TradingSutra

PremiumNifty is likely to correct lower towards 23400-23000 zone before resuming up.

The pair is rising impulsively and currently about to conclude it's 4th wave (Circle) and break the previous high under wave-5 circle. The confirmation for the same will come above 1.36.

Nifty is rising in an impulsive manner of which 4th wave is already concluded at 23847 zone and currently trading under wave-5. This shall take the index towards 24875 zone where wave-5 becomes equal to wave-1.

Stock is rising in an impulsive manner and currently started it's 5th wave which shall take the prices towards 7000/7600 zone in the coming weeks. On the downside key level is 5400. One should remain bullish as long as prices are trading above this level.

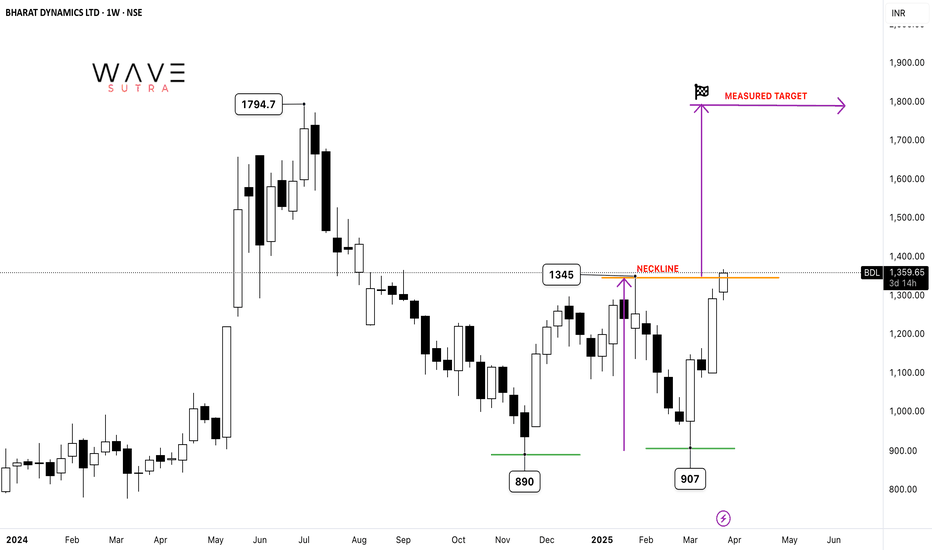

Stock has given a breakout of Cup & Handle pattern and retested the neckline in Jan'25. The measured target for the same is coming in the region of 1900. On the downside the key level can be 1080.

Stock is rising in an impulsive manner and currently trading under wave-4 correction. This correction is likely to conclude in the zone of 2215-2200 zone and then we can expect another rally on the upside under wave-5 towards 2350 zone.

The Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components: Structure of the Pattern: Left Shoulder: A price decline followed by a temporary rally. Head: A deeper decline forming the lowest point, followed by another rally. Right Shoulder: A...

The Double Bottom pattern is a bullish reversal chart pattern that signals the potential end of a downtrend and the beginning of an uptrend. It consists of two consecutive troughs (lows) at roughly the same level, separated by a peak. The pattern resembles the letter "W." Key Features: Two Lows: Nearly equal in price, indicating strong support. Neckline: The...

The Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components: Structure of the Pattern: Left Shoulder: A price decline followed by a temporary rally. Head: A deeper decline forming the lowest point, followed by another rally. Right Shoulder: A...

The Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components: Structure of the Pattern: Left Shoulder: A price decline followed by a temporary rally. Head: A deeper decline forming the lowest point, followed by another rally. Right Shoulder: A...

Stock traded in a range of 2060 and 1640 since Oct'21. The current price action suggests for a breakout of the rectangular range. A sustained breakout shall push the prices higher towards 2590-2600 zone in the coming weeks and months ahead.

The Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components: Structure of the Pattern: Left Shoulder: A price decline followed by a temporary rally. Head: A deeper decline forming the lowest point, followed by another rally. Right Shoulder: A...

A symmetrical triangle is a chart pattern in technical analysis that forms when the price consolidates with lower highs and higher lows, creating a converging triangle shape. This pattern indicates a period of consolidation before the price breaks out in either direction. SRF stock has already given a bullish breakout. One should go long on the stock with Stop...

Since the low in January 2024, the stock has been rising impulsively and is currently trading within wave 3. This indicates that any pullback should remain above the 590 zone, with prices expected to continue trending toward 730 in the coming weeks to complete the wave-4 and wave-5.

Nifty has risen up in an impulsive manner from the bottom of 21964. Any correction is likely to hold above 22175 and extend the recovery towards 22800-23000 zone in the coming days and weeks ahead.

Theory: DIAGONAL: Diagonal are the motive waves like an impulse wave, but diagonals are different from impulse wave in that they do follow the first two Sutras (rules of impulse wave) for wave analysis, but it does not follow the third one i.e. Wave 4 should not intervene the territory of the wave 1. In a diagonal wave 4 always enters into the price territory of...

Prices have formed a continuation Head & Shoulders whose neckline is 775 zone. Prices have given a breakout of the neckline and likely to continue the uptrend. The measured target of the pattern is coming in the region of 950 zone. On the downside the key level is 712.

From the Covid low of 145 zone prices have given a rally for two years and made a high of 590 in Jan'22. From there prices have retraced 50% and made a low of 272 and recovered back to hit new all time high. Prices have made a continuation Head & shoulders pattern whose neckline is 500 zone. Prices have given the breakout the neckline and currently retesting the...