WSMS199

PremiumBGS has built a base at $4. U.S. tariffs = pricier Mexican imports. U.S. producers may gain less competition, ability to raise prices, potential for better margins and more demand from buyers shifting away from imports. Call flow has seen some interest recently with a 20.47 short float I added JAN 5C at .40. Overall, insiders bought 219,570 shares for $1.7 million...

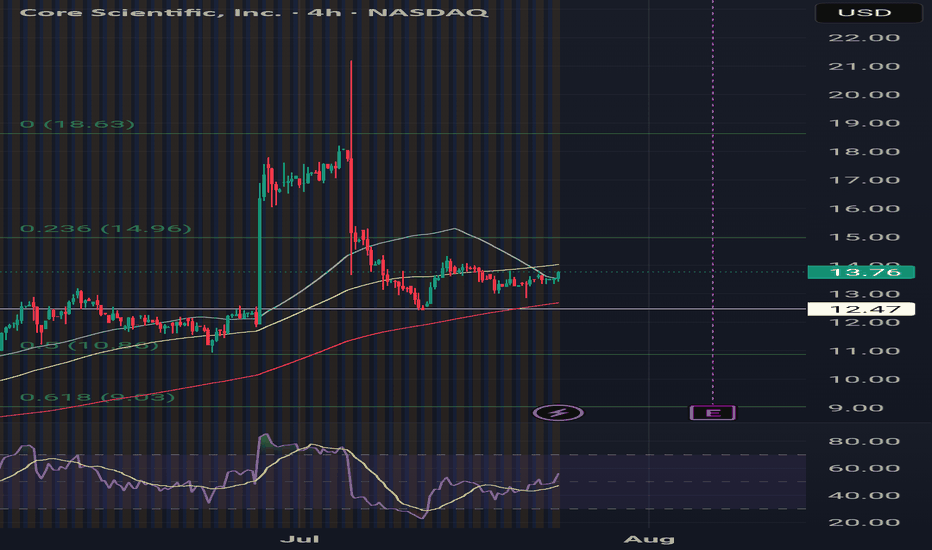

I grabbed the 15c Jan today chart setup looks good I know there's an active lawsuit going on DYOR but the flow calls have been active. Add to your watchlist atleast incase we get a dump.

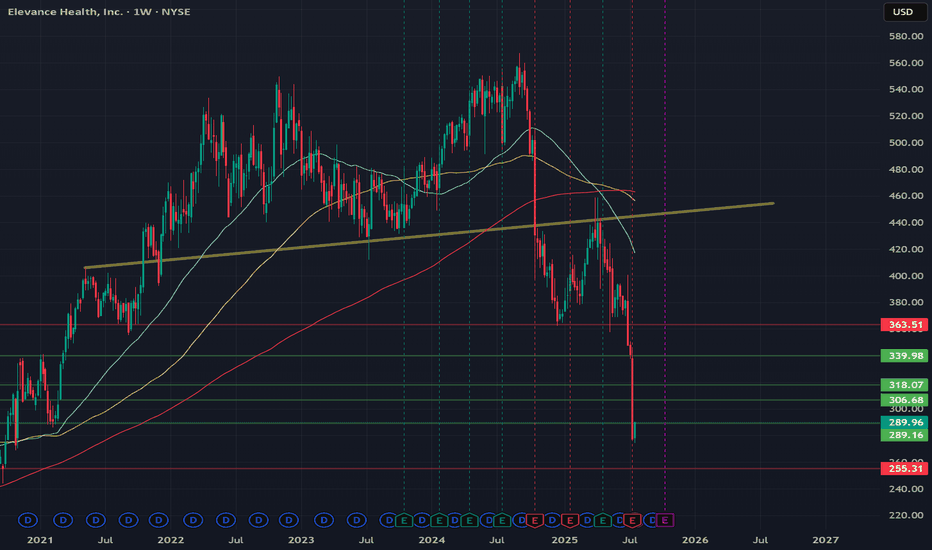

Looking for back over 300 quickly CEO just $2.44 million strong Q2 revenue growth of 14.3% year-over-year to $49.42 billion, revenue is as good as it was at 500$ but expenses have been high. Institutions are loading here, good long-term hold if we need to continue DCA.

