UnknownUnicorn373805

When Ethereum was contrived it unleashed hell in the cryptocurrency space. So many scams, so many ideas too good to be true, and so much money being thrown at it. Meanwhile BTC trying to be dilligent, responsible, recievieving barely any attention. Its relative size in the crypto economy kept shrinking. Thats what i consider it the 5 years of hell, if you were a...

The dollar is slowly losing its reserve currency status and its possible gold make a comeback as money in the ensuing turmoil but how it will play out remains to be seen. This is my guess based on a "dumb" projection on the weekly chart.

There is alot of excitement in the ETH community about layer2 and general adoption as well as the coming switch from proof of work to proof of stake. It is generally believed that the western establishment will disrupt BTC adoption going forward and not ETH adoption due to the way ETH has evolved. ETH doesent try to educate people about money and decentralization,...

The bubble is basically the consolidation area. The price entered below, and may exit the top. "Continuation". This is a longer term prediction.

stETH is a promising token that is basically pegged to ETHUSD. It basically works like this: You give ETH to Lido, and they give you stETH (You can also buy stETH that is already circulating on an exchange or dex or whatever) but what happens is that any address that holds stETH will have more stETH added each day. How can this work without disrupting the peg?...

"You cannot have money without a king." The first wave depicted on the chart was driven by speculation more than anything else. The price went up, so it seemed like Bitcoin was a good idea. Then the price went up more and Bitcoin seemed like an even better idea. But now the speculation phase is over because there isn't as much money to speculate with as there...

On Bitcoin there is a red yearly candle every now and then. We can sort of "play around" with the numbers. The first red yearly candle was a correction of ~57% The second red yearly candle was a correction of ~74% This gives a difference of 17 percentage points. By now it looks like we are going to have a 3rd red yearly candle. If we extrapolate then this...

The difficulty bomb is active in Ethereum, there is no plan to stop it yet. So fees are likely going to increase exponentially over the coming months. This will likely push users away from ETH bottom layer and maybe into ETH layer2 aka rollups? No, because ETH layer2 rollup fees also go up when ETH bottom layer fees go up so alternative layers/chains like Solana,...

some people have written books about the Bitcoin Standard. It sounds ridiculous. Bitcoin as money? Lol A reserve asset? Lol But what if they are serious. PS. this is the satoshi index which Tradingview implemented recently. A satoshi is basically the smallest unit of Bitcoin as defined by the protocol. 1 satoshi = 0.00000001 BTC which is currently = $0.00029....

There is some nice symmetry in this chart. Def you need exposure to oil _yesterday_ if this chart ends up being correct.

BTC.d collapsed many years ago when ETH was born. After the collapse in LUNA it has regained some strength. How high will it go?

There are over a trillion dollars sitting in the reverse repo market at 0.4% interest. As soon as the dip is over, this money will probably flood into the stock market again. It also seems that a spike to 8000 fits the overall trend in the chart but lets see. The dip may not be over until a bulldiv emerges. I will try to update the chart if this happens.

Over the past few years hundreds of thousands of people have delved into bitcoin and at prices 20-50% higher than currently.So their conviction is being tested right now. Are they long term holders or just someone chasing a quick buck? If its the former the price is likely going to go up quick as they have established the new price floor. This is some TA on how...

It looks like Bitcoin is going to $150M. Its a logarithmic chart, so thats why it gets a bit extreme. But if Bitcoin clears $70k then its pure price discovery after that. And its got the longest term momentum on its side, even after the dip to $26k this week. Lets see.

Just a simple logarithmic chart with a price prediction based mirrored rektangels and "long term" trend

Given the current situation on the market this is likely going to be considered the most extreme bitcoin idea in the world right now. Yes i know that statement is a bit extreme. But clearly the market is in the mood for something extreme? Why else would the volaility be so extreme right now? This isnt really trading advice, but still thought i would put it out...

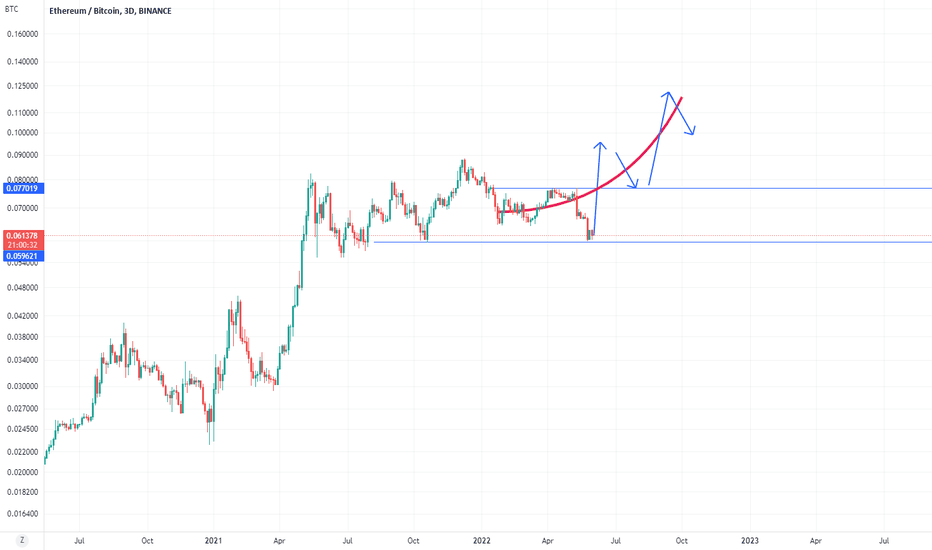

algos will completely stop selling if ETHBTC goes up just a little more but lets see

A chart depicting the price of one bitcoin in barrels of oil. Basically at the time of writing one BTC = 387 barrels of oil. It will be an interesting chart to follow going forward as the Euro Dollar system implodes. If BTC can outperform OIL in that scenario, that will be very strong imo.