VROCKSTAR

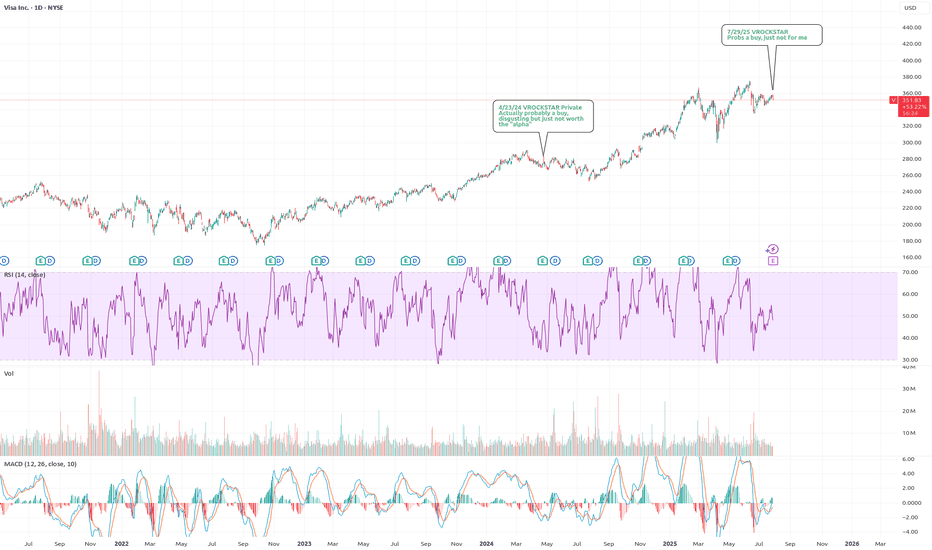

Premium7/29/25 :: VROCKSTAR :: $V Probs a buy, just not for me - over 3% fcf yields, growing, consumer spending well - over time (probably long duration) I think the biz model probably gets eroded, but also mgmt has done a nice job evolving, perhaps they keep up with the times etc. - don't think anything is broken here - all else equal a nice barometer for the consumer...

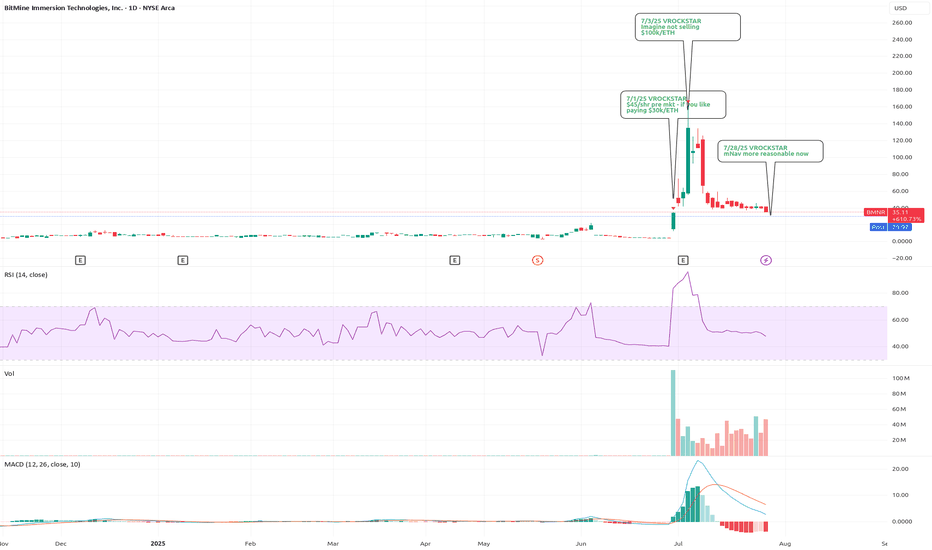

7/29/25 :: VROCKSTAR :: NASDAQ:SBET What r u guys doing...? - feels like i'm always in early, out early - but here we are, buying AMEX:BMNR in the 30s post market, halving that in the run this AM... adding it back - you all realize that NASDAQ:SBET 's mnav is pretty close to 1 right? - i just don't get it, perhaps it's all these call options, negative...

7/28/25 :: VROCKSTAR :: AMEX:BMNR mNav more reasonable now (1.3x at ~$30/shr) - i'd link the docs but tradingview wants you to do the digging and doesn't want me to "promote" doing your own DD. ironic. - so here's how you get there - go the sec dot gov website search edgar in google - type in the ticker - check out the latest 8K - click presentation - slide 30...

