VROCKSTAR

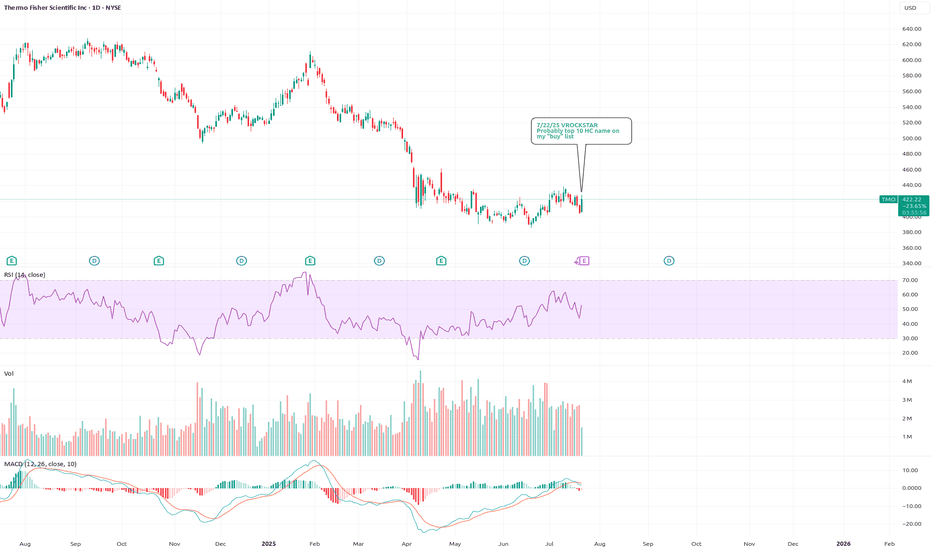

Premium7/22/25 :: VROCKSTAR :: NYSE:TMO Probably top 10 HC name on my "buy" list - as HC (healthcare) stonks are at multi-year lows and basically everyone is bearish - positioning is important to account for when calling stock inflections - i'd say... here's a pick and shovel name that has great FCF yields, better than utilities (4%+) but more like a consumer staple...

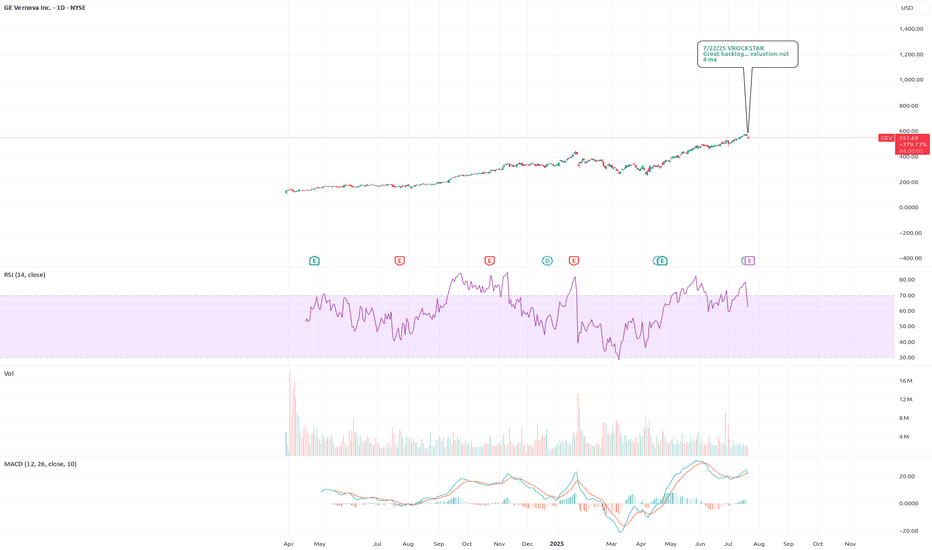

7/22/25 :: VROCKSTAR :: NYSE:GEV Great backlog... valuation not 4 me - literally demand for as long as the eye can see - is that worth 2% fcf yield? probably - 50x next year PE? probably - i'd dip buy this. but honestly i think results/ comms are +ve and stock all else equal goes higher. i just don't care b/c that valuation in this toppy (ST) tape is just too...

