Position established prior to earnings and scaling in on set-ups in the intermediate uptrend. This set-up is a day trade with a higher than 1:1 RRR with exit price set on previous high.

4-WK CONSOLIDATION BREAKING OUT OF PATTERN RESISTANCE. 38% PRICE RETRACEMENT ON PROFIT TAKING. OBSERVE VOLUME ACCELERATION FOR TRADE ENTRY CONFIRMATION.

6 WK CONSOLIDATION ON THE BACK +124% PRICE RALLY FROM MARCH BOTTOM. +980% EARNINGS GROWTH ON THE PREVIOUS QUARTER, +44% REVENUE GROWTH, AND POSITIVE EARNINGS REVISION.

6-week consolidation pattern with price finding support on 38.2% Fib retracement. Revenue growth >30% YoY Gross profit margin >80% Positive Cash Flow

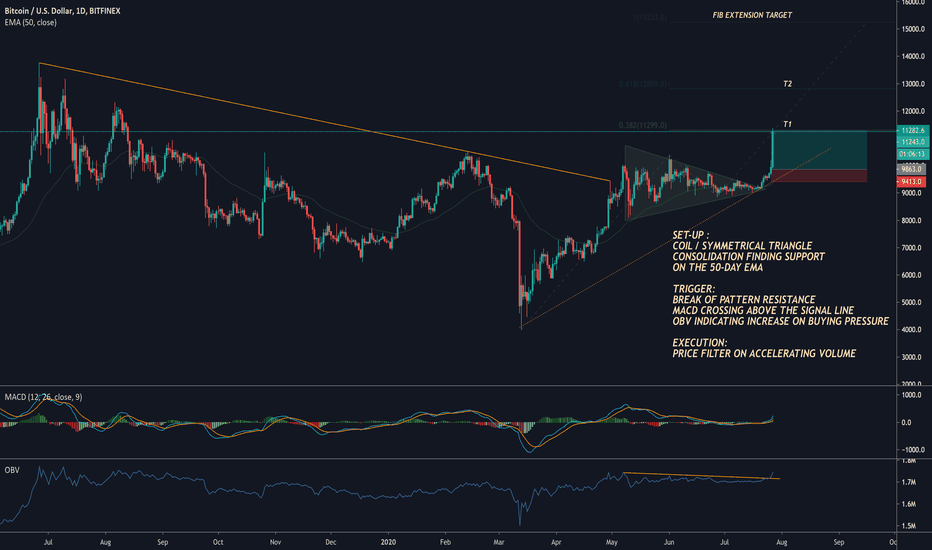

SET-UP : COIL / SYMMETRICAL TRIANGLE CONSOLIDATION FINDING SUPPORT ON THE 50-DAY EMA TRIGGER: BREAK OF PATTERN RESISTANCE MACD CROSSING ABOVE THE SIGNAL LINE OBV INDICATING INCREASE ON BUYING PRESSURE EXECUTION: PRICE FILTER ON ACCELERATING VOLUME

Ethereum managed to follow Cardano's lead. Trade management on it's way to hit potential Fib Extension price target would be ideal to buy on pullbacks.

Potential break out from 5 week consolidation pattern with ADX > 30 indicating sustained accumulation on the stock at current price level.

GBTC POSITION TRADE Narrative, Use Cases, and Addressable Market can be found on the following link (pages 74-80): www.slideshare.net Position Trade: Grayscale Bitcoin Trust (GBTC) enables investors to gain exposure to the price movement of Bitcoin through a traditional investment vehicle, without the challenges of buying, storing, and safekeeping...

Revenue (YoY) 19.25% Revenue 3 Year (CAGR) 22.66% Gross Profit Margin 85.60% EBIT Margin 31.36% Net Income Margin 30.71% Total Cash (MRQ) 4.35B Total Debt (MRQ) 4.70B Total Debt to Equity (MRQ) 43.17% Current Ratio (MRQ) 1.29 Quick Ratio (MRQ) 1.11

Revenue (YoY) 27.66% Revenue 3 Year (CAGR) 28.93% Gross Profit Margin 40.27% EBIT Margin 5.20% Net Income Margin 4.10% Total Cash (MRQ) 71.39B Total Debt (MRQ) 91.40B Total Debt to Equity (MRQ) 123.97% Current Ratio (MRQ) 1.18 Quick Ratio (MRQ) 0.97

Revenue (YoY) 32.11% Gross Profit Margin 68.36% EBIT Margin -34.93% Net Income Margin -32.87% Total Cash (MRQ) 1.70B Total Debt (MRQ) 151.28M Total Debt to Equity (MRQ) 7.93% Current Ratio (MRQ) 11.75 Quick Ratio (MRQ) 11.48

Potential swing trade on AMD or a beginning of a consolidation pattern. Revenue (YoY) 30.14% Revenue 3 Year (CAGR) 17.26% Gross Profit Margin 44.36% EBIT Margin 11.56% Net Income Margin 7.96% Total Cash (MRQ) 1.77B Total Debt (MRQ) 894.00M Total Debt to Equity (MRQ) 27.05% Current Ratio (MRQ) 2.10 Quick Ratio (MRQ) 1.47

DAY TRADE ON PRICE ACTION AND VOLUME. POTENTIAL NEW HIGH ON THE BACK ON ACCELERATING MOMENTUM.

POSITION TRADING ON THE BACK OF A 6-WK CONSOLIDATION WITH 38% PRICE RETRACEMENT. OBSERVE VOLUME ACCELERATION FOR TRADE ENTRY CONFIRMATION.

Volume build-up on new high. Ascending triangle pattern with ADX > 30 and OBV indicating sustained buying pressure.

Just as Gold is breaking out to new highs, Silver is potentially on a juncture where it could continue is intermediate uptrend. Fibonacci Price Extensions and Elliot Wave analysis applied. SIL (silver miners ETF) already breaking out from consolidation observed thru On Balance Volume (OBV) indicating buying pressure.

As markets uncertainties become more evident, risk-aversion leads to flight to safety.

Increased demand for testing for COVID19 as cases begin to increase. Breaking out from 10-day consolidation after a breakout from 1 month consolidation. ADX accelerating to 30. OBV indicating buying pressure.