4/2/25 :: VROCKSTAR :: NYSE:FC Solid co, but dip buy ONLY - been on my radar for about a year, but "rolling" over starting last quarter and estimates really got floored - so the "setup" from a financial POV such that we can *see* bottom and *have confidence* in mgmt "optimistic" speech is a stock you could buy - but honestly, at higher EBITDA multiple than NXT...

3/31/25 :: VROCKSTAR :: NASDAQ:PANW Adding once again... - trading position - but >3% fcf yields on industry winner - u see that google txn on Wiz for $32 bn? here's 109 bn and dominant - mid teens growth unaffected by tariffs - if anything more cross border cyber warfare is secular "issue" that benefits these guys - since last writing, they put up a great...

3/31/25 :: VROCKSTAR :: NASDAQ:QQQ Correlation 1... no more protection 4 me - bought back all my (covered calls) on the "rental" book, which is NYSE:VST , NYSE:UBER , NYSE:DECK , NASDAQ:BLDE , NASDAQ:GAMB as i'd rather take the 15-20% downside on what I believe are stocks that have at least 2x this in terms of upside into YE at this pt. esp in a...

3/28/25 :: VROCKSTAR :: NASDAQ:BLZE Watchlist, but need lower px - i'm more positive on this stock than negative, but i am not convinced of a few factors in the ST that have not much to do w/ the business but the "zipcode" of what it does that keep me sidelines looking for a lower px - i wouldn't expect a 250 mm ent value company to be pumping out cash in this...

3/28/25 :: VROCKSTAR :: NASDAQ:BLDE sizing up 5% - i've covered 2/3 of the position for aug exp $2.5 strike b/c the implied 13% yield in this chop for an asset which already trades below fair value for 5 mo looks way better than cash - but 1/3 of the book which i just added on this ((ridiculous -6%)) move and just a factor-end-of-month-small-cap etc etc....

3/27/25 :: VROCKSTAR :: NYSE:NVO obvious at $70... 10% size - at btc conf in miami so have been hoping for a quiet week. well. whatever. another day in trumptopia. but alas, we can't tell the market what we want. so the game today is just don't make big mistakes and try and find interesting asymmetric oppties. - i literally flipped my NVO after last post two...

At Miami Disrupt this week and no relevant EPS, so taking it easy on mkts to unplug (kind of) Figured I’d put the FSLR pair (NXT/FSLR) pair on everyone’s radar bc straight lines aren’t natural. There’s clearly one or several big holders that are in the process of dumping FSLR and bidding NXT. While I’d not disagree, in concept, bc NXT is perhaps the best equity...

3/21/25 :: VROCKSTAR :: OTC:OBTC Portfolio update into Q end - thanks for your comments, suggestions, and to the trolls and of course those who challenge my thinking with reason (you know who you are - and I appreciate you keeping me sane and keeping emotion in check). - as I roll into Q end and think about 2Q a few things come to mind as i've chewed, slept...

3/20/25 :: VROCKSTAR :: NASDAQ:NXT better than bitcoin - i fkn love bitcoin - but nextracker generates mountains of cash - and it's not subtle about eating competition. array is getting it's skin torn off as we speak by TrueCapture - forget the wallsheet estimates. they're pansies. they don't neck out. because their job is "keep muh job" been there done that. -...

2/24/25 :: VROCKSTAR :: NYSE:NKE dead money, bro. - the trends are cooked - jefferies upgrades this to buy and you r chasing it higher on a rough risk day/week/ setup? - trades in the high 30s PE for no EPS growth - you really going to wait in this? - NYSE:DECK is hard enough to own, probably the only ownable shoe co at the moment when factoring returns,...

3/20/25 :: VROCKSTAR :: NASDAQ:ARRY Rant - this whole space ((solar)) is a meme - most of these companies are as useless as salad robots, space lasers and google's quantum supremacy - in terms of trackers, you have "the bitcoin" or "the king" or "the only company worth ever investing in" i.e. NASDAQ:NXT and you have... the memes. the companies getting their...

