I like the RR in this trade, that's why I am choosing TSLA over others. As we are bearish on current order flow, the price prints are showing bearish movement in the coming days. One possibility is that it might take out buystops before trending lower and I think today's day will give more information on that. However, the technicals are there that favors the...

Will be posting this on X, in regards to why I took this and this was along the same idea of Amzn shorts that I had posted. I'll also post the swing gains in X with 700% banger on the contracts. This played pretty well than AMZN did.

This trade idea was posted couple days ago and now the target has been met. I believe there might be some more room down but might get some retracement tomorrow before expanding more on Friday, let's see. But if you followed this you're getting bangers tomorrow.

With bearish trend and how price is now taking out buystops and coming into equilibrium/discount, there's opportunity to sell at a premium. This trade idea is based on daily and H4 levels, and considering the fact that Nasdaq (QQQ) becomes bearish rest of the week. With High Impact news remainder of the wick, there might be manipulation to take out more buystops...

I added another position on the retracement and took some off at the PDL now, the final target I am leaving for is the BISI and will close out the trade for today or if it hits my stop which is now halfway at the TP.

While NQ and ES was trending lower DOW was going higher. This was to take out stops, pair smart money orders and start the sell program. I waited for multiple confirmations before entering the trade. Buystops, rejection, CISD and IFVG. I could've entered earlier targeting even higher rr but the more confirmations there are showing bearishness, the higher the...

PDH taken, CISD, H1 IFVG, MMSM forming with draw on PDL but with RB right above profit target needed to be adjusted. The price kept creating bearish pd arrays showing hand that the draw was lower and entry was after H1 BISI was inverted and entered on retracement with partials along the way. I'll try to label my charts post trade.

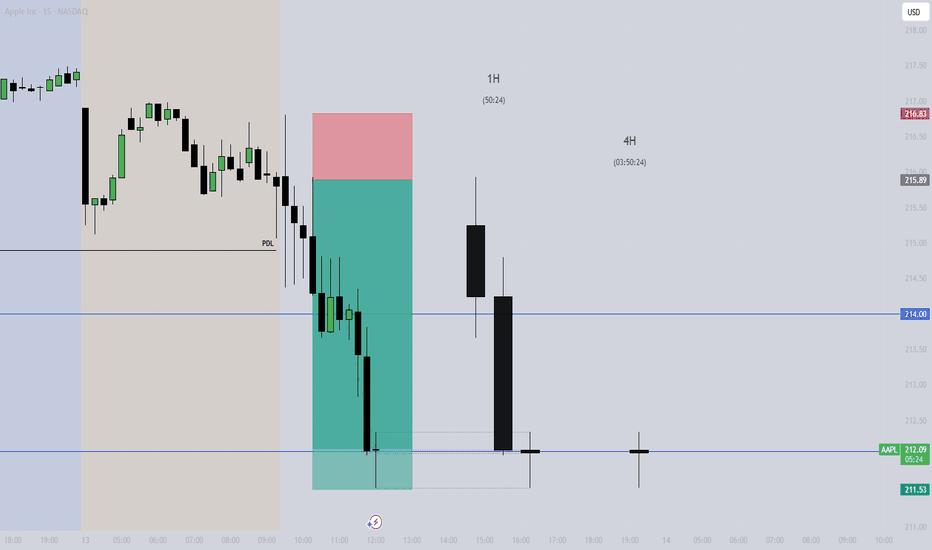

If we look at AAPL this week, it's the most bearish asset this week. But how can we confirm that there's room for APPL to trend lower. After invalidating the weekly bisi there are no PD arrays to support price higher or to hold it. Next, indices are bearish! In Daily and H4 tf, it leaves FVGs without being retraced to while indices, especially QQQ and other tech...

Rejection from Daily SIBI. Intraday trades taken and 90% positions off. I still anticipate price to trade to the target. Leaving runner only small position and no risk on the trade.

I have been posting this same model on all the trade ideas and you can see my previous post on how those have played out, including swing opportunities. Out of 90% of my position as the PDL was my first target that was obvious, leaving runner for the low of the week. Let's see if it gets there.

Intraday profits taken. Tradingview doesn't let less than 15m timeframe chart to be published. The path was drawn on 5m chart when 15m candle created displacement above the H1 SIBI. This long trend idea depends on how indices do. For NFLX the technicals are there and any support from indices would see NFLX move higher, and possibly the weekly reversal with the...

This trade idea was posted before the move even happened, the reasoning behind it and the target. Most positions are already off at different partial levels. It doesn't need to hit the final target but it still is the strong draw on liquidity I am anticipating. The other thing I am noting while on this trade is that NQ (QQQ) has already taken that level and we...

Levels work for both swing and intraday trades. On the same basis, this trade was taken. Half is already off and the trade is now risk free and remaining with partials along the way. With the bearishness we are seeing there may be more room for downside.

This trade idea was posted earlier and now all positions have been closed, even if someone who followed the trade halfway still got paid big. When you have high resistance liquidity in indices, you look for low resistance assets to trade.

This swing trade idea is based on the daily timeframe. I have also already traded intraday on the same levels and trade idea and have already cashed in those positions. I have few that I am swinging and will take partials along the way and manage them accordingly. One doubt I have is how the NVDA earnings will play into effect. As for now, for indices this trade...

Tradingview doesn't show executions but most positions are already taken of and remaining will be adjsuted accordingly. Partial will be taken right on that wick/low and the remaining will be left as runner to see if we can take out the low in H4 tf. SMT with indices, rejection from H4 FVG and invalidation of 15m Bullish FVG.

Knowing when your model shows up and when to pull the trigger is important. This TSLA short was the exact model I have been posting for the last few weeks, if you see previous posts. Partials taken, trade is risk free. May swing couple.

This trade idea was posted last week even before the major move started. All the narrative and confirmation behind this trade idea was posted in the previous AMD short swing trade post. Those who followed got paid heavy!