Trading_King_Arthur

💥 Post-market surprise news shook the gold market: About a week ago, Trump publicly hinted at “considering firing” Powell. But just after today’s market close, he suddenly walked it back, saying he “never thought about it.” At the same time, he dropped signals of easing trade tensions — this combo crushed gold’s safe-haven sentiment, causing a gap-down open that...

📊 Yesterday, gold resumed its bullish move after a minor pullback, breaking through the 3400 level and reaching around 3440 during today’s early session, before starting to retrace. 📉 In the chart I shared yesterday, the black line represents the key bull-bear boundary. The current price has already broken below this level, and if it fails to reclaim it, the...

Congrats to everyone who followed my long positions before last Thursday’s market close! Gold opened higher today, bringing us the first profit of the new week — a great start with accurate direction! Currently, gold is facing selling pressure near the historical high around 3360. On the 1H chart, technical indicators look solid. Once the pressure is absorbed,...

📌 Gold has surged over $400 in just six trading days—a textbook example of an extreme short squeeze! Yesterday, gold broke above the 3300 psychological barrier and is now trading above 3360. While safe-haven demand driven by escalating trade tensions is part of the reason, such a rapid and steep rally is clearly unsustainable. ⚠️ If you enter at these levels...

Yesterday’s market remained calm without any significant swings, unlike the strong movements we’ve seen previously. Today, however, appears to be a critical turning point as the market prepares for a directional breakout. 📊 Technical Overview: Gold is showing signs of retesting the resistance around 3240, while short-term support lies at 3194–3188. If this...

Over the weekend, Trump announced a pause on tariffs for popular consumer electronics, prompting gold to gap down to 3210 at today’s open; ✅ Our recommended short entries at 3230–3260 are already in profit; New semiconductor tariff announcements are due during the U.S. session today — the key driver for gold’s next move; Given the fragile U.S....

Gold has continued its strong rally, hitting a new all-time high, with bullish sentiment running extremely hot. However, we must approach this rationally — every new high is usually followed by a technical pullback. Currently, the 3200 level is a significant psychological resistance, as well as a key threshold for short-term bullish momentum. From a technical...

Today's signals for XAUUSD / BTCUSD / GBPUSD all hit their targets! Congrats to everyone who followed—great profits all around! 🕒 Reminder: CPI data will be released in 1.5 hours. Before that, we may see: A quiet, ranging market, or A pre-release pricing-in scenario that leads to sharp volatility ⚠️ Trading Suggestions: ✅ If you want to avoid...

Gold remains under pressure around the 3100 level, where previous trapped buyers are creating significant selling pressure. The heavier resistance zone lies between 3127–3146, so if you’re holding long positions, don’t be greedy — this is a crucial area to watch! Tomorrow during the U.S. session, we’re expecting major economic data and headlines. The market...

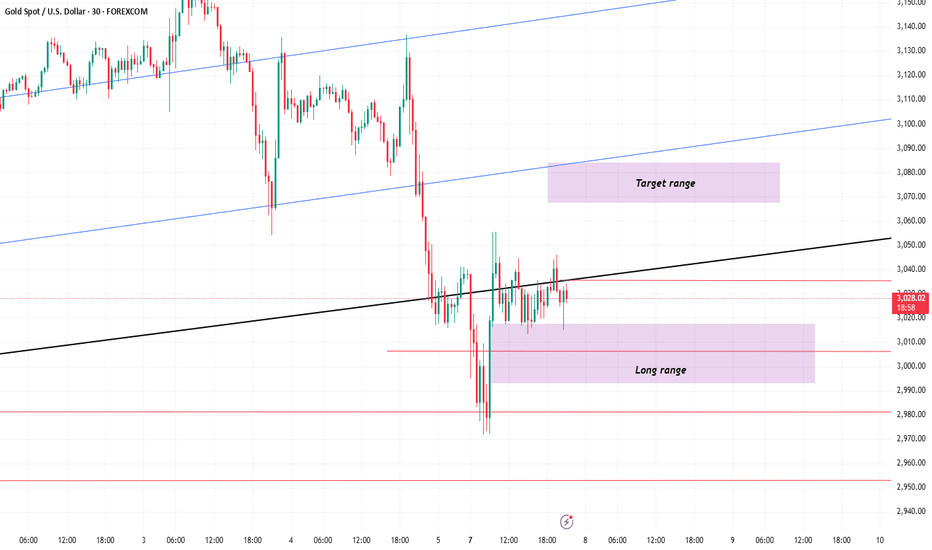

On the 1H chart, the MACD is showing a bullish divergence, signaling a potential bottom. If gold can build a base around 2960-2980, bulls will have the upper hand from a technical standpoint. While today's major macro news will hit during the U.S. session, technical analysis dominates the Asian and European sessions — which favors a buy-on-dip strategy. The 3030...