3/20/25 :: VROCKSTAR :: NYSE:GLOB I'm back mid 120s - sub 20x pe - AI integrator - down on NYSE:ACN results - ex M&A capex, you're pretty close to 3.5% yield, probably growth understated - going much slower than the initial move i made (which admittedly i feel lucky to have exited monday at a gain) - i'd like to rent this out, confident in product, mgmt - but...

1/21/25 :: VROCKSTAR :: NASDAQ:DCBO Interesting learning co. Buyer in FWB:30S - impressive historical growth - clear opex flex and cash generation (no SBC issues) - multiples while not "obvious" are reasonable - great partnerships w/ leading tech, and B2B focus > consumer - all else equal, stock should be a buy today at $42ish, but i don't have a mandate to...

3/17/25 :: VROCKSTAR :: NYSE:JILL Big chicks dig the long ball - co seems to be chugging along - 20%+ ROIC "not bad at all" - pretty niche category - won't be stepping on any lululemon toes and vice versa (*ouch*) anytime soon - i walk by a store occasionally and accidentally make a comment when the wife is with me about going in - and truly accidentally - the...

3/17/25 :: VROCKSTAR :: NASDAQ:ARQQ short. - from qubt on friday... to an even lower quality name today, arqq - co has never generated any meaningful revenue - at least d wave has a concept product - these guys have a marketing deck - gl to the longs. - the april 20 P's look pretty good for a micro position to keep that knife short. dare you to send it...

3/14/25 :: VROCKSTAR :: NYSE:QBTS A carrot for the donkey - having closed a lot of shorts early and "missed" a lot of the move (admittedly w cash tho)... i was feeling some FOMO - and while a lot of the market will continue to chop lower with high vol (but we're probably thru the majority of the big drawdown and in needing a bid) - we've got the posterboi...

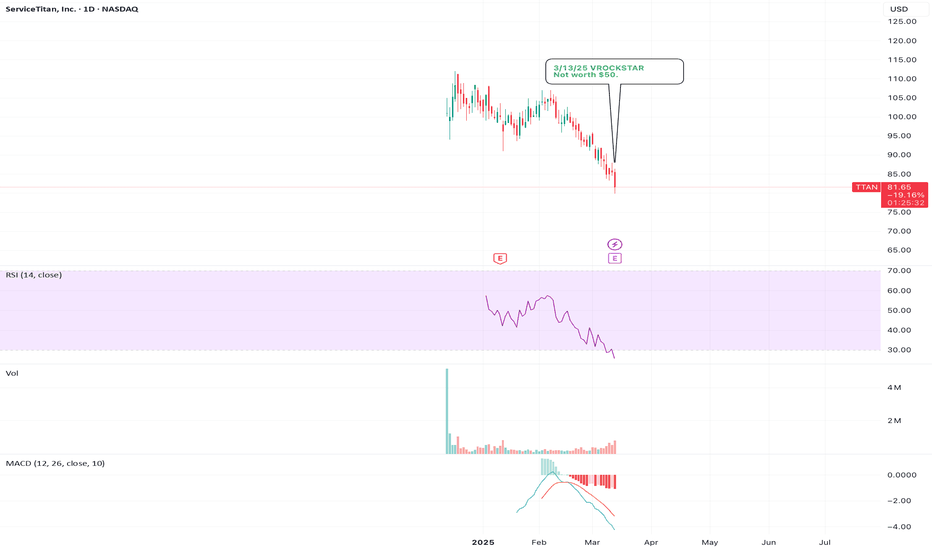

3/13/25 :: VROCKSTAR :: NASDAQ:TTAN Not worth $50. - a total avoid - this thing pops and i'll be there to fade - but 10x sales for hardly 20% growth - mediocre mgns - hardly 1% fcf flow - and worst of all, stinky PEs trying to dump their bags on public bag holders. let those trolls hold their own dog poop. - probably a nice mgmt, good company etc. but i'm...

3/13/25 :: VROCKSTAR :: NYSE:DECK Rental book - ppl ditch their shoes and go homeless chic in a recession, right? - look. of all the shoe names, this is the only one w the best growth, economics etc. etc. - but what's probably SHTF 20% case low? 7-handle. instead of high $5s EPS, you probably end up near $5 and so instead of 20x PE you're at 15x (remember the...