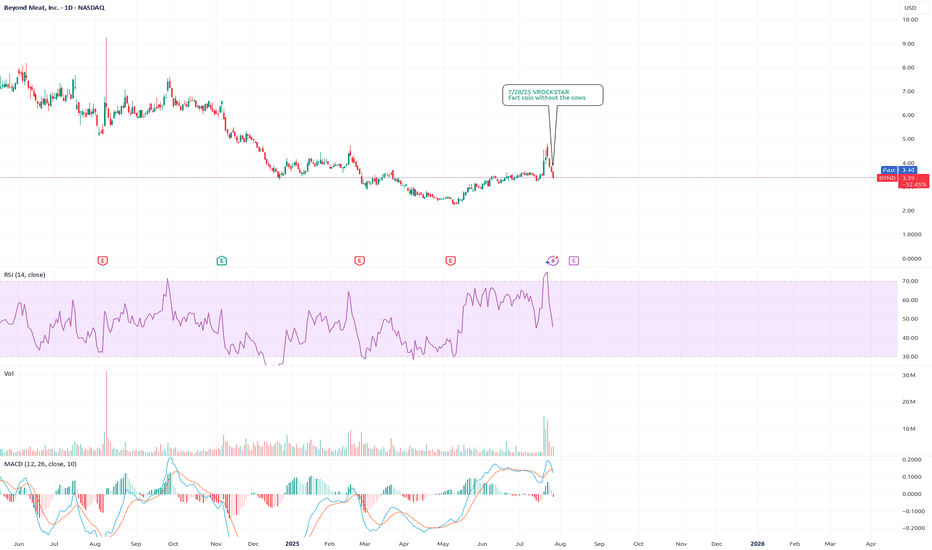

7/28/25 :: VROCKSTAR :: NASDAQ:BYND Fart coin without the cows - over a $1 bn enterprise value - no sales growth - bill gates - burns 100 mm a year - nobody eats this product - same valuation as fartcoin but fartcoin doesn't burn cash - almost obviously going to zero - but it's impossible to short - if i owned it, i'd probably need an intervention, but beyond...

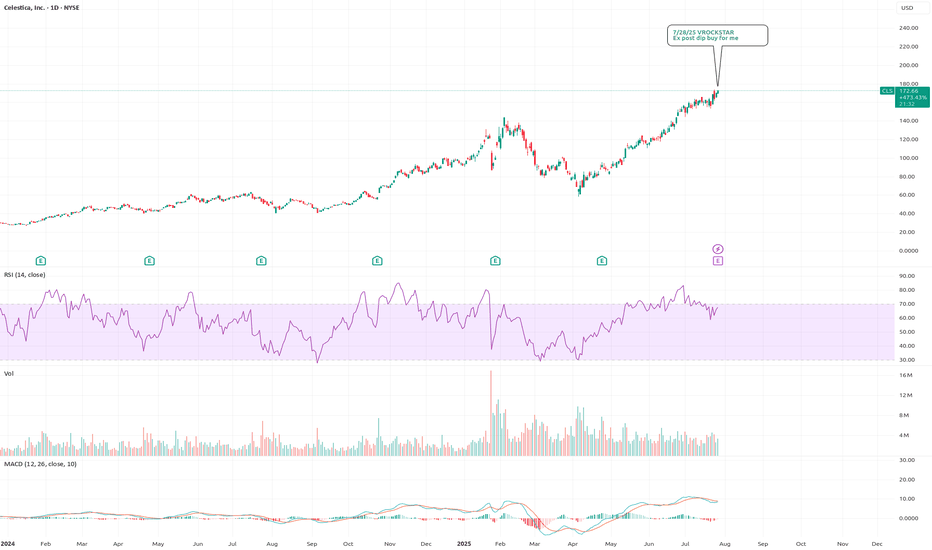

7/28/25 :: VROCKSTAR :: NYSE:CLS Ex post dip buy for me - reminds of NYSE:GEV , great product, backlog, growth etc. etc. - valuation at 2.5% fcf yield, low leverage and mid teens EBITDA for teens EBITDA growth++ is v reasonable - don't really have an edge here, except to say.. i think any "miss" will quickly get bot and that's where i'd participate - otherwise...

