Trendxinc

EssentialCAPITALCOM:COPPER Weekly Chart Analysis 📈 Current Price: $5.05(-1.43%) 🎯 Key Levels: Support Levels: $5.00 (Major), $4.92 (Next support) Resistance Levels: $5.50 (Next major target) 📊 Trend & Market Structure Breakout Confirmed: Price has broken above previous resistance (~$5.00) and is sustaining. Retest in Progress: Currently testing support at...

NSE:APOLLO - Breakout Setup 🔹 Current Price: ₹122.44 (+2.43%) 🔹 Ascending Trendline Acting as Support 🔹 Potential Upside Target: ₹183.30 (+49.28%) Technical Analysis: ✅ Strong bullish momentum with higher lows ✅ Breakout confirmation expected around ₹140-150 ✅ Volume increase supports upward move 🚀 Potential 50% move ahead if trend sustains!

📈 NSE:REDINGTON 🔹 Current Price: ₹243.97 (+0.43%) 🔹 Support Zone: ₹240 🔹 Target Price: ₹323 ✅ Stock following an ascending trendline ✅ Retesting breakout zone – bullish momentum expected ✅ Gradual higher highs indicate strong buying interest 🚀 Potential for a rally towards ₹323 if support holds! For study purpose ONLY. Never a Buy/Sell...

📈 NSE:CARTRADE 🚗 - Strong Breakout with Retest Opportunity! 🔹 Current Price: ₹1,694.95 (-4.94%) 🔹 Key Support Zone: ₹1,500-1,600 (Buy near this level) 🔹 Target Price: ₹2,459 (54.33% potential upside) ✅ Stock broke out of a trendline resistance ✅ Retesting breakout zone – potential buying opportunity ⚠️ Watch for support holding before entering positions 📢...

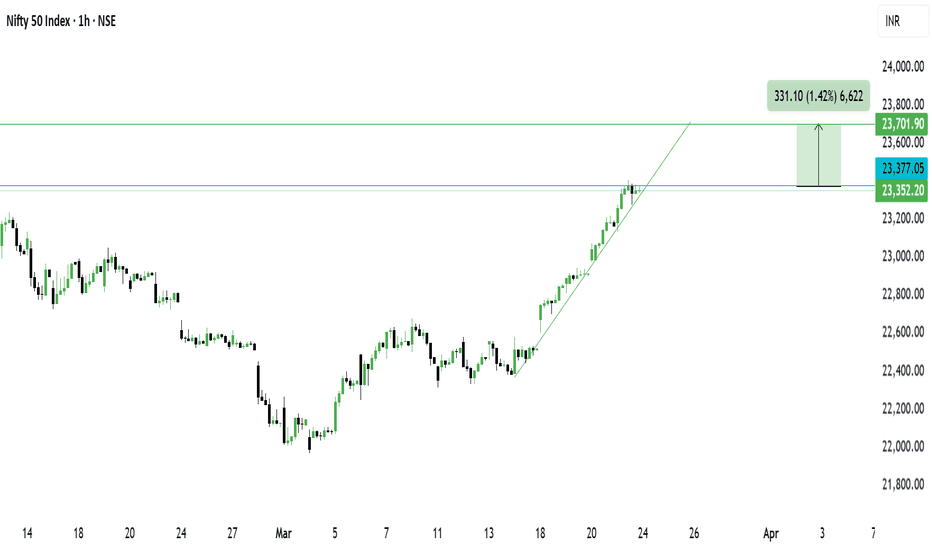

Nifty Trading Strategy for the Week Ahead 📝✅ Nifty has recovered strongly from the 22,700–22,800 zone up to around 23,350. Momentum on the 1H chart is still pointing upward (higher highs and higher lows since early March). Max Pain: ⚠ The current Max Pain appears around 23,200–23,300. Price (≈23,350) is slightly above Max Pain. Often, option sellers benefit if...

NSE:BAJFINANCE - Multi-year breakout suggests strong bullish momentum 🔹 Current Price: ₹8,633.20 🔹 Breakout Above Resistance 🚀 🔹 Pattern: Ascending Triangle 📐 🔹 Target Price: ₹12,439.20 (+53.31%) ✅ Volume confirmation supports further upside ⚠️ Support level at ₹8,000 should hold for bullish bias 📢 Traders & investors should watch for sustained breakout...

What the NSE:NIFTY Data Points as on 18 march 2025 📈 Key Observations:🔍 - Spot Price & Max Pain:Spot Price: 22,508.75 - Max Pain: 22,500 - The max pain theory suggests that the price might gravitate towards 22,500 by expiry. Open Interest (OI) & OI Change:📊 High OI build-up at 22,500 and 22,600 strike prices. Call writing seen at 22,600 and 22,700,...

