From our Previous post where we predicted ETH's top around $2,600 we have now had the retracement. We created a 4H doji and have found support at our extremely key level of $2,150. Given this level continues to hold with candles bodies we should expect a dead cat bounce or continuation to the upside. Really important to watch right now.

Manta looks decent from a technical perspective. Starting to build market structure on the 4H by holding the 21 MA. Still very new and hot which could lead it on a nice rally given BTC and Eth do not continue to sell off.

The low we just put in for Bitcoin looks quite promising in the short term. All fib levels looks to have confluence at he various price points. In addition to that, BTC just filled the CME gap.

Just wanted to warn my SEI fans that we are currently in a strong supply zone. Everytime price has entered this range between $0.80-$0.88 it has been hammered back down. We also created an 8H doji that could signal a reversal. All fib levels of the current trend have been listed. If we get a full retracement then the 0.618 would be our perfect target around...

Here is an update to my previous post which has so far called the short term top. ETH continues to get rejected around $2,570-2,580. This shows the 0.236 has currently flipped into new resistance. A potential $2,300 target is still in play.

Here is an update to this post where we predicted this move perfectly. So far we have come up for price to fill the gap and test our old support as new resistance. If this trendline holds as resistance our technical measured move is around $38,810 even though I think we will go a little lower based on other trendline and targets.

Here seems to be the channel price has been in for the past month and a half. If price reaches the mid/upper band then there is liquidity for sellers while the mid/lower band has been liquidity for buyers. Due to the deviation of the trend to the upside, price is more likely to break down from this pattern. Will have an additional post later today of some things...

On the Left is the CME chart and on the right is a spot chart. We did open with a gap on CME and that gap almost always get filled. That gap is between $42,365-$43,425. If price goes up to fill that gap it would also be testing our white line of old support that could be flipped into new resistance. With the spot chart, we see BTC has created railroad tracks...

Within the next 7-8 weeks we should see XRP breakout of its weekly symmetrical triangle. This is significant as we have been forming this pattern for over the past 1000 days. Our measured move price target could lead us to around $1.33 which is also the 0.618 of this move. My guess is within the next 7-8 weeks we see some serious development with an XRP ETF...

Hello Traders, here is an update to my pervious post. After hitting our price target that was shown over 3 weeks ago, price seems to be stalling out. On the 4H we can that currently we are creating a doji that could signal a reversal to the downside. If this occurs and we are not able to get above our last high here are our targets. The main target I will...

Just a quick idea. I gave you fib levels on the macro (weekly) that show $35.5k will be our new support. But, on the daily it looks like around $38k could be our next low (given FWB:48K ) remains our short term top. Just something to watch.

Here is my chart of our macro ranges on the weekly. This is all assuming our test of FWB:48K was our short term top. If we break above I will update the numbers given in the chart. Here you see I have 5 Ranges drawn. - The Bottom Range (Capitulation) - The Lower Mid-Range (Mid-Range) - Majority of Price Action (Accumulation Zone) - The Upper Mid Range (Thin...

First let me say this post is pure speculation and based on my own knowledge and experience in the crypto space. When trying to trade news events it can be very volatile and TA does not have to work during periods of time like this. In my opinion, Yesterday gave us everything that we need to determine what's next for BTC. Everyone's focusing on the wrong thing...

DYDX is beginning to look very good on the weekly. Here are some key indictors that could point to dydx finding a low soon. -0.618 of current trend was just tested -Close to lower band of support (price could visit $2 if 0.618 does not hold) -Weekly RSI uptrend structure still holding (green circles) -Lower timeframes creating bullish divergences -Currently...

Some People have asked me to post TIA's breakout targets if we are able to hold this old resistance level as new support. Using Viaquant's predictive Fibonacci Sequence we could see our next target is between ($20-21) (if of course we break the last high of $17.30) this would be followed by a potential peak around $27 later down the road. This 0.236 target also...

Although most eyes will be on BTC this upcoming week, Tia looks good from a structural perspective. After having a 40%+ move upon breaking out of our triangle we are now retesting it. If this can hold as new support we should see price reach new highs. Something to keep and eye on as long as we do not get bad ETF news for BTC.

Here are some trendlines for INJ on the 30min trimeframe that have played a key role with current price action

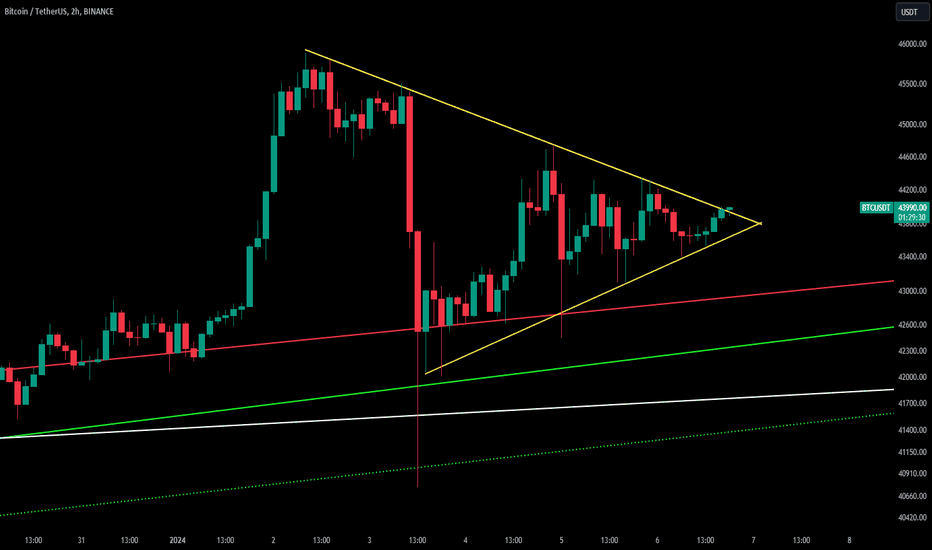

Right now BTC seems to be in this symmetrical triangle. We have a series of lower highs followed by a series of higher lows thus validating the pattern. Right now we are testing the top of the pattern. Even if we breakout, I expect some kind of retest until CME opens to really add some volume to this market.