TradingNutCom

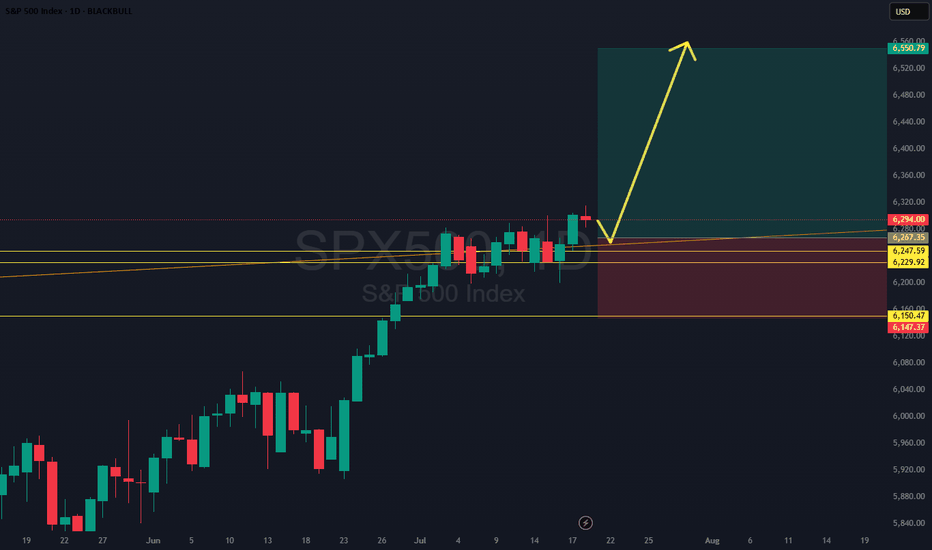

EssentialSPX500 just broke and closed above a key daily level, confirming strength after a bull flag formed off a skinny leg up. The plan? Wait for a retest of that flag structure, then ride momentum higher. We’ve got a conservative stop below solid support, making this one of the cleanest, most technically sound setups of the week. Only watch-out: price may not give the...

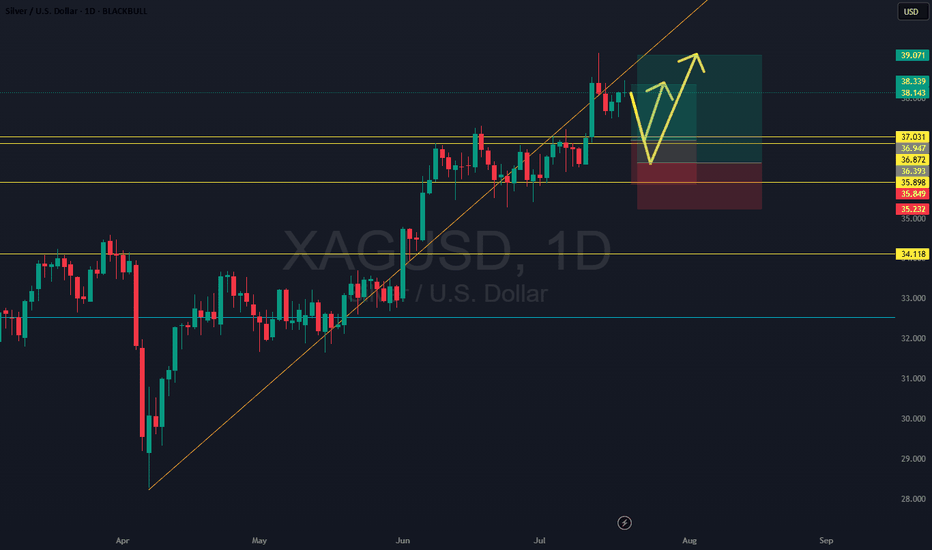

Silver’s uptrend is alive and kicking—with the daily breakout confirming bullish momentum. Price looks primed for a retest before a potential aggressive push toward new highs. We’re eyeing two entry scenarios: a conservative play with higher fill probability and a more aggressive setup with better structural protection but less chance of triggering. Both setups...

