VROCKSTAR

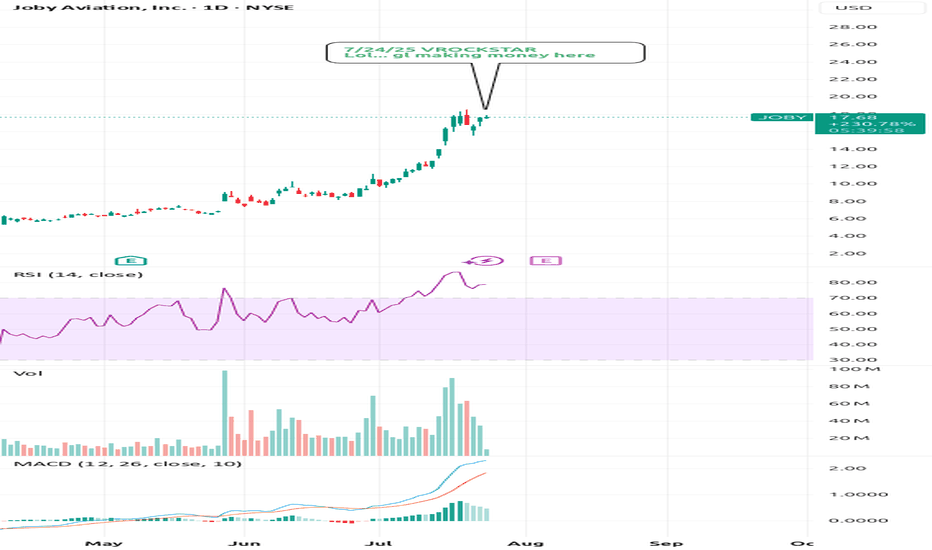

Premium7/24/25 :: VROCKSTAR :: NYSE:JOBY Lol... gl making money here - have long followed the evtol "space" which is a bit more quantum-mechanical in nature... because it "is here" and also "not here" - will be a long wait here - somehow retail $ has allowed story tellers to write season after season of "wait and trust me bro" and this is no exception - perhaps they...

8/1/25 :: VROCKSTAR :: NASDAQ:MSTR Selling spot and buying MSTR - keeping it (purposefully) short today for everyone's benefit - sold a bit of OTC:OBTC (which is nearly 15% off spot, e.g. $100k/BTC) to buy NASDAQ:MSTR MSD exposure here - why? - 1.6x mNAV is lowest it's been (nearly ever in current BTC move) - Saylor not going to hit the ATM sub 2.5x, will...

8/2/25 :: VROCKSTAR :: NASDAQ:TALK Unclear to me, still - I really like the growth profile here, at least what's expected but the stock has not really been beating expectations in the last few Q's and while the market moved higher this has been bad money and while stock price doesn't necessarily reflect reality in the ST, if the stock has been sideways for a...

8/2/25 :: VROCKSTAR :: NYSE:FC Sidelines w better oppty costs - came to this company over a yr ago bc it's a well managed business, throws off cash and still does - the issue are maybe 3 things in this current environment, all of which are likely transient but nevertheless relevant to my sidelines and not interested at the moment thinking. - so this hit my...

8/1/25 :: VROCKSTAR :: NASDAQ:QQQ How i'm positioned - 2x leverage on the whole book. 75% at risk so 150% gross - so 25% powder 47% obtc 30% nxt (12.5% leaps) 36% deck (ST and leaps for 6.5%) 27% lulu (ST gas for 1% lol!) 8% mstr (ST gas for 80 bps lol!) 5% gme (ST gas for 40 bps!) 5% ses (covered with calls at 1 strike already) be well. let's attack monday....

8/1/25 :: VROCKSTAR :: NYSE:DECK 50% position - if you have followed long enough, you know that when i write this sort of thing, it's maybe 5-10x a year, at most - i still think anything can happen here in the mkt, so there are a lot of arrangements i've made in my portfolio to account for further drawdowns - with that being said, conservatively DECK is 6%...

7/31/25 :: VROCKSTAR :: NYSE:WEAV Just watching tn - this tape has enough issues where $10 or $15 or $25 bn companies can't catch a needed bid for fcf yields and growth far in excess of what fiat IOU's yield - so i already have my "favorite" $500 mm c'mon let'sgoco called NASDAQ:GAMB and liquidity and size seem to matter right now - which (see private notes...

7/31/25 :: VROCKSTAR :: NYSE:BIRK PSA from a NYSE:DECK owner... - not as close to this one as NYSE:DECK - but it's hard enough to own names NYSE:DECK (reported nice beat and good indiation on 2H) and NASDAQ:LULU that reports end of aug with 6+% fcf yields and trading in the mid teens - i "get" birkenstock is a great brand - but should it trade high 20s...

7/31/25 :: VROCKSTAR :: NYSE:FIG gg - didn't even want this at $33 or wherever the money changers filled it - saw that it opened at like... $90? tf - now it's $100? - i'm commenting here to share with you that we're at the point in the market where nothing makes sense if you zoom far enough in - take a step back, there's a lot of value out there - but paying 3x...