NSE:NIFTY Analysis and Trading Strategy Key Observations: Nifty Spot Price: 22,397.20 Max Pain: 22,450This suggests that option writers will try to move the market towards this level by expiry. PCR (Put-Call Ratio): 0.99PCR near 1.0 indicates a balanced market, with no extreme bullish or bearish bias. A rise above 1.2 suggests bullishness, while a drop...

NIFTY Trading Strategy Based on Data Analysis Key Observations: 🔍 Spot Price: 22,470.50 Max Pain: 22,450 → This suggests options sellers will benefit if Nifty expires near this level. OI (Open Interest) Analysis:📊 Total Calls OI: 1,758.40 L Total Puts OI: 1,527.76 L Call OI Change: +192.31 L (Increase in call writing, indicating resistance) Put OI Change:...

NSE:VOLTAS – Strong Recovery & Breakout Potential! 🚀 📌 Current Price: ₹1,410.00 📌 Target Price: ₹1,645.15 (+15.55%) 📌 Recent Trend: Reversal from Bottom 📉➡️📈 ✅ Bullish Momentum Picking Up 🔥 ✅ Key Resistance at ₹1,437.55 - Potential Breakout Level 📊 ✅ Upside of 15.55% If Breakout Holds 🚀 What’s your take? Will this breakout succeed? Drop your thoughts!...

Hey everyone! Let’s check out Intuitive Machines, Inc. NASDAQ:LUNR – it’s been making some waves recently! On February 114, 2025, LUNR closed at $19.62, marking a solid gain of +2.40%. The stock hit a high of $19.93 and a low of $18.44, with a trading volume of 10.43M. That’s some serious activity!🔥 Here’s the breakdown:💡 - Entry Zone: Above $20 (near...

Rigetti Computing Inc NASDAQ:RGTI – Breakout Trade Setup 💪🔥🚀 Entry: Above $12.50 for confirmation Stop Loss: $10.50 to manage risk Target: $31.63 based on measured move projection Risk-Reward Ratio: High potential reward compared to risk Why This Trade? 📚💡 The stock has been consolidating under a descending trendline and is attempting a breakout....

Stocks I'm looking to short tomorrow in #StockMarketIndia: 1. RBL BANK NSE:RBLBANK Entry Level: ~164 Target Level: ~154 Potential Drop: -5.95% (~9.85 points) ✅Volume Consideration: Moderate liquidity (~301.92K) ✅Trade Plan:The price has broken support around 164, signaling a short opportunity. ✅Maintain a stop-loss above the entry point (~166-167) to avoid...

📢 Loma Negra ( NYSE:LOMA ) Breakout Alert! 🚀 A breakout from this bullish pennant could push the stock up 42.7% towards $17.54! 📊 Current Price: $11.94 (-1.40%) 📈 Breakout Target: $17.54 🔥 Potential Gain: +5.25 points (+42.73%) Are you watching this breakout opportunity? Let us know in the comments! ⬇️💬

🔥 Texas Pacific Land Corporation ( NYSE:TPL ) Ready for a Major Move! 🔥 This weekly chart is showing a breakout pattern, with 63%+ upside potential to $2,258.15! 📊 Current Price: $1,381.19 (+2.67%) 📈 Target: $2,258.15 🎯🔥 🚀 Potential Gain: +879 points (+63.75%) Will TPL hit new highs? Drop your predictions below! ⬇️ 💬 #Stocks #Trading #Breakout #Investing

The chart of Palladyne AI Corp. NASDAQ:PDYN suggests a potential breakout move: Technical Analysis: Breakout from a Downtrend: The stock has broken out from a descending wedge/pennant, which is generally a bullish pattern. Strong Weekly Close: Last week, PDYN closed +17%, confirming strength. Above Key Moving Averages: It is trading above the 5-day, 10-day,...

NSE:SRF has broken out of a downtrend with strong buying momentum. The breakout indicates a potential upward move. - The price has decisively crossed the trendline, confirming bullish sentiment. - Increasing volume on the breakout confirms participation by buyers. Entry Point: Around 2,325 INR (current level or on slight pullback). Stop-Loss: 2,220 INR (below...

NSE:POKARNA has shown strong momentum with a breakout above key resistance levels. Currently trading at ₹1,223.55, with a 9.8% breakout target in sight. - Breakout from a consolidation range with strong bullish candles. - Significant volume spike supporting the breakout. - Resistance: ₹1,353.80 - Support: ₹1,195.45, ₹1,149.38 Trade Setup: - Entry:...