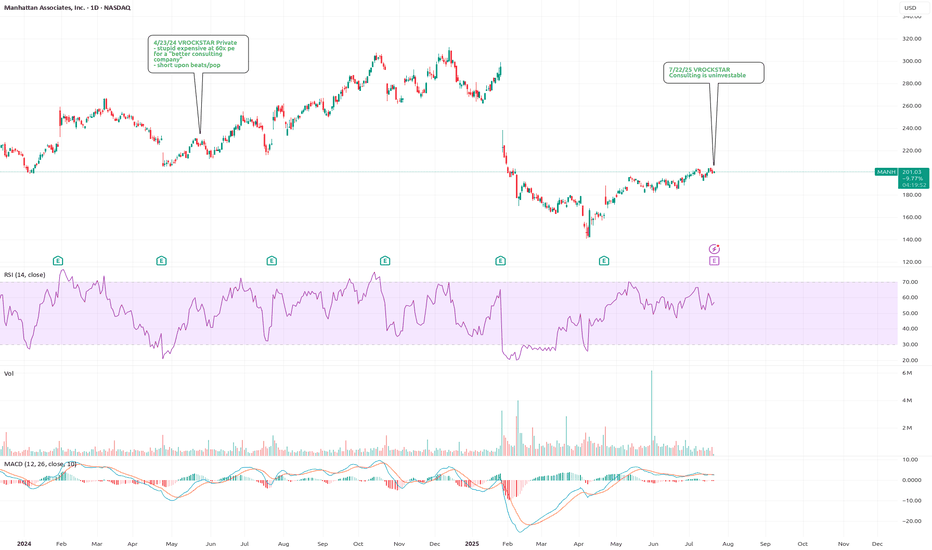

7/22/25 :: VROCKSTAR :: BOATS:MANH Consulting is uninvestable - AI will gut this useless industry. I can discern this from using enough AI tools long enough. not interested in your "but muh integration moat bs". it's fafo, prefer u don't have to fafo pnl - so while it might not be a short here (it is and i describe it as such, b/c anything that's not a buy is...

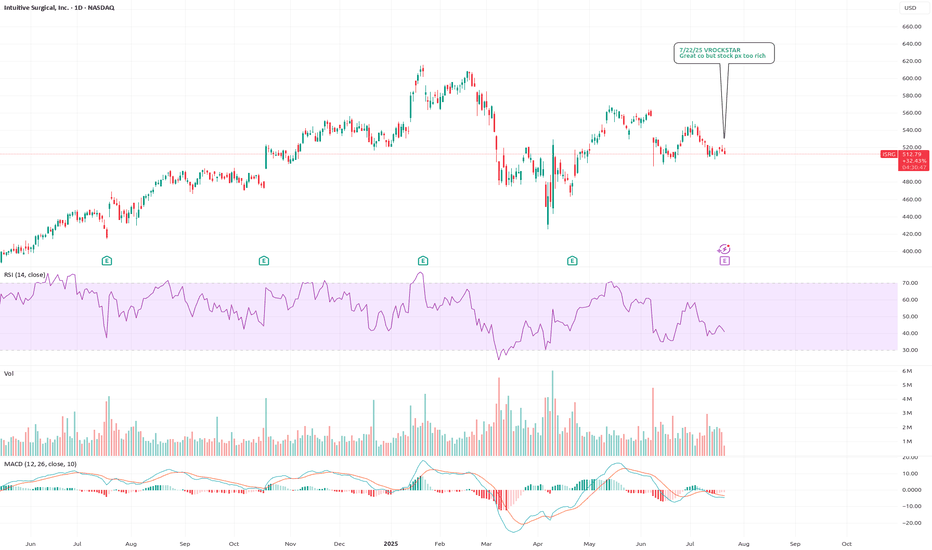

7/22/25 :: VROCKSTAR :: NASDAQ:ISRG Great co but stock px too rich - high multiples forgivable given rare leadership role - "robotics and AI in high value healthcare industry" - the valuation and growth aren't necessarily "too" expensive like memes pltr, cvna, sym, joby, qubt, qbts, rgti etc. etc. - with that being said, idk at what poing i'd dip buy this - and...

7/18/25 :: VROCKSTAR :: NASDAQ:BTOG DOGE treasury? let's go - doge is the better meme - POW - still small - this ticker trades "cheap" vs. what they need to raise - no way otherwise to buy doge in this way - i'll add to this next week if down V