7/28/25 :: VROCKSTAR :: NASDAQ:CDNS Just buy NVDA instead - higher multiples - less growth and less fcf generation - technically an industry-float-higher-beneficiary - but if you look at my last notes... stock has really not gained much ground vs. say SPY or QQQ - you're one bad print away from this thing going -15 or -20%. does it happen this Q? no idea. but...

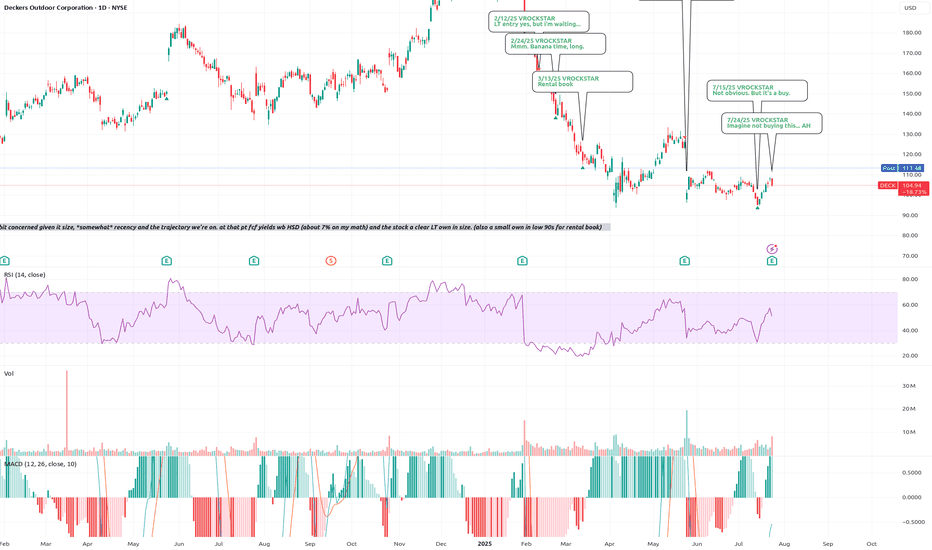

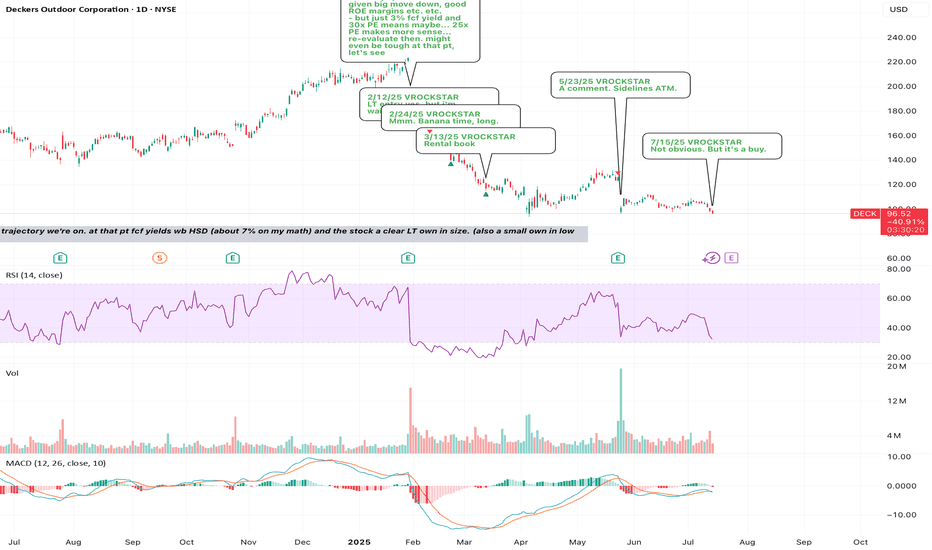

7/28/25 :: VROCKSTAR :: NYSE:DECK De risked, a few ways to play - mid teens PE - 2 brands hitting on all strides (pun intended) - great result, everyone offsides - the action you're seeing here is MM re-adjusting post pop - can buy spot/ sell covered calls for healthy mid 40s IV and roll - my sense is sub $110 you are getting almost a simple play into YE and...

