- Tesla in a battle to reopen with California government. Elon tweeted he may move Tesla out of California as a result ! That would be a big financial hit and cost big $$ to initiate if this eventuated. - Technically the chart is pretty clear - the battle lines between the bulls and bears have been drawn. We like Tesla but are not buyers at these prices...

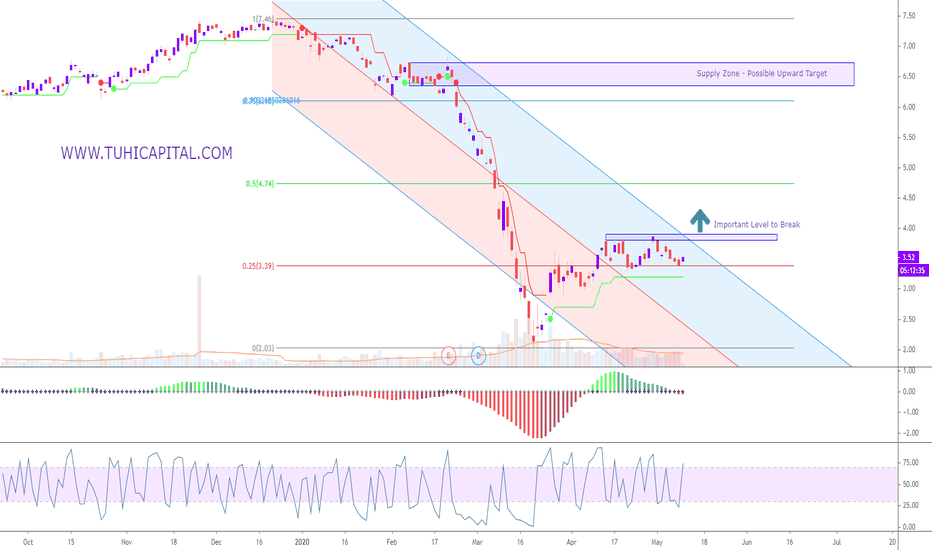

- Qantas is in talks with the government to secure an exemption for 1.5m social distancing rules on its its flights. - If given the green light and the ability to kick off at full capacity for domestic flights / (possibly incl. New Zealand) we expect the stock to move higher - possible to the 50% retracement. - Technically we are in a downward Channel and...

- We maintain a positive outlook on the dollar given its 'safer' haven status and continuing global trade concerns. - We are waiting for a buying point at the below demanz zone ideally.

- Has retraced over 50% of its downswing. - Momentum needs to be resolved here - currently we in a volatility contraction which needs to play out. Up and Down targets have been set.

- NYSE:SHOP has a market cap over $82bn and over 1 million small business customers - definitely one of the best growth stories over the last few years. -Technically it's maintained a strong uptrend and recently stayed within a steep narrow uptrending Pitchfork. Over 136% since its April 20 lows. - Some concern that this current run up isn't sustainable...

- Currently in a trading halt. Still operating stores in China. - Chinese company which has been accused of manipulating their financial reports. - This is lesson to keep in mind - there is indeed a higher operational and fraud risk in Emerging markets which needs to be managed. This is why technical analysis is also so important. Luckin dropped out of its...

- Ripple is experiencing a flash crash / distribution day today. - Demand zone buying opportunity - currently oversold making this zone prime for a bounce back up. Wait for the daily close.

- The total crypto market cap is worth $240 bn presently. It has moved out of it's downtrending pitchfork and broken above the upper parallel. - As more money is pushed into Crypto due to Fed money printing - we see a possible Market Cap Target of $360 bn. - The old $750 bn market cap can be reached but will need more real world application of blockchain...

- Silver has broken out of its consolidation and is heading higher. Have set targets at the immediate resistance zone and old highs. Momentum needs to turn up on our squeeze momentum indicator to hit Target 2 otherwise we will see more corrective behaviour from silver. - Not as strong as gold but precious metals are often sought as the Fed expands its balance sheet.

- Oil has stopped its massive downtrend - now pushing higher. Is the worst behind us? - Fundamental outlook is slightly more bullish given a number of countries moving out of severe lockdowns - this will help drive demand and sort out the oversupply. - Technically we have crossed the downtrending median line and we have targets at the upsloping median lines....

- Apple results were better than expected +13%. Revenue and EPS much higher than anticipated although overall profit down YoY. - Very impressive result considering China sales (down a reported 60%) and all Apple Stores were closed. - Technically Apple is in a strong recovery and the uptrend is showing renewed signs of acceleration - this is evidenced...

- 24% quarterly positive earning surprise pushes DropBox higher on the back of more people using Drop Box to support work from home. - They added an additional $1m paid users YoY and it's ~20% YTD Performance. - Technically the price has been pushing higher and zooming through the upsloping median line. We expect prices to head back to the support zone at $24

- Uber Shares break out from price consolidation after Eats Revenue increases buffers its $3 Billion Quarterly Loss - Stay at home orders gave an unprecedented 53% year-on-year revenue growth for the Eats Business. - Technically price has broken out of its down trending Pitchfork with a strong burst on the Connors RSI. Longer term momentum has been somewhat...

- Bitcoin futures now above $10k! Up ~40% YTD. - Billionaire Paul Tudor Jones reported he bought Bitcoin contracts as a hedge against central bank money printing - Have Price Targets of $13,600 and $20,000. - Connor's RSI showing a huge upthrust in this trend - now expecting a small pause / consolidation but Bitcoin Halving may accelerate us to our targets...

- Disney reported a $1.4bn miss to profits in the first three months of FY, as it closed its parks, movie releases and reduced advertising sales. - It reduced capital investment by $900m and suspending a planned dividend payment. It also has furloughed more than 100,000 employees last month. - Technically the stock is bounced of the pitchfork resistance...

- On Friday Chinese tech giant Tencent Holdings revealed it had taken a 5% – roughly $300 million stake in Afterpay. - This has caused a massive rush to buy APT. - Technically the stock is very overbought and is at a significant Supply Zone which also happens to be a 52w high. - From a fundamental perspective - price is currently over analyst estimates and...

- ASX 200 has not recovered as fast as the US Market but enjoyed strong gains today +1.6%. - Technically we have retraced to the 32% Fib level from our 52w Highs. We want to see a breakout from this level and a push past the 50% level. - From a Health perspective Australia has flattened the Covid19 curve but some of the biggest contributors to the ASX 200 such...

- The Aussie has been its trending up over the last couple of weeks. - Given the RBA outlook on Aussie GDP and Rates - we don't think buying this strength is the right side of the trade. This is also coupled with very weak commodity prices and taking into account's the Aussie's strong long term correlation to this. - Prices may present a shorting opportunity...