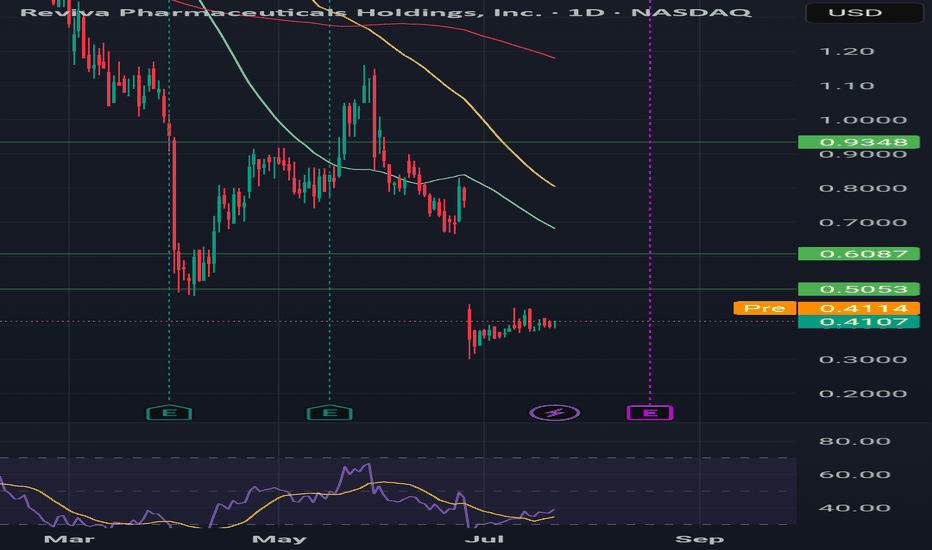

Grabbed shares at .41 just looking for a gap fill see what happens if we get there i believe a PnD group has sent this on an impressive rally before and are looking to do it again, tight stop recommended. Daily and weekly rsi look good for a move only thing that would crush this further right now is a reverse split as I belive they've already completed a couple...

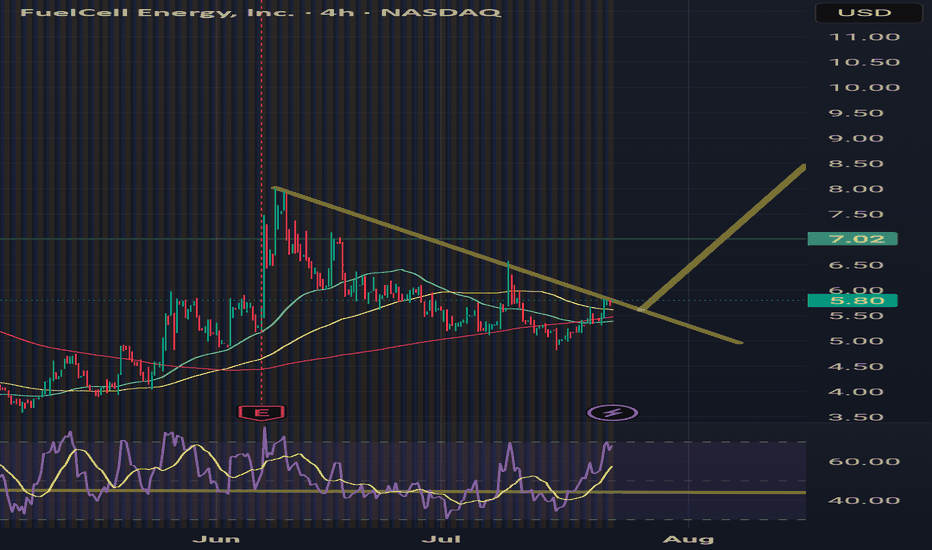

Daily weekly both look great, need to break this trend and get 7$ maybe a break out and retest of trend line to cool off the 4hr rsi or a plan ol rejection but the way small names are getting sent right makes me believe this is a decent possibility. Holding shares and a few 5 and 10 calls.

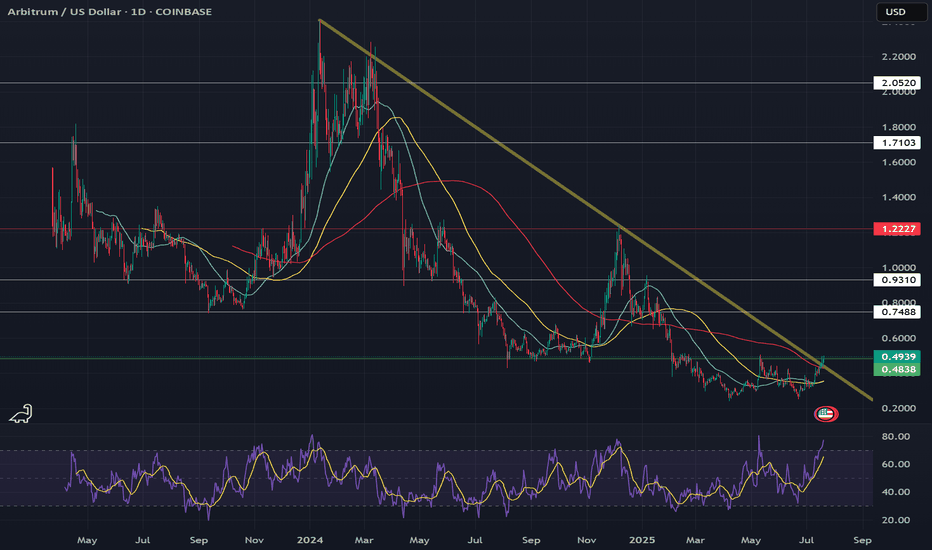

ARB/USDT recently showed a breakout above a descending trendline from Jan 24' on the daily timeframe, suggesting bullish momentum. .43 would be a good entry off the 200 MA if we get a back test and if ETH decides to pullback or continue its run to 4000. Arbitrum has officially hits a ATH in stablecoin supply $7,900,000,000. Adoption is in full swing BTC stable I...