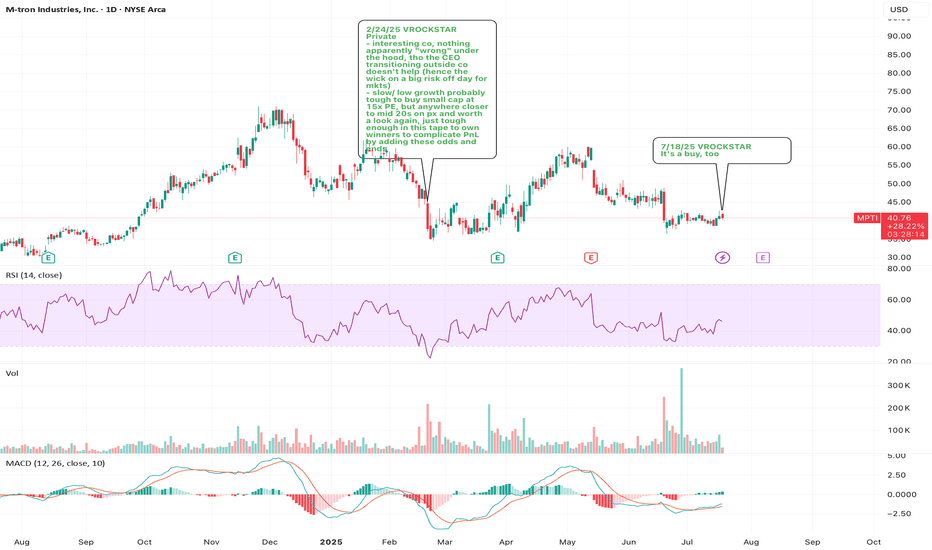

7/18/25 :: VROCKSTAR :: AMEX:MPTI It's a buy, too - in the world of meme everything - it helps to trade closer to $1, bc apes like to talk about $1 going to $100. - it's also helps to have an active options chain - but nevertheless, there are good businesses that are growing, generate cash and have good stories in the right industries that don't necessarily...

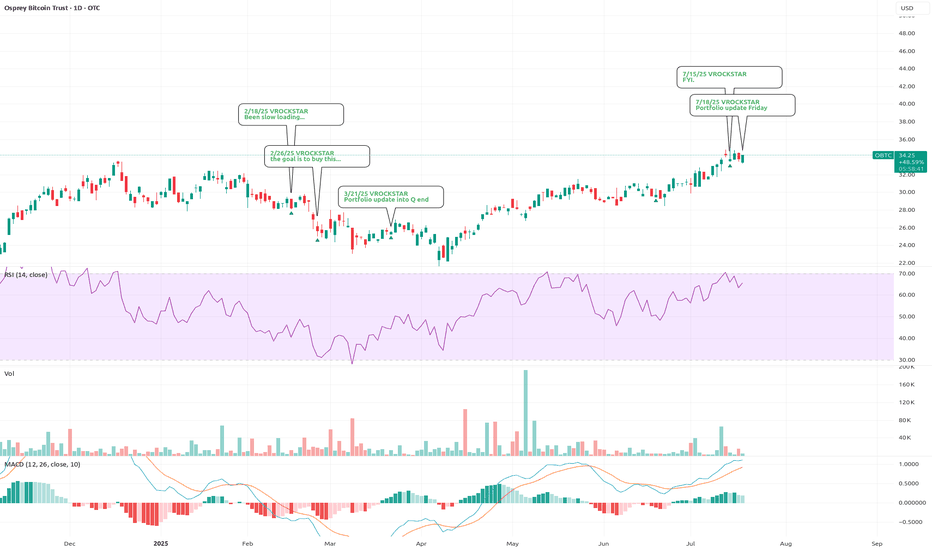

7/18/25 :: VROCKSTAR :: OTC:OBTC Portfolio update Friday - it should be no surprise to you if you've followed my notes (to myself, which is really the point to airing everything out - though the friendships I've made have been a wonderful bonus)... that CRYPTOCAP:BTC is really the asset I know best, have cleared POV on and where my edge comes from (the...

7/3/25 :: VROCKSTAR :: NASDAQ:META Still a buy sub $1k/shr - reality is, why would you bet against zuck - his platforms are hitting on all strides. he is willing to internally build the best AI when he's falling behind by hiring the best talent and it is a LOT cheaper to hire for collectively $500 mm than say pay billions for a developed product and internalize...

7/15/25 :: VROCKSTAR :: NASDAQ:PLTR going for kill shot again. - using the 2x levered meme etf PTIR to buy P's - there are no logical explanations anymore for me to justify valuation "yeah V valuation doesn't matter"... you'll see what i mean, kid - even 2x'ing FCF over the next 2 yrs and this thing with decelerating growth and the emergence of super...

