UnknownUnicorn487550

Sell at 14.25 SL: 15.40 tp1: 13.95 tp1: 13.20

NZD/CHF Buy Stop at 0.5800 Sl: 0.5500 TP: 0.6050

Resistance above 1.23 awaits at 1.2440, that capped a recovery in mid-March, followed by 1.25, which provided support beforehand

GBP/JPY is pressured and it's a historical low. Momentum are still down but the rebound is expected t0 130.40 area, as long as 126.65 holds as support.

Technically, the pair sellers are catching a breath around 0.6100 marks ahead of targeting 0.6000 psychological magnets. On the upside, The monthly support-turned-resistance around 0.6185 acts as the immediate resistance and take profit target.

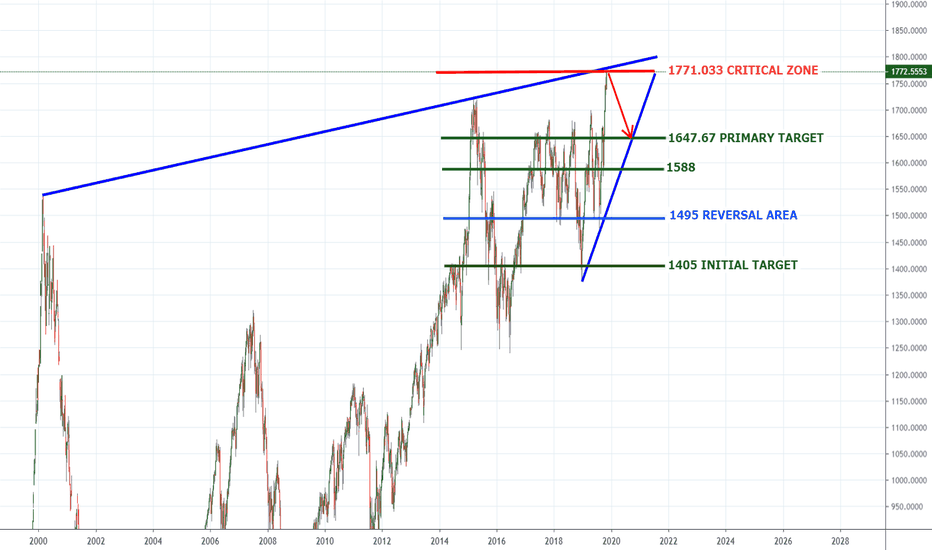

1600 may test again.

If FED doesn't cut the deposit rate by minimum 50 bp or higher, EUR/USD must die. If FED cut funds rate 1.00% or higher EUR/USD will immediately test 1.1250 and next target 1.1500/1.1550 area in the next week.

As long as USD/CAD below 1.4000 still hopes to downward correction. Coronavirus and oil price suffering Canadian Dollar but there is something to say about price action.

History says when bonds up, Gold rallies. Bond market near to the bottom level. Any time Bond may correction to upside and Gold will fall.

VOLVO B MAY TEST 155.145 AGAIN AS LONG AS 144.40 IS SUPPORT.

ECB may be more focused on steepening the yield curve that easing lending conditions. If so, that argues for less QE and more 10 BPS rate cuts. That's a scenario that could lead to short-term euro selling as it's used to fund carry trades. And my target is 1.0930 if rate cut is 20 BPS and QE Less than 50 billion EUR per month than final target is 1.0800 This...

Fundamentally safe heaven JPY is still favorable. but USD/JPY reached the bottom, so the corrective bounce is expected. Next week the FOMC and Jackson Hole Symposium will play good roles on USD/JPY. The market is expecting fed will cut-rate, more two times this year. But US economic report coming better than expected recent days. so FED may delay cut rates next...

Next week the market can start with a gap. today Trump-XI will talk about the tariff. The market is expecting something good form them. if the US responds positively about tariff the common currency will take a breath and can open by upside gap. There are other issues for EUR next week is EU-SUMMIT. Present governor Mario Draghi will ret.. next October so...

Eur Index and Usd Index Chart Comparison Indicate Us some correction in EURUSD Pair. USD Index Near to fibo 78.6 area and EUR Index Near to 23.6 area. So EURUSD Might Have Some Upward corection to 1.1500 or 1.1720 area..

When EUR Index Drop USD Index Rise. It has a good Good Inpact on EURUSD Pair.

present in flation is 2.6% and Fed is going to hike their bank rate. so market should be priced in to the rate. So Dollar should be buy till 27 of september.