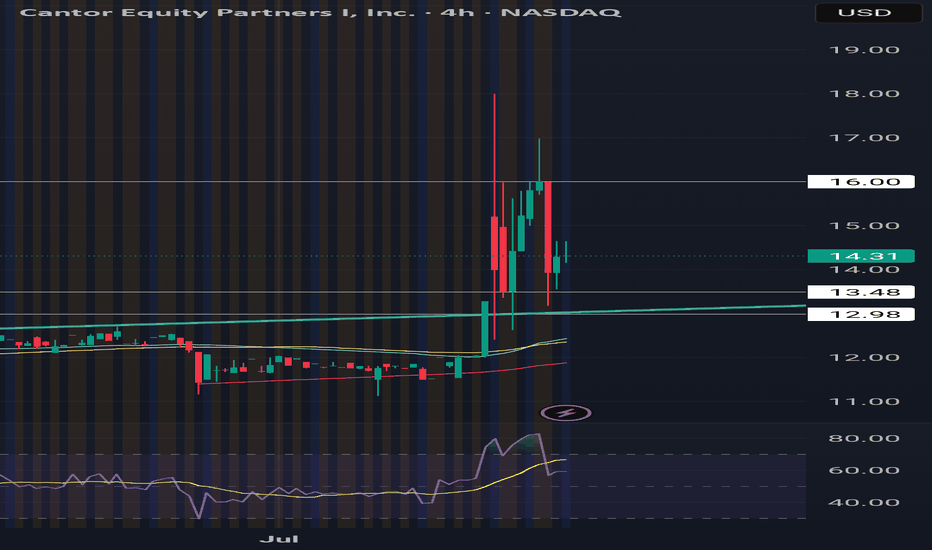

Adam Back, a satoshi era OG, is launching Bitcoin Standard Treasury Company (BSTR), which plans to go public through a merger with Cantor Equity Partners I (CEPO), a special-purpose acquisition company. BSTR will debut with 30,021 BTC, valued at approximately $3.5 billion, making it the fourth-largest public Bitcoin treasury. The company has secured $1.5 billion...

Bought shares today at close new legislation is going to send this sky high. BMNR just may actually be the MSTR of ETH with the players they have. SBET BTBT COIN all will do great, but BMNR currently holds the lead for largest ETH treasury. Maybe more chop to average shares but this will be going SOON. As long as the daily RSI is above 50, we should be holding...

Averaged shares at 3.39 4 calls Jan for second or third largest holder for ETH

GME coiled on the 4hr RSI break 50 were launching from the POC area to 24.50 to next MA. Overall target after taking 26 is VAH around 27.58. The drop down was profit taking/ overextended /sell the news after all the hype leading into the btc purchase announcement they didn't disclose purchase price either from what I know. But btc is at ATH the 500M is now in...

I'm holding the 1/16/26 25C those are the highest and furthest out options you can get on hood. Bought at 1.55 on 7/2 now worth 3.30 good entries if eth pulls back would be 12 and 10 best case. I see this running quick I will sell atleast half at 30. They hold and are staking over 500M worth of eth largest amount for any publicly traded company, yeild will be...

shitter stock on my radar longed this break see if it can run. Ill be out if it on pullback below 4.50. 90% cut to Ebidta guidance. Has a domestic supply chain but capacity-constrained so 30% of revenue will be affected by the China tariffs. Although $4.5B backlog, 50% revenue growth despite some of their practices it's a very real company with a good bit of hate...

Ouster’s global partner network spans over 50 countries, supporting approximately 600 customers with applications in autonomous vehicles, robotics, drones, mapping, defense, and smart cities. Ouster has been getting lots of attention lately 230k 20 call 1/16/26 I'm wondering if someone knows there's an announcement coming this year that will get them ABOVE $20....

Chance to get hot with semis if SPX can claim above 5950 High $8 for buying until we lose the 50MA. Break above 12 with strength/volume will be key for continuation to 20. Price-To-Earnings ratio (12.6x) is below the US market (17.8x) * Revenue is forecast to grow 17.78% per year * Earnings grew by 47.8% over the past year * Short Interest 6.94M Short...

Chip stocks are back with loaded a ton of cheap calls very underpriced, new leadership will recover 35% decline 30 gap fill is easy money here. Same goes for AMD 110 although high premiums compared to intel.

Seems consolidation is coming to an end. 4 hr is set up for bulls to take the move before earnings on the 15th. Easy beat for them with likely more good news to be announced. Also kulr has been buying btc which is currently breaking out I'm sure they will ride with the hype. Looking to move through 1.50 and flip $2 with some decent volume for continuation....

Easy money here just a matter of when likely soon, text book cup and handle. Depth of cup takes exactly to resistance where im sure it will wick up. $PNUT is the lowest market cap crypto on hood at 183 million pretty low volume for now, just accumulation.

I don't think it would actually go this low into the wedge but if it chatches the moving averages then rejects I would hold other wise just a retest of support im guessing since they came in under last three quarters it'll be more pain. Plus US lawmakers want it delisted for "national security". No beuno.