has held the 56666 area 10K below 66666 fulcrum level. Bias is tilted toward bullish/neutral. Dxy is currently skewed toward short due to oil and potential BOJ. NFP numbers coming in a bit light helps the case for Fed rate cuts to still transpire. That being said not looking for that until sept. Oil moving lower will potentially help USD CPI numbers...

Looking at EURUSD for potential longs which broke above a prior level that was acting as res. Looking for price to remain tilted toward dxy shortside. Oil is moving lower. Potential BOJ intervention. Trade Safe Trade Smart Manage Risk. Respectfully Trade Navigator.

The nature of the number and overbought conditions warranted to put more risk on for the macro target of 42K. There maybe shorts being held by jp morgan via blackrock for the macro gap target of the quarterly level for gap fill on the BTC1 chart.

There maybe a better price available for the event. Looking to get some rest and sleep through the volatility. Trade Safe Trade Smart Manage Risk. Respectfully Trade Navigator

Looking to enter the market short EURUSD at 0315 EST for EUR PMIS release. Target will be 50-75 pips for the series of releases. The exact price level of entry is unknown yet. It will be executed at right before the first release as liquidity exits the market. Trade Safe Trade Smart Manage Risk