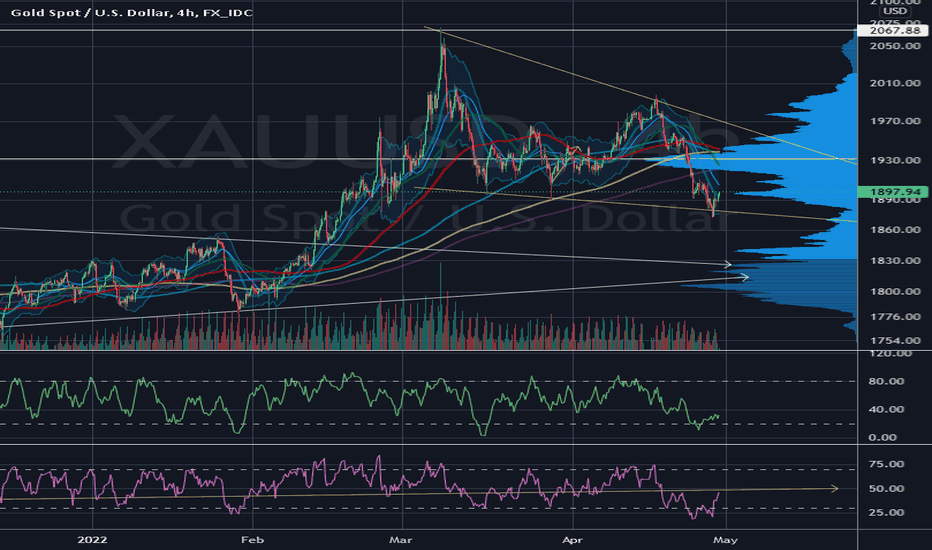

Gold may have found a floor today as both MFI and RSI indicators have bounce out oversold territory. Looking at the 4H chart, the MFI and RSI indicators have been a consistent indicator this year of telling when gold bottoms. I have started entering into gold again but I will be trading with caution as the range is small and I am looking to liquidate my...

Gold has had an amazing run over the last couple weeks but its been selling off over the last several days. $1900 appears to be a good support area and buyers are starting to move back in. $1900 level was previous highs last May and sort of last November. This level is also a bounce off Fibonacci .786, where the bulls can pick back up this rally. If we do go down...

Gold has been trading in a flag pattern for a little over 1.5 years. This consolidation pattern tends to lead to a big break out, which could point prices to go higher but also lower. Fundamentally speaking, if stocks are under performing and real bonds rates are returning negative yields, gold would be an attractive hedge against inflation and beaten asset prices.

If we look back at 2015, we had a similar sell off in anticipation of a rate hike from near zero percent fund rate. This pattern looks similar to what we are experiencing in the markets past couple days. A risk off approach and growth stocks no longer being as green as we were use to. Will we see further sell off in the market coming off tomorrows FOMC meeting? My...

Over the last several days, Bitcoin has been hovering just below all time highs, waiting to break out. Now it appears we may have a signal for the big rally we've all been waiting for. The one to take us to the holy land, $100,000! Starting at the daily, Bitcoin has been making a steady bull run from $41,000 till $67,000 before consolidating back. This...

Bearish pattern forming with Visa, which could turn into a 15-20% correction if pattern plays out.

Looks like the year long uptrend channel has finally broke (It was fun while it lasted). Now we wait and see the next move for $SPY as it makes a recovery bounce off the 100 Day Moving Average. Couple things to look out for before going full BTFD. Fundamentally speaking: The Evergrande debacle should have very little to do with the US economy, so a continuation...

Gold has been moving down this year but it looks like that is about to change. With inflation at over 5%, it is surprising gold is lagging behind. I see this as a great opportunity, as well as maybe for institutions already, to start hedging for whats ahead. The analysis: Starting from the weekly chart on the right, it appears gold has finished the correction...

Good news! We have another bounce today off the yearly trend line on $SPY. We've been tracking SPY and this trend channel for awhile and this has been our 6th bounce off the bottom of the channel! This trend channel has proven to be a good buy opportunity whenever we bounce off it, even though SPY has seem resistant at breaking new highs. I expect bullish momentum...

Things are looking bearish for S&P 500 index. Using the $SPY chart, A bearish wedge pattern has formed and we have started to break down from it in today's session. Pattern usually retests the bottom wedge before it completely sells off. I expect prices to drop to $416 this week and test our year long trend channel. If $416 area does not hold, I expect it to drop...

Since my last posting, Doge did break out of the wedge pattern as predicted and we made nice 30% gain. Unfortunately, we just tested a previous high of .43 and saw rejection. This rejection now forms a bearish head and shoulder on the larger time scale with very bearish indications of a much larger correction to the downside. As I predicted, if the whole crypto...

Doge is taking the lead in the crypto space! Very exciting move and hopefully an indicator for the rest of the cryptos. We have been holding at around 30%-50% drop on most of the market but this looks like a bullish sign. Some important indicators to look at. Daily 20 & 50 MA are converging together. Could see some resistance at this level. Breaking above would...

Keep calm and hodl Dogers. Sentiment is bearish but bad news catalysis's like this happens every time we have large rallies. Ive been in this space for almost 5 years and the government will always coming out with some bad news only to keep the dollar strong and collect your money through taxes. Breaking down the charts, we are actually forming a nice descending...

Interesting week and it looks like the bears are loosing steam. (Left chart): We bounced twice off the 2021 trend line and that now confirms 5 points of support for the bulls that this trend line is here to stay. The 2 bounces on the last 2 Wednesdays also adds double bottom pattern, a very bullish signal. We are currently are still testing a resistance of the...

Since the beginning of they year we have seen 4 corrections and they have held a consistent upwards trend line so far. Today we approach this trend line as well as the 50day Moving Average. I am not recommending any long positions as there could be wicks that could blow past the trend line like seen in March. I am looking for a solid day closing in the green and...

Its good to sometimes look and compare at what history has done when we governments allow loose monetary policies followed by sharp increase of interest rates. During the late 1980s, Japan growth was largely pushed by ease of borrowing and increasing money supply. By late 1989, inflation worries lead Japan to increase their interest rates which ultimately killed...

We have break out of what appears to be a bear flag on TLT today. Next level of support after this break up appears to be around $128 and $122. CPI report today confirms fears of inflation, thus bonds prices will fall and yields will rise.

An Inverted head and shoulders looks to be forming with Euro against the dollar. Break out of this pattern could lead the Euro to 1.26, a 450pip move