At the market open today, we signaled a buy opportunity near the 2980 level for gold. Since then, the price has surged over $30, and those who followed the strategy have already secured solid profits. Gold is now approaching a short-term resistance, so a minor pullback may occur. However, the overall uptrend for the day remains intact, and our strategy continues...

Gold witnessed another round of extreme volatility today, plunging below the 3000 level before quickly rebounding. Since then, the price has repeatedly tested support in the 3030–3018 range. So far, this support zone has held up well, suggesting buyers remain active at lower levels. However, traders should keep a close eye on the 3047 resistance area, which may...

Over the weekend, geopolitical tensions remained elevated: A mortar attack targeted the vicinity of Aden Adde International Airport in Mogadishu, Somalia. U.S. forces launched airstrikes on key targets in Saada, a city in northern Yemen. Ukrainian forces conducted multiple strikes on Russian energy infrastructure. Massive protests erupted across dozens of...

During his ongoing speech, Powell mentioned that tariffs may push inflation higher in the coming quarters. While inflation is currently close to the 2% target, it still remains above it. The market has already begun to anticipate a Fed rate cut, which is a potential bullish signal for gold. From a technical perspective, the recent drop has partially corrected the...

The gold market experienced huge fluctuations on Thursday, which created very good profits for us. During the entire trading process, we seized the profits of fluctuations of more than $50. The unemployment rate and NFP data during the US trading session on Friday, as well as Powell's speech on the economic outlook, are the focus of Friday's trading. Judging...

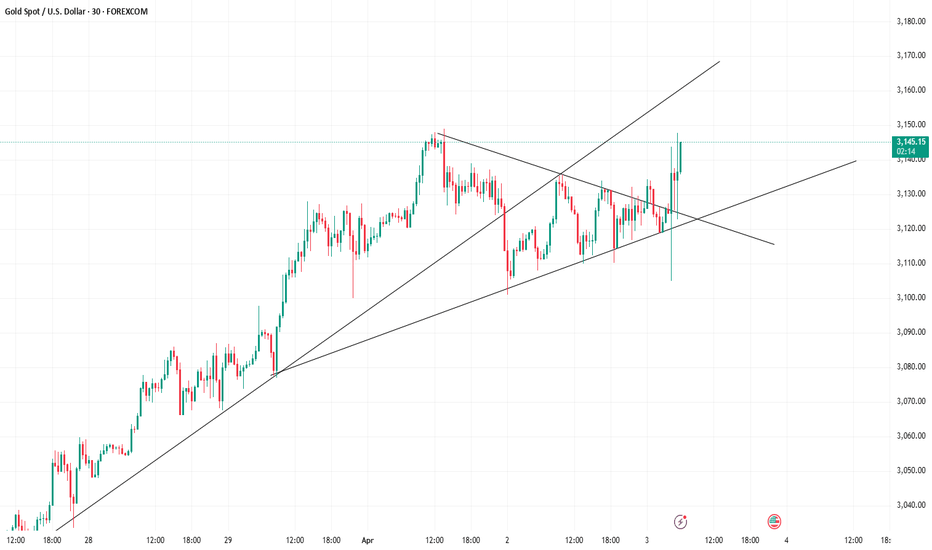

Affected by tariffs and inflation news, gold fluctuated sharply before the market closed. The market was in a situation of double kills for both long and short positions, and the sentiment was still fermenting. At present, the bulls also took this opportunity to successfully break through the resistance, and the price returned to above 3140 again. From the...

So far, gold has continued to fluctuate in the 3110-3136 range. Although the candle chart has many long lower shadows, the high point is moving down. If this trend is not broken, the probability of falling below 3100 today is very high, so when trading, everyone must be cautious. Personally, I suggest selling as the main method.

If the price reaches the 3136-3148 range, there is no need to hesitate, just sell. This is the gold trading strategy for today provided to you before yesterday's closing. I wonder if any friends have grasped this profit? After getting support near 3125, the price rebounded again. It is still in the rising stage. The resistance continues to focus on the vicinity...