7/15/25 :: VROCKSTAR :: NASDAQ:SYM RIP regards. - sizing this up - muh robots - but didn't do muh work - hedge - but seeing that -6% open on monday told me how incredibly fragile this structure is - might head higher idk idc. one of my 10 hedges rn. you guys know - pltr - cvna - qubt - sym - ura - qs - a few others ;) V

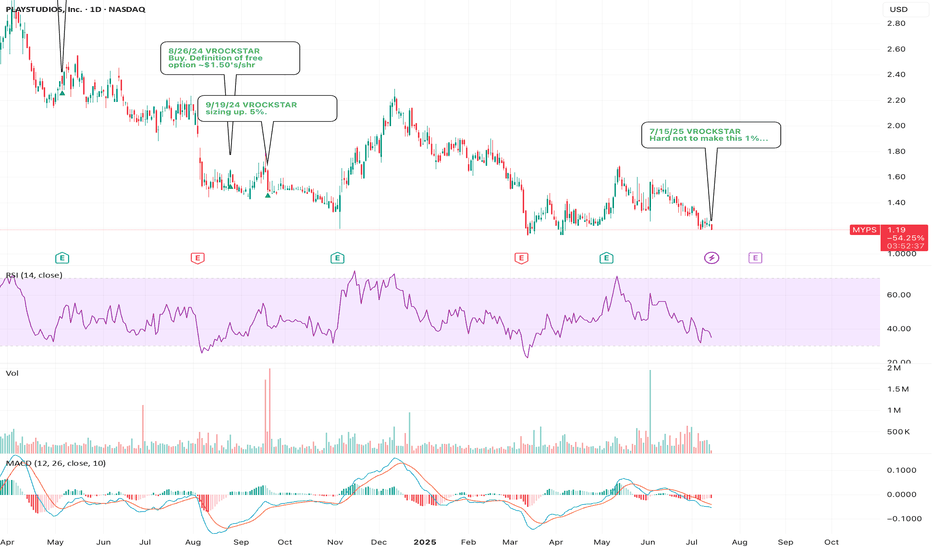

7/15/25 :: VROCKSTAR :: NASDAQ:MYPS Hard not to make this 1%... - i'll probably remind everyone to take it ez on this old man this week, i'm not supposed to be watching mkts, but here i am... at least keeping an eye out on my "price alerts" - this is an old-friend name i've written about before - at this price... $50 mm cap, founder-style social casino game...

7/15/25 :: VROCKSTAR :: OTC:OBTC FYI. - out of pocket this week, but wanted to comment here given it's my largest position and BTC trade has worked in terms of how i'm managing this - go read last posts for context - OBTC remains at >10% discount to spot BTC. so as of writing this morning, you're still buying equivalent of $103k/BTC - talked w the Osprey/ Rex...

7/7/25 :: VROCKSTAR :: NYSE:SES Still my fav R/R in battery - revenue is scaling - 1Q revenue tripled 4Q last year - mgmt's speech on last call was "15-25 mm" for 2025 - their software platform is ramping across core (EV/auto) OEMs and basically anyone (tier 1 battery co's) - if you look at their PnL R&D is 20 mm. that's what they're burning, really. and they...

7/9/25 :: VROCKSTAR :: NASDAQ:ENVX Friends tell friends the truth - not a fan of Raj, seems inauthentic on one front... and tbh, that might seem "judgy". i've made my money on wall street reading mgrs in the first 5 seconds i meet them. i'd just not give this guy my money, that's all. it's my human LLM. - the company financials look ready to "explode" (mm in a...

7/9/25 :: VROCKSTAR :: NASDAQ:FLNC Does the AES offer... - AES *apparently* got a takeout offer y day (check stock px) - i'd believe it, as long as they don't get coreweave'd (*sigh*) - that aside, i can swear i was reading about grid scale M&A in my newsflow and Grok isn't helping tn - I think FLNC is super interesting given it's AES/ siemens ownership and...

7/9/25 :: VROCKSTAR :: NASDAQ:DPRO PSA... rotate - saw some d00d shilling this - couldn't help myself - this isn't a company with a future outside M&A or restructuring - the meme move is simply what we've gotten in chitco's since the liquidity bottom in april - you do you - but friends don't let friends drive drones or PnL drunk V

7/9/25 :: VROCKSTAR :: NASDAQ:SLDP Pass. - this thing just has kinda weak energy top line growth - maybe that changes - burns cash (which is "fine" - big quotes - if there's some real lift off on growth, which there's NOT) - my impression (change my mind) is this co got listed to create bag holders for the bag holders - not going to look at it much more closely...

7/9/25 :: VROCKSTAR :: NYSE:AMPX Hrm. Got my interest. - high energy, high power lithium ion warez for aviation etc. - i think what's most interesting are two things 1/ i first came across this in march '24 and said "not interested - bonkers valuation" and in some resepects... for a year... esp given mkt had been ripping, it was awful risk-on reward 2/ NOW, if...