UnknownUnicorn890690

The EUR/SEK currency pair has been trading in the falling wedge since the middle of August. Also, the pair has reached the lower boundary of the long-term ascending channel. Currently the rate is testing the lower channel line at 10.22. If given channel holds, a reversal north occurs in the nearest future and a breakout north from the wedge follows. Potential...

Bearish sentiment has been dominating the European common currency against the New Dollar since the beginning of October. The currency pair has already reached the lower boundary of the long-term ascending channel at 1.6380. Currently, the rate is testing the lower channel line. Given that the pair is being pressured by the 55-, 100– and 200-hour SMAs, it is...

The Australian Dollar has been appreciating in an ascending channel pattern against the Canadian Dollar since October 8 after the currency pair reversed from the bottom border of a dominant descending channel at 0.9100. The exchange rate broke the dominant descending channel pattern a few days ago. Currently, the pair is trading above a traditional weekly PP at...

The previous forecast worked, and the USD/MXN currency pair has breached the medium-term ascending channel. As apparent on the chart, the US Dollar is continuing to appreciate against the Mexican Peso. This movement has been bounded in the short-term ascending channel. Currently, the pair is testing its lower boundary at 20.05. if given channel holds, it is...

The BTC/USD pair has been trading in a junior descending channel pattern is the beginning of November. From a technical point of view, the bitcoin cryptocurrency is likely to continue its downside momentum. The potential target for the pair will be at the bottom border of the channel pattern at 2848.6. However, the cryptocurrency needs to surpass support levels...

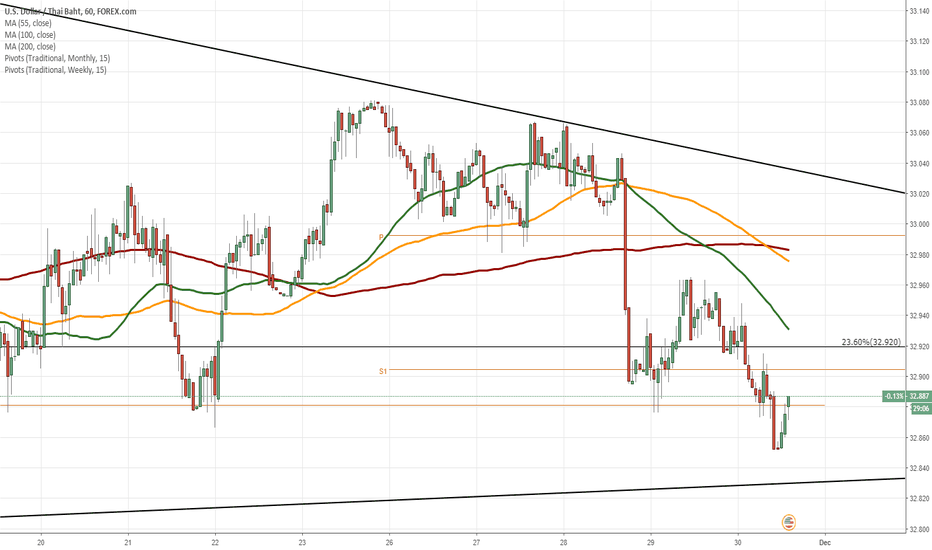

The USD/THB currency pair has been trading in a descending triangle since the end of October. From a theoretical point of view, a breakout north from the pattern occurs in the nearest future. A potential upside target is the upper boundary of the medium-term descending channel located circa 3.24. Technical indicators for the 1W time frame support bullish...

The Turkish Lira has been driven by a strong upside momentum against the Japanese Yen since the middle of August, and thus sending the currency pair to the weekly R2 at the 21.94 mark. As apparent on the chart, the pair is testing the upper boundary of the medium-term ascending channel near 22.10. Given that the exchange rate is being supported by the 55– and...

During Tuesday’s trading session, the yellow metal depreciated by 1339 pips or 1.09% to end the trading session at the 1,213.88 mark. During Wednesday morning hours, the gold was trading near the 38.20 % Fibonacci retracement level at the 1,214.48 mark. In regards to the near-term future, most likely, the 38.20 % Fibonacci retracement level at 1,214.55 should...

During Tuesday’s trading session, the currency exchange rate broke the resistance of the weekly R2 to end the trading session at the 113.75 mark. On Wednesday morning, the US Dollar was kept surging upwards to trade at the 113.86 mark. In regards to the near-term future, the US Dollar will keep surging upwards to trade at the 114.00 level on Wednesday. The...

During Tuesday’s trading session, the currency exchange rate was trading near the weekly S1 at 1.2750 to end the trading session at the 1.2737 mark. On Wednesday morning, the British Pound was located at the 1.2746 mark. In regards to the near-term future, most likely, the resistance of the weekly S1 at the 1.2750 mark will push the British Pound to decline...

During Tuesday’s trading session, the currency exchange pair passed through the support of the medium horizontal pattern line at 1.1301 to end the trading session at the 1.1285 mark. During Wednesday morning hours, the rate was trading between the weekly S1 and the medium horizontal pattern line at the 1.2978 mark. In regards to the near-term future, most likely,...

The LIGHT.CMD/USD pair has been moving in a descending channel since the commodity price reversed from its upper boundary at 76.88. As shown on the chart, the Light crude oil is testing the weekly pivot point and the 50-hour simple moving average at 52.81 during the morning hours of today’s session. If this resistance level holds, it is expected that the...

The US Dollar has been moving in an ascending channel pattern against the Swiss Franc since mid-September. The exchange rate reversed from its lower boundary at 0.9550 on September 21 and followed by a bullish sentiment. The exchange rate broke the channel pattern at the end of yesterday’s trading session. Given that a breakout had occurred through the bottom...

The Euro has been appreciating gradually against the Polish Zloty since the middle of August. This movement has been bounded in an ascending channel. As apparent on the chart, the currency pair is trying to surpass the resistance cluster formed by a combination of the 55-, 100-, 200-hour SMAs, the Fibonacci 38.20% retracement, the weekly PP and the monthly S1...

Downside risks have dominated the EUR/TRY currency pair since the beginning of September. This movement has been bounded in a descending channel. Currently, the exchange rate is testing the support level formed dy a combination of the weekly S2 and the monthly S1 near 5.9200. Given that the currency pair is being pressured by the 55-, 100– and 200-hour SMAs, it...

The SGD/JPY currency pair has been trying to surpass the resistance level—the Fibonacci 50.00% retracement at the 83.00 mark. Two scenarios likely. If given resistance level does not hold, it is likely that the exchange rate go upwards to re-test the upper boundary of a long-term ascending channel located circa 83.45. Important level to look out for is the...

The ZAR/JPY currency pair breached a long-term descending channel north at the beginning of November. The South African Rand has been depreciating against the Japanese Yen since the end of August. This movement has been bounded in a rising wedge. Currently the exchange rate is testing the resistance level formed by the Fibonacci 50.00% retracement at 8.23....

The US Dollar has been depreciating against the Polish Zloty since the currency pair reversed from the upper boundary of a long-term ascending channel at 3.8400. This movement has been bounded in a short-term descending channel. From a theoretical point of view, the general direction is expected to be south—the exchange rate should target the lower boundary of...