7/29/25 :: VROCKSTAR :: NASDAQ:NXT Still long and strong - have written a lot about this name since last yr, so won't bore you with more details - but still MSD++ FCF yields - mkt still wants to ignore solar - any credit-related phase-out is acutally likely to pull fwd demand/ beats (that backlog) - mkt already seems to be pretty conservative on next year, as...

7/30/25 :: VROCKSTAR :: NASDAQ:ALGN Beat, but i'm only dip buying - 20x PE for growth, leadership position, 5% fwd fcf gen... great - consumer names on mgn doing just fine as we over spend from the mar/apl pullback - a higher cost discretionary purchase? hrm. tough to say. - i think result is +ve and stock is higher. it's health-care-adjacent and not an...

7/30/25 :: VROCKSTAR :: NASDAQ:QUBT Quantum tunnel to zero - what's this price action called? i'm not the TA guy - looking at that $10 to fill. i'm sure there will be call buyers standing ready to eat that juicy "generational opportunity" as the 0dte cowbois call it these days - not short at the moment. looking for right oppty to reload - but i remind you this...

7/30/25 :: VROCKSTAR :: NYSE:FICO Probs a buy - not really my cup of cottage cheese - but these growth/ mgns and strong fcf generation (2.5% fwd) speak for themselves - look at $LC... people are handing out debt to whichever person wants to finance their NYSE:CMG burrito with installments - hard to imagine in a consumer-gone-wild environment this thing...

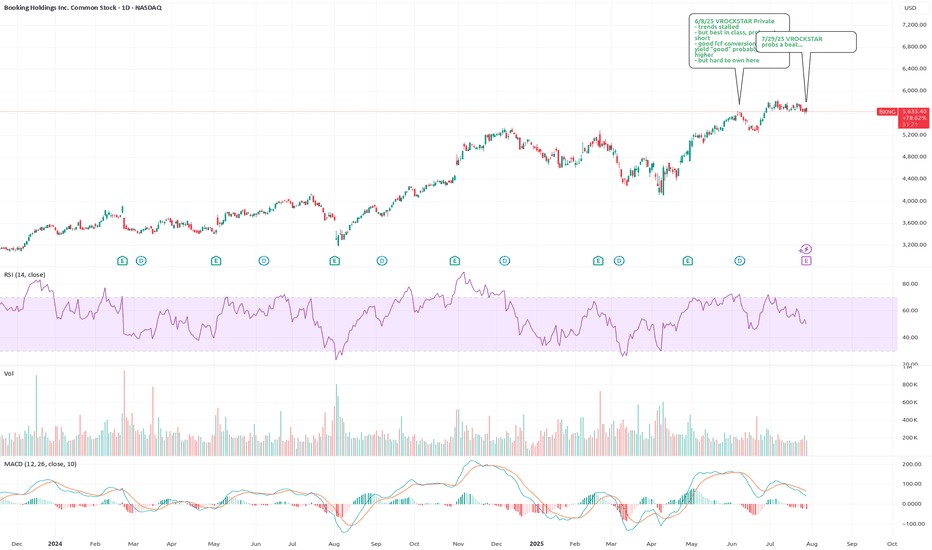

7/30/25 :: VROCKSTAR :: NASDAQ:META And u think they'll miss? - we continue to collect data pts that the consumer is spending like a drunken sailor and somehow the market still wants to bid the trash meme stocks that will burn cash until kingdom come - amazon prime day - dubious/ but still... government data - yesterday... visa... booking - we've seen the "oh...

7/30/25 :: VROCKSTAR :: NYSE:DECK Degen time. - look at the last NYSE:ANF report... and tell me you're not noticing the exact same pattern. massive rip. massive gap fill retrace. - do we re-test pre-report levels mid to low $100s? - that's what keeps me buying ITM leaps here, but going quite large - i'm trying to figure out w/ $V report, consumer spending......

7/30/25 :: VROCKSTAR :: NASDAQ:PANW Adding back slowly - leader is extending it's lead w/ NASDAQ:CYBR - NASDAQ:CYBR was a top 3 name for me in the sector - so yeah, i'm buying ITM leaps here, slowly - welcome back to the long book NASDAQ:PANW V

7/29/25 :: VROCKSTAR :: NYSE:PEN It's a LT buy... seems "reasonable" into print - medical device company... peripheral thrombectomy products - it's never been cheap, probably for a good reason - about 3% fcf yield... mid teens growth... "not" health insurance (which i think is probably part of what's happening here... the read thru from perhaps pricing/...

7/29/25 :: VROCKSTAR :: NASDAQ:BKNG probs a beat... - while everyone's happy to pay 150x for PLTR... there r a lot of consumer names that seem to be trapped in trump tariff paralysis. - what happened... is trump... caused a dip... consumer spending paused... then nothing happened... and all that pent up demand came right back in the last quarter... most...