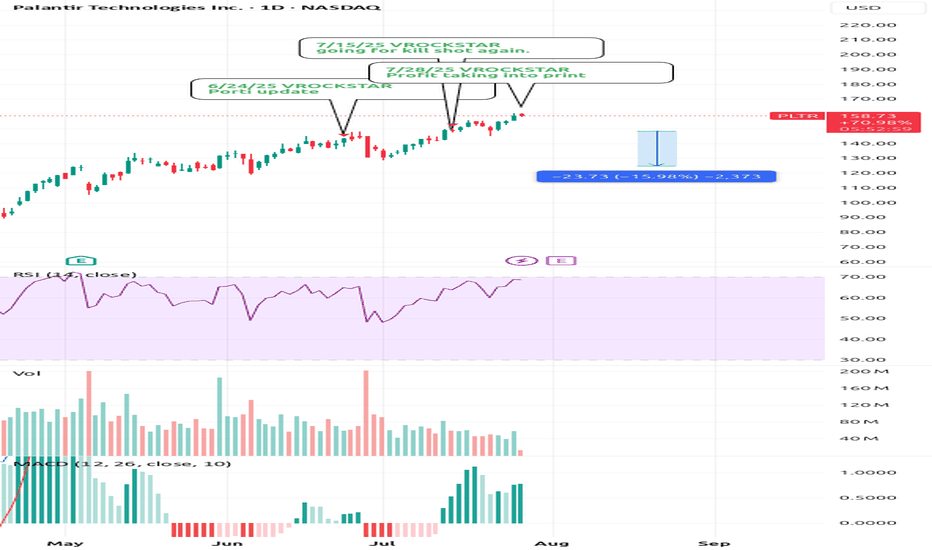

7/28/25 :: VROCKSTAR :: NASDAQ:PLTR Profit taking into print - no idea what print brings - but mgmt have been sell-only - valuation is what it is... inexplicable by anyone - i'd not be surprised to see anything happen on the result - but into result, big holders (read: not you) are likely going to see some profit taking/ risk mgmt given tape, outperformance -...

7/28/25 :: VROCKSTAR :: NASDAQ:LULU I like it Apparently i can't post my thoughts anymore w/o it being flagged. so what's the point? And i don't play stupid games and win stupid prizes... so goodbye public notes. ez decision. Also... purely technical analysis will go the way of AI. So beware. Learn to think independently without just drawing lines on charts...

7/24/25 :: VROCKSTAR :: NYSE:DECK Imagine not buying this... AH - amazing to listen to the mental degradation of "sell side analysts". - the quarterly ritual when real shareholders must endure management answering the room temperature IQ questions from these "research" providers is a circus - right now there's a sell side "analyst" demanding an explanation...

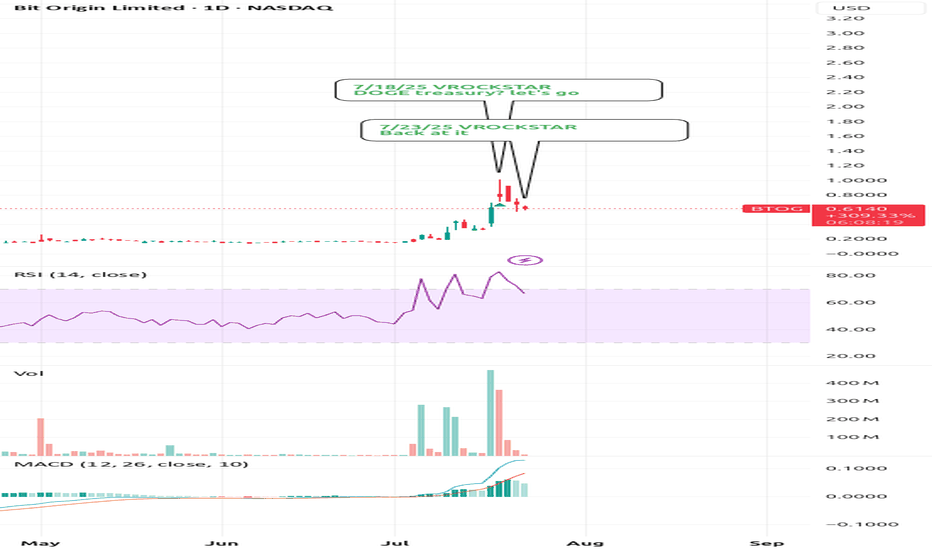

7/23/25 :: VROCKSTAR :: NASDAQ:BTOG Back at it - not much to say except this thing holds about 70c worth of CRYPTOCAP:DOGE - CRYPTOCAP:DOGE < $BTC. let's get that out of the way - i certainly don't think a "doge" or "eth" or "sol" or whatever crapcoin treasury company is similar to MSTR. again let's get that out of the way - but you're basically buying the...

