TradersAICorp

PremiumResults of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: Medium-Frequency Models: Lead to -11.8 index points in losses on two long and two short trades. Aggressive, Intraday Models: Lead to +1.7 index points in gains on six...

Its All About Hong Kong this Morning! The Hang Seng was up significantly overnight on the news that Carrie Lam has announced that she was scrapping the controversial extradition law. US indices are up in sympathy. “How long would this last?” is the question on everyone’s mind, but the indices are shooting up for now. Given that nothing has changed with respect...

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: Medium-Frequency Models: No trades triggered today. Aggressive, Intraday Models: Lead to +5.2 index points in gains on ten long and ten short trades. The high number of...

Be Wary of These Choppy Markets The US-China trade war does not seem to go away anytime soon (until some "leaders" hopefully learn that shewing and bullying does not make for "negotiating" strategies or tactics). Friday's market action indicated that our models' often cited level of 2926 is still a major resistance for the upside. Our models are back to the...

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: Medium-Frequency Models: Lead to -25.6 index points in losses on two long trades and close out of the carried short trade. Aggressive, Intraday Models: Lead to +1.9...

The Bear Case is Back to Rest, for Now With China's softening (?) stand - or, the spin of it - has put the last few days of growing bear case to rest, at least for now. Until the earnings come into focus, there does not appear to be any fodder in sight to feed the bears (which may change in a whiff, of course). The 2926 level our models have been monitoring is...

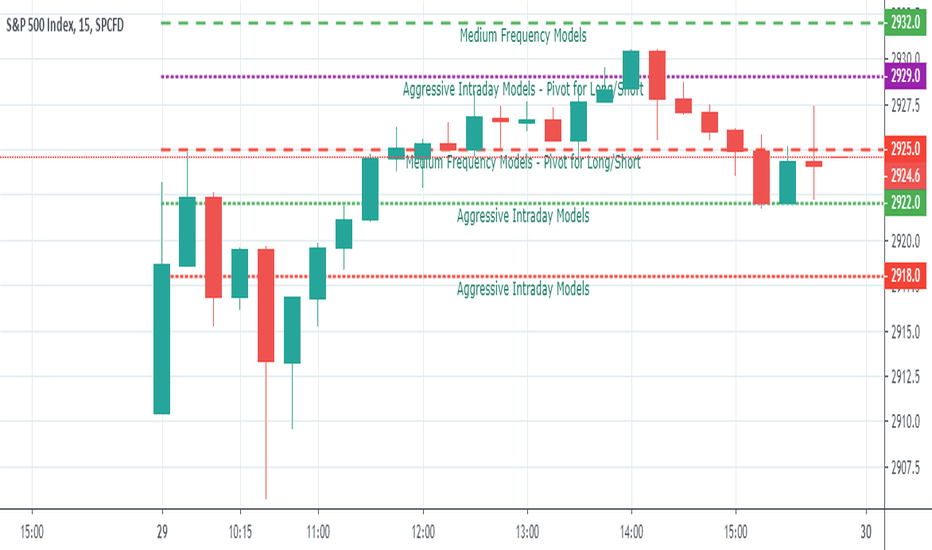

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: Medium-Frequency Models: One short, opened at 2925.0, being carried to the next session with a 9-point trailing stop anchored at 2930.7. Aggressive, Intraday Models: Lead...

China's "Calm Attitude" To Calm the Markets? China's words about it willing to resolve the trade dispute (war?) with a "calm attitude" seem to be settling the nerves of the markets this morning. Is it sustainable or just a tweet away from blowing up? We have to wait and see. Read below for our models' trading plans for the day. tradersai.com NOTES - HOW TO...

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: Medium-Frequency Models: No trades were triggered Aggressive, Intraday Models: Lead to +18.2 index points in gains on three longs and three shorts. THE DETAILS: For...

Do Not Rush Into Position Trading The geopolitical and economic situations and potential signals (yield curve, anyone?) are getting increasingly slippery and there could be a lot of false signals in these markets. Staying out of the markets can be much better than getting trapped on the wrong side. Agile and nimble trading is the continued theme that our models...

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: The index reflected the confusion, the flip-flop, and the uncertainty surrounding the contradictory stands/statements coming from the administration about the tradewar,...

When You Can Not See the Road Ahead The whipsaw that bears got caught in on Friday's melt down, and the dismay the bulls felt with the ease of the free fall...is likely leaving both sides feeling trapped with the spike up from the 2810.25 lows. If you got in on the right side and/or looking at just entering into the markets afresh, have a clear and well defined...

RESULTS of MODEL TRADES for FRI 08/23 Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: The index essentially melted down on Friday, logging the fourth straight week of losses, due to Powell's not-so-supportive (for rate...

Horror Stories From the G7 and/or Jackson Hole Over the Weekend? Investors seem to be fretting over the potential for market horrors to unfold over the weekend involving unexpected headlines from the G7 summit or the Jackson Hole. Add to this the Friday options expiration plays and we have got a recipe for chaotic and inexplicable moves today, especially during...

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: The index essentially closed unchanged (-1.48, -0.05%), after oscillating within a range of 26.43 points intraday. Our medium-frequency models didn't trigger any trades -...

(these plans were published at tradersai.com much earlier - re-posting it here for your easy reference; please subscribe at tradersai.com for free - no credit card required - if you want to be able to view the posts as soon as they are originally published) PLEASE NOTE that the chart shows a short level at 2921 (from yesterday), but it is updated to 2918 (the...

Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts. THE GIST: Medium-Frequency Models: No trades triggered today. Aggressive, Intraday Models: Lead to -13.70 index points in losses on two longs and two shorts. THE DETAILS: For...

FOMC Meeting Minutes to Offer Help for Market Bulls? The early exuberance around retail earnings notwithstanding, FOMC meeting minutes release at 2:00pm EST is going to set the tone for the market's mood for the rest of the week until Friday. Plummeting bond yields and the underlying recession concerns, or the skyrocketing retail earnings and the strong consumer...