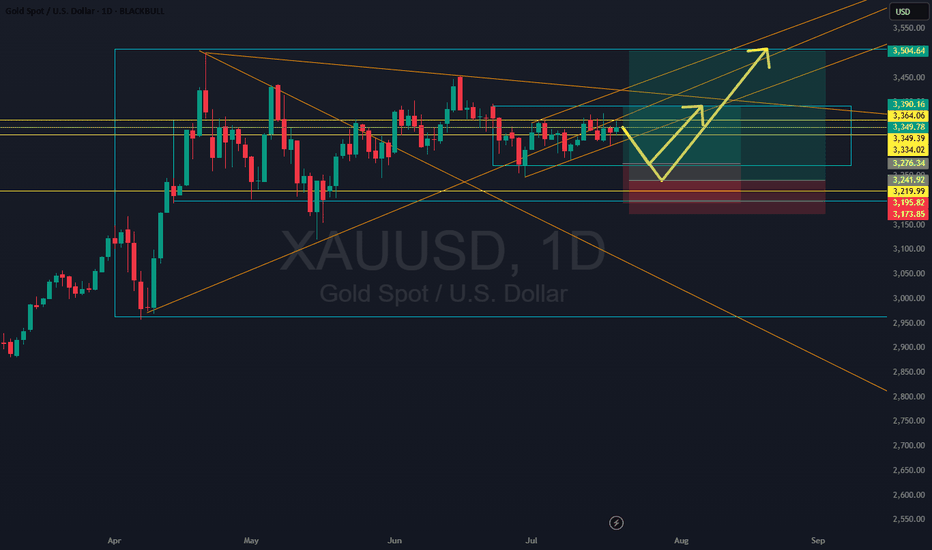

Gold’s still technically trending up, but momentum is fading with failed attempts to push into new all-time highs. This setup explores two potential plays: one conservative and one aggressive. Both anticipate a move down toward the lower boundary of the current range before buyers step in. Whether we bounce off the base or push higher for a breakout attempt, the...

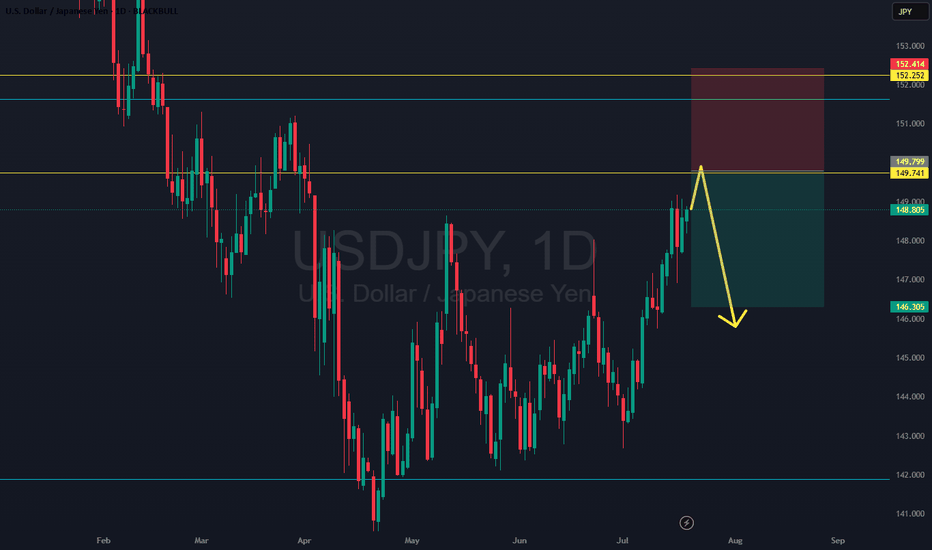

USDJPY remains in a broader uptrend but has recently stalled after breaking out of multiple ranges. This setup targets a short-term move as price attempts to test the top of a lower timeframe range—likely the daily. We're trading within nested ranges here, looking to catch a small piece of the move before higher timeframe resistance steps in.