7/15/25 :: VROCKSTAR :: NYSE:DECK Not obvious. But it's a buy. - will reiterate that i'm not on tape so closely this week, but will revert w any comment replies by next week; nevertheless i'm checking in here on the tape - see what T did today on NVDA/ China? - you think it's easier or harder to resolve some of these discretionary names in the meanwhile vs....

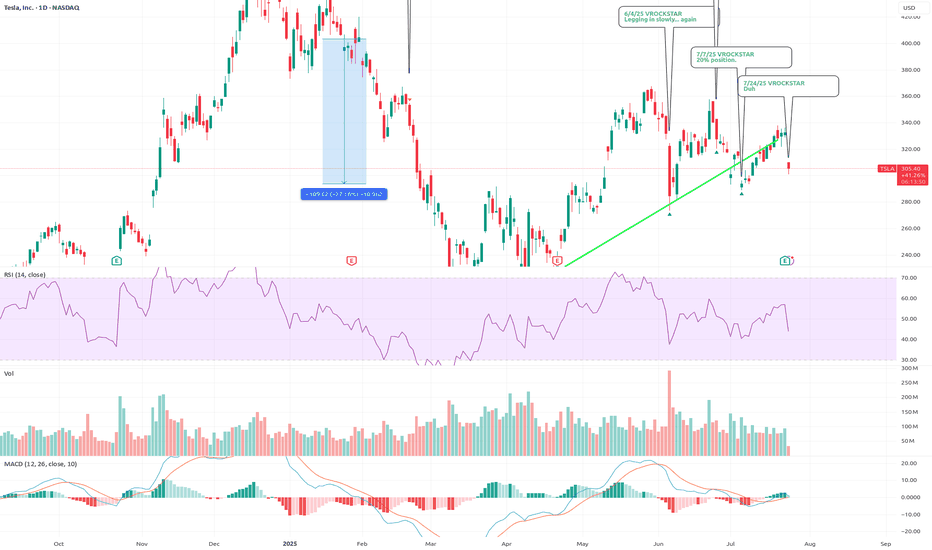

7/24/25 :: VROCKSTAR :: NASDAQ:TSLA Duh - ppl focused on ST FCF (all over X!) is 100% of the reason why when you put the pieces together, you realize that while ST this might not behave like anyone expects... LT, TSLA is v likely going to in, elon's own words, be the largest cap in the history of capital markets - two leading robots with leadership position...

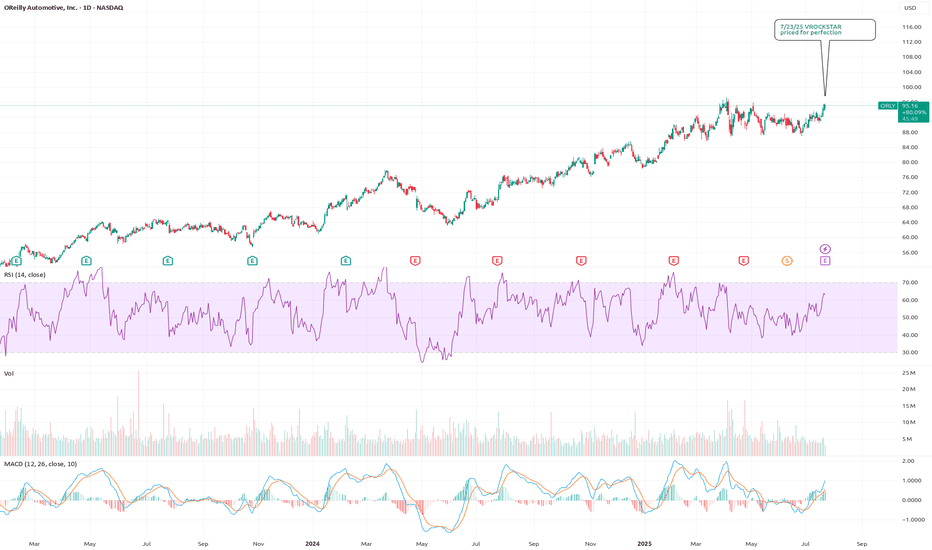

7/23/25 :: VROCKSTAR :: NASDAQ:ORLY priced for perfection - hard to not consider this as a hedge to my NYSE:DECK long (into tmr print) - stock has had series of weak Q's - google trends remains meh - stock not cheap at <3% fcf yield (staples closer to 3.5%+) - IV on the chain seems lazy... not pricing in much move - i'd sense that the upside is quite limited...

