UnknownUnicorn890690

The US Dollar has been depreciating against the South African Rand gradually since the beginning of August. This movement has been bounded in a falling wedge. During this week the pair has been trying to breach the resistance level formed by the weekly R1 at 14.54. Given that the exchange rate is being pressured by the 55-, 100– and 200-hour SMAs, it is...

During Friday’s trading session, the yellow metal slumped against the US Dollar passing through the support of the monthly pivot point at 1213.84 level to end the trading session at the 1,210.66 mark. On Monday morning, the gold passed through the support of the 50.00% Fibonacci retracement level to trade at 1207.26. In regards to the near-term future, the gold...

During Friday’s trading session, the currency exchange rate was supported by the 55-hour simple moving average to end the trading session at the 113.83 mark. On Monday morning, the US Dollar kept surging upwards to trade at the 114.13 mark. In regards to the near-term future, most likely, the US Dollar will meet the weekly R1 at the 114.30 mark during the trading...

During Friday’s trading session, the currency rate passed through the support of the 200-hour simple moving average to end the trading session at the 1.2936 mark. On Monday morning, the British pound passed through the supports of the monthly PP at 1.2907 and the weekly S1 at 1.2899 to trade at the 1.2892 mark. In regards to the near-term future, the British...

During Friday’s trading session, the European Single Currency was trading downwards to end the trading session at the 1.1319 mark. During Monday’s morning hours, the currency exchange rate was located near the medium horizontal pattern line at the 1.1308 mark. In regards to the near-term future, most likely, the currency exchange rate will keep trading downside...

The British Pound has declined significantly against the Australian Dollar after the currency pair pulled back from a resistance level formed by the monthly pivot point at 1.8700. The exchange rate breached the lower boundary of a two-month ascending channel pattern and the monthly PP at 1.8080 during the early hours of Monday’s trading session. If this support...

During a recent Dukascopy Webinar this channel up was spotted. Although, it is not fully confirmed, if it sticks, oil will continue to surge.

The US Dollar has been depreciating against the Turkish Lira since the end of August. This movement has been bounded in a falling wedge. Technical indicators for the 1W time frame suggest that a breakout north occurs in the nearest future and the currency pair surges towards the Fibonacci 23.60% retracement at 5.7597. However, this advance might not be...

The Euro has been depreciating against the Swedish Krona since the end of August. This movement has been bounded in a falling wedge. The exchange rate reversed south from the upper wedge boundary at 10.41 at the end of October. Given that the currency pair is pressured by the 55-, 100– and 200-hour SMAs, it is expected that the pair aims for the lower boundary...

Downside risks has been dominated the CAD/CHF currency pair since the rate reversed from the upper boundary of a long-term descending channel at 0.7710. The pair managed to reverse to the upside from the Fibonacci 50.00% at 0.7565. Currently, the exchange rate is trying to surpass the resistance cluster formed by a combination of the 55-, 100-, 200-hour SMAs,...

The Euro has been depreciating against the Singapore Dollar since the end of September when the pair reversed from the upper boundary of a long-term channel at 1.6080. Currently, the pair is testing the lower channel line located at 1.5691. Given that the rate is pressured by the 55-, 100– and 200-hour SMAs, it is expected that a breakout south from the channel...

