UnknownUnicorn13514545

Gold was trading inside the 7 week range since the hawkish FED statement initiated drop a month ago. 1830 resistance tested many times and failed to break + better unemployment rate and added jobs pulled the pair to drop hardly and closed around 1763 area . As of now , 1750 stands as a strong support which is also the range bottom . In my opinion, gold is likely...

76.50 level monthly resistance/top looks like a strong rejection level ,profit booking like pattern has already formed after the OPEC meeting and indications are clearly visible in the weekly chart. Speculative sentiment index is around 50/50 hence we are expecting the price to drop and test the 65 handle monthly support . Signal : Sell every rise Target ; 65...

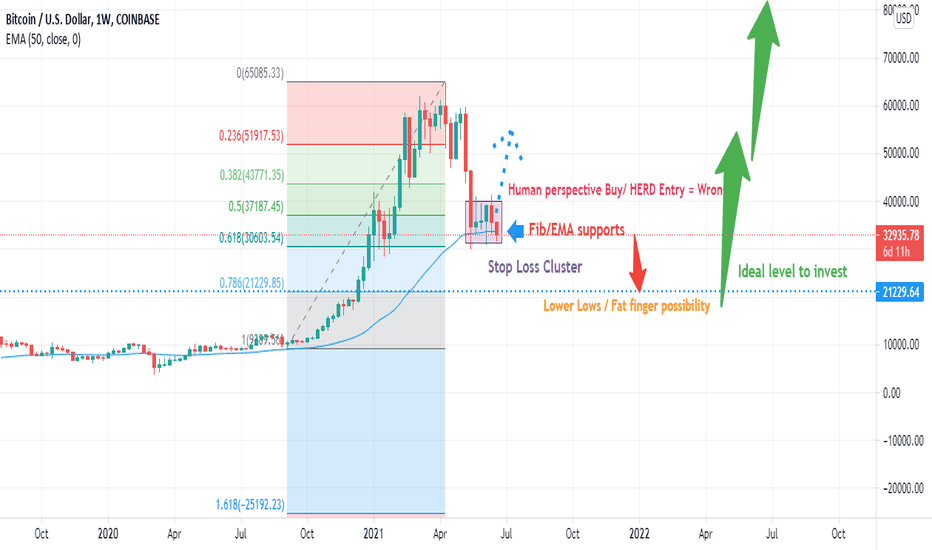

Bitcoin is trading inside the 30k-40k range since many weeks and likely to break the range bottom aiming the Stop loss cluster areas below 25k . Ideal level to invest is around 18-21k ,splitting position and entering long positions at every dip till 20k or slightly below is ideal in our opinion. On the other side , scalping inside the short term range is also good...

Buy signals given around 67-68.50 hit the target of 74 Handle . One more possible upside target is there around 76.50 handle however since the R-R is bad , its not good to enter fresh long positions .

Bitcoin is still trading inside the 5 week rectangular range 30k-41k and likely to continue for few more weeks so that the frustration tactics of algos accomplish / Early investors stop hunts . Like we said few weeks back, there is an inevitable possibility of a heavy second leg sell off / stop hunt / fat finger formations from the big players . Hence , it is...

Gold dropped around 60$ last night as the result of a hawkish FED comments ,tested almost the weekly support around 1800 handle . Technically 1795-1800 handle is an ideal level to go long and keep adding every dip targeting the short term resistance around the 1920 handle .However, on the other side, Since the FED is going to raise the rate sooner than expected ,...

It looks like the stop loss hunt has been done around 1.4035 which is also the 50 day exponential moving average support and the price got a strong rejection from that level . SSI is around 35% and there are high volatile economic numbers / Press conference on the calendar today. Hence we are expecting an upside break out above 1.4250 resistance heading to further...

Retracement is likely to finish around 1845-52 handle / 1830 weekly support . Speculative Sentiment Index is around 80% so its not that easy for the bulls to come back soon however since the trend is up better is to split the positions and add long position every dip targeting 1920+ and stop loss or manual close below the EMA 50 major support Signal : Long at...

Trend : Up Signal : Split Long Entries Market Price @ 154.80 , Pending order #1 @ 154.10 , Pending order #2 @ 153.50 , Pending order #3 @ 153.00 Stop Loss / Manual Close : Below 152.40 Target : 156.50 & 157.20

Its been a month the Price is consolidating around the 50-62.8% fib / EMA 50 support around the 30-32k handle. Since the profit is booked around 65k, we do not expect investors to come back soon as the HERD is in mass buying/averaging mode . As per our opinion, 30-40k range likely to continue or we will see another leg down towards the 20k handle or slightly below...

Speculative sentiment index is around 25% hence our advise is to find only long scalp entries in smaller time frames . Price likely to continue in the 100 pip range (1.2130-1.2250) with a minor support around 1.2100 ( EMA 50 area) . Breaking 1.2250-70 range top will push the price towards the major resistance around 1.2370. Trend : Range Signal : Long Scalp in...

Seems like a clear upside break out with a short term support near 67 handle ( previous resistance) + SSI is around 30% on an average Trend : Bullish Signal : Buy @ 68.50 (weekly pivot) , Buy limits above 64.25 - 66.00 (Supports) Strategy : Split positions Target : 73.75 - 76 Handle Stop Loss : Manual close / Parallel position below 64

1157 (August 2018 low) to 2075 (August 2020 high)- two year strong bull market made correction around 1676 (March,2021) which is the price in between the 38.2% - 50% Fib retracement level. Last month, price managed to close above 1900 handle and then tested the monthly pivot around 1860 and reversed. Speculative sentiment index is around 40% on an average. Its...

Speculative sentiment index is just 7.5% on an average indicating an open above 15660 eyeing the targets 15820 and 16k + psychological level / Possible stop loss cluster area . Stuck sellers just be patient and do not put equal parallel positions at the moment ,you will be stuck for life time . Do that only if your margin is in trouble and deposit later to avoid...

Since the last two months, the Germany index was trading inside the Inner Range 15130-15330 together with the outer range 14800-15550 by making stop hunt higher highs and lows many times . Last days we saw some strong upside push towards the 15670 handle indicating a possible break out of the ascending triangle like formation eyeing for 15820 and 16000...

As of now trading around 67 area with speculative sentiment index around 20% hence an upside break out is highly possible targeting the 72+ levels coming weeks . However, considering the trade on the last day of month + price around the range top , You can try putting sell limit orders 100-150 pips above the 67 top although success rate will probably very low as...

Speculative sentiment index is less than 20% for Gbp pairs , hence more upside movement is likely . Technically, Gbp/Usd aiming at testing the 2018 high around 1.4400 handle. A lot of Sell limit orders will get executed from that level since is the major resistance and top of the range since many years . Trend : Up Signal (pending) : Sell limit 1.4400-1.4550...

SSI: 45% Trend : Range Signal : Sell @ 1.2230-1.2275 Stop Loss : 1.2290 Target : 1.1975