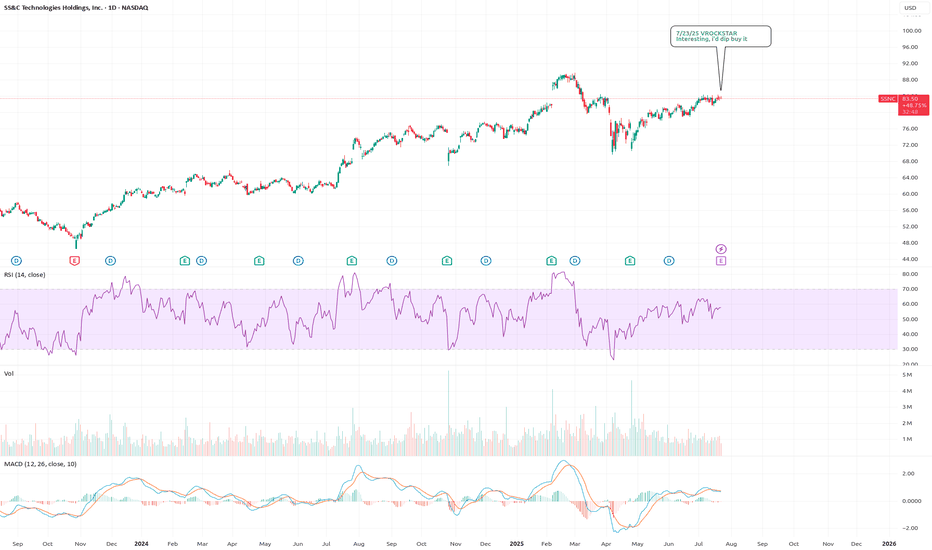

7/23/25 :: VROCKSTAR :: NASDAQ:SSNC Interesting, i'd dip buy it - 5% fcf yield - ez does it top line growth, nothing stellar MSD - mid teens PE - software-esque ebitda mgns - nothing that i know well and it's HC, so honestly the fact it's bid, doesn't run similar risks as insurers but ultimately (as my pea brain understands it) is probably a net +ve on MLR...

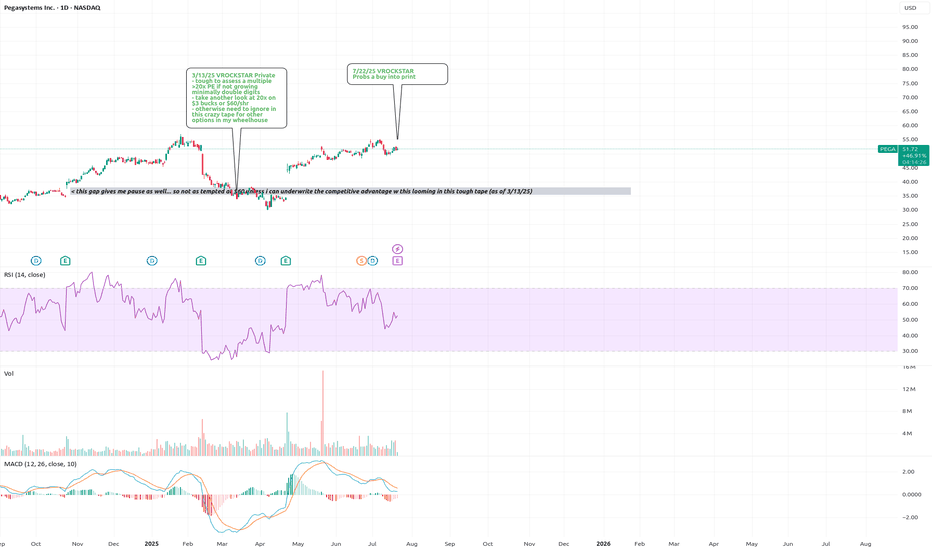

7/22/25 :: VROCKSTAR :: NASDAQ:PEGA Probs a buy into print - not expensive - great growth - expanding margins - good early barometer for consumer/ journey stuff - insane beat last result... hard to extrapolate these things w/o digging in more... but setup is solid into results on a quick look. - probably not going to participate but wanted to share thoughts V