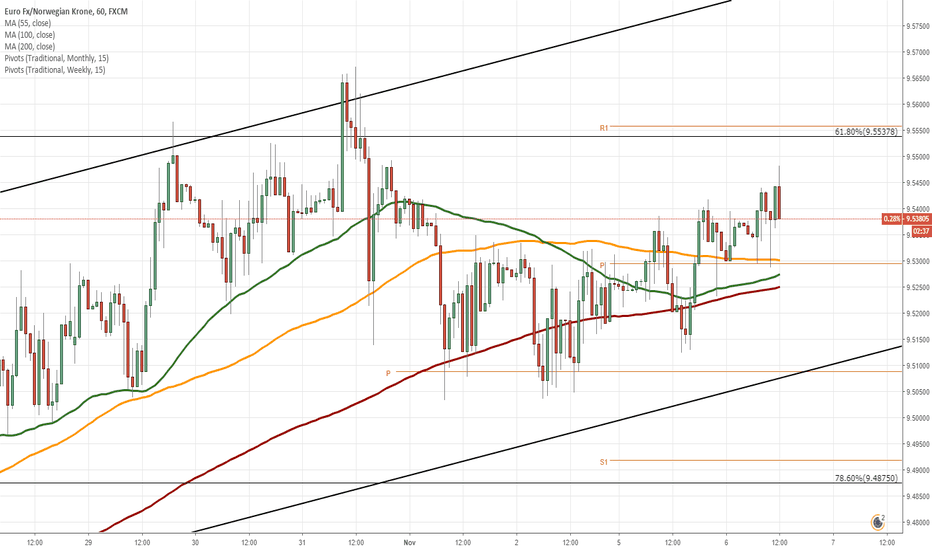

The Euro has been appreciating against the Norwegian Krone since the the middle of October. This movement has been bounded in an ascending channel. Given that the currency pair is supported by the 55-, 100– and 200-hour SMAs, it is likely that the rate continues to go up within the following trading sessions. Technical indicators for the 4H and 1D time frames...

During Friday’s trading session, the yellow metal was supported by the 200-hour simple moving average to end the trading day at the 1,232.81 mark. On Monday morning, the gold was supported by the 55-hour and the 200-hour simple moving averages to trade at the 1,231.46 mark. In regards to the near-term future, most likely, the gold will trade upwards to reach the...

During Friday’s trading session, the currency exchange pair was trading sideways to end the trading day at the 113.16 mark. On Monday morning, the US Dollar was trading at the 113.27 mark. In regards to the near-term future, most likely, the US Dollar will trade towards the 113.40 level during the day. None of the technical indicators could prevent the rate from...

During Friday’s trading session, the British Pound was trading sideways to end the trading session at the 1.3000 mark. On Monday morning, the British pound was supported by the 55– hour simple moving average to trade at the 1.2995 mark. In regards to the near-term future, the British Pound will keep moving sideways to stay at the 1.3000 level. The 55-hour simple...

During Friday’s session, the rate broke the resistance of the monthly PP at 1.1413 but was diminished to end the trading day at the 1.1388 mark. During Monday morning hours, the European Single Currency was supported by the 200-hour SMA near the weekly PP at the 1.1390 mark. In regards to the near-term future, the currency exchange pair will trade upwards due to...

The Russian Ruble has been depreciating against the US Dollar since the beginning of October. This movement has been bounded in an ascending channel. Currently, the currency pair is testing the upper channel line at 66.40. If given channel holds, a reversal south occurs in the nearest future, and the rate aims for the support cluster formed by a combination of...

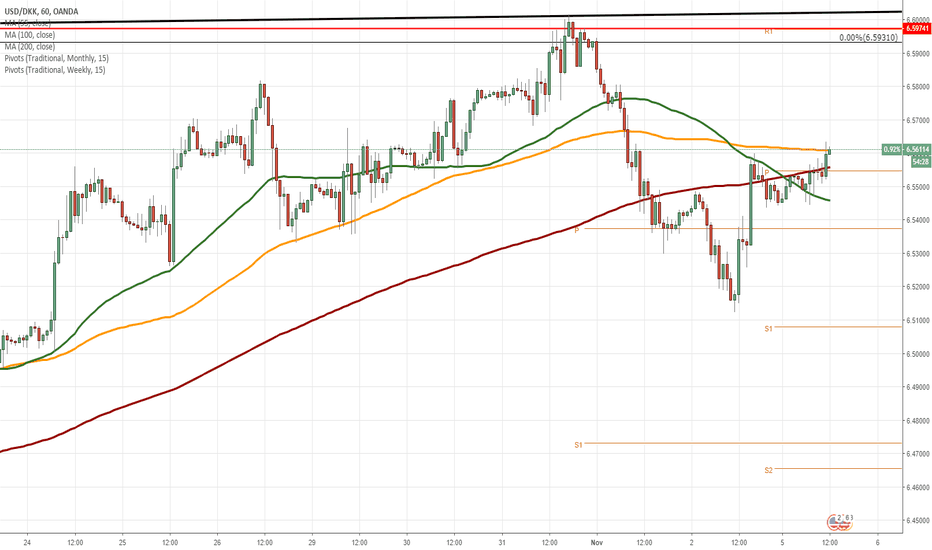

The previous forecast worked, and the USD/DKK currency pair has reached the upper boundary of a long-term ascending channel located circa 6.6000. As apparent on the chart, the exchange rate reversed south from the upper channel line at the beginning of November. From a theoretical point of view, it is expected that the pair goes downwards. A potential target is...