NAS100 is hovering near all-time highs. While a retest of the weekly trendline remains likely, this idea aims to ride the current bullish momentum. The plan anticipates a short-term pullback to recent lows to potentially form a head and shoulders pattern before a move lower toward the weekly trendline. This is a high-risk setup I’d typically avoid, but the strong...

Gold is still stuck in its broader range, but a recent upside trendline break opens the door to a test of the range highs - or beyond. This setup presents two ideas: one targeting a move back to the top of the range, the other a potential fakeout with a more conservative TP. The trade fails if either TP is hit before entry. Patience and precision are key here.

Gold has broken back inside the higher time frame range, with price stalling on the monthly chart — a clear sign of indecision. On the 4-hour chart, a clean downtrend is forming and appears likely to hold. Despite visible rejection wicks suggesting temporary buying pressure, the broader structure hints at a potential retest of the broken trend line or even a...

WTI is showing signs of a breakout following reports suggesting price spikes ahead. I've taken an aggressive position early, with an extreme risk-reward setup. A more conservative 3R idea also sits in play if price confirms. Watch for a trendline break—the clearest sign of lift-off. But be warned: the gap breakout may hit before many can get in. Momentum is...

EURUSD has been trending higher but is now flashing signs of exhaustion. While shorts remain risky without more confirmation, aggressive traders could explore them near the highs. Longs also carry increasing risk at these extended levels. Two idea paths: a cautious long continuation, or a speculative reversal trade. A clean break of key trendlines will likely...

NAS100 may be carving out a triple top or micro head-and-shoulders, hinting at a potential short-term reversal. A confirmed break of the current range is still required to validate downside momentum. With heightened geopolitical risk (U.S. strike on Iran), capital may rotate into gold and oil, weighing on equities. This is a low-risk, short-term idea only—more...

With the U.S. entering the Iran conflict, Gold’s flight to safety narrative may be reigniting. Price recently faked a range break and snapped back inside a key trendline—potentially setting the stage. This idea anticipates one final pullback to form a micro head-and-shoulders, offering a cleaner long entry before a push to new highs. Confirmation still needed, but...

The NAS100 has formed a potential triple top, and key trendlines are starting to break to the downside. This could signal a short-term correction before bulls attempt another push for new highs. A temporary drop might offer a better long setup if momentum resets.

Gold is surging as the Middle East conflict intensifies, fueling a rush to safety. We’ve seen a clear breakout from the recent range, with a significant gap up at the open. While momentum could drive price to new highs, I’m eyeing a pullback to key zones for a cleaner entry—either at the trendline retest or a daily weakness setup.

Gold (XAUUSD) is testing a key higher timeframe trendline with strong confluence. The break is clean — now we watch for the retest. Entry location’s uncertain, so the stop sits wisely below the prior HTF bounce. Targeting the opposite trendline and nearby consolidation zone.

NAS100 is stuck mid-range on the 4H — neither pushing up nor breaking down. This idea plays it safe: placing a long at the bottom of the range, aligned with the overall bullish trend. If the channel holds, this may never trigger — but if it does, we ride it to the highs.

EURUSD has already made its bullish push — but now it's flashing mixed signals. While the trend suggests continuation, forex's mean-reverting nature says otherwise. This low-probability idea targets a drop to the 4H range lows, then a rebound to retest the highs. Caution: we’re trading the chop here, not the trend.

NAS100 has broken its uptrend but still feels bullish overall. The plan? A tactical short on the pullback and a long if it reclaims strength. If both play out, it’s a multi-legged win. If not, it’s a lesson in humility. Here’s how we’re threading the needle with a high-risk/high-reward setup.

EURUSD has snapped its trendline and may now aim for the far side of a large monthly wedge. But the big question: does it pull back for a retest or push higher straight away? Two trade ideas here—one if it comes back, one if it launches. Here’s how we’re preparing for both outcomes and the key levels to manage risk.