UnknownUnicorn1738519

This is roughly what I am looking at right now. A lower low would invalidate this.

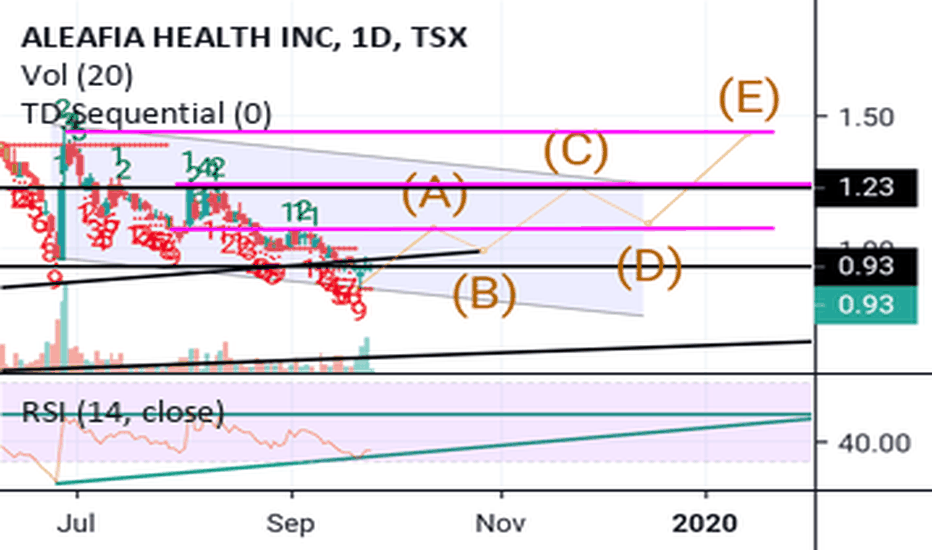

Aleafia looks like it is ready for a bounce at the very least. The RSI is also forming an ascending triangle. Easy risk to reward on this one. Either it breaks out from a $1 entry with a target around $1.50 or it breaks down from the $1 level, invalidating this trade idea.

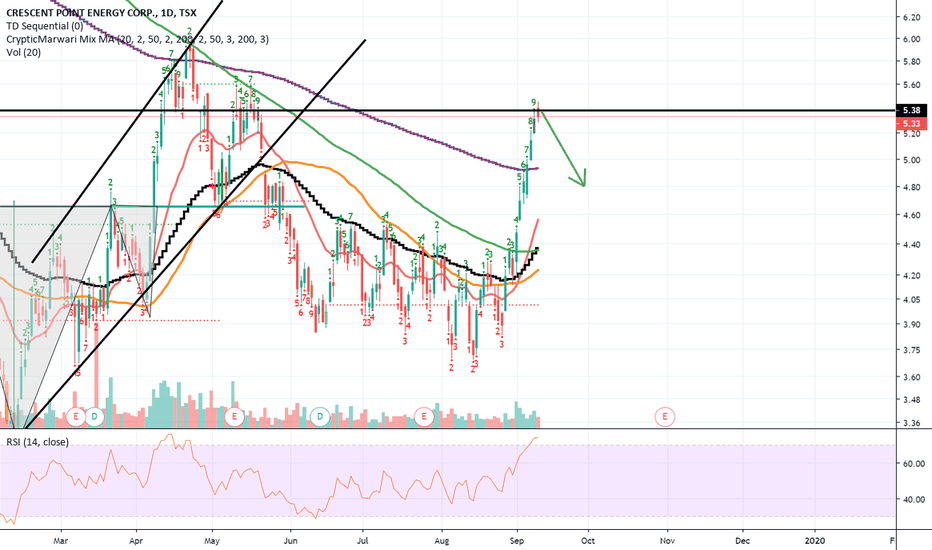

Daily 9 on the TD Sequential. CPG has gone up exponentially so I am expecting a pullback at the very least the prior support level. A daily close above 5.6 would invalidate this trade idea.

It looks like there is a head and shoulders forming on Gold. A measured moved would take us back to re-test the breakout of the ascending triangle which would present a great buying opportunity.

I love Tesla but I am expecting a short term pullback. It is on a daily 9 and a 4 hour 9 on the TD Sequential. Any closes higher invalidates this trade idea and we'll probably complete the gap fill if that is the case.

Daily 9 on SPX forming. Expecting a pullback to at the very least fill the futures gap. A close above the black trend line would invalidate this.

I am no technical analysis but Jumia has gone straight down for a while now. I think it is ready for a bounce at the very least. It is currently on a weekly 9 and as you can clearly see, selling pressure has levelled out. A new low would invalidate this trade idea.