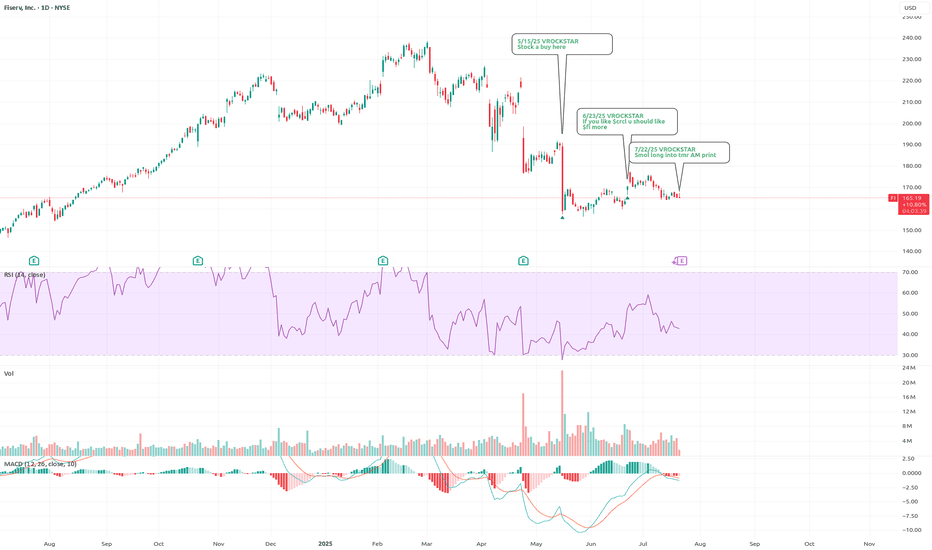

7/22/25 :: VROCKSTAR :: NYSE:FI Smol long into tmr AM print - sub 20x PE and 2x peg (pf adj. for debt) is reasonable for mkt leader - like the stable coin angle, think they really talk this up... as i've written about previously - v "consumer" exposed (similar to how i wrote about NYSE:DECK ). if this name sells off hard, i'd be happy to 2...3x the size of...

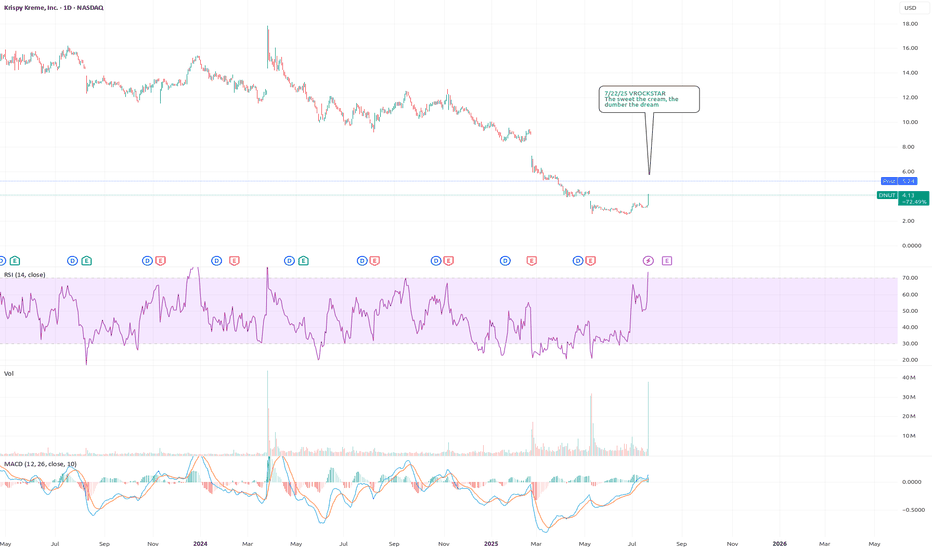

7/22/25 :: VROCKSTAR :: NASDAQ:DNUT The sweet the cream, the dumber the dream - i've followed and trade this up/down/all around since the IPO - and honestly, i wish i never had - this company has one of those capital structures that is set up to F you as a minority shareholder - it's a private equity scam (which is why at this stage in my life, i stay away from...