I like trading EURUSD and it is my recommendation for beginners because of how much it ranges making it one of the easier pairs to trade. Confluences for this trade: The overall trend is an uptrend Price is inside a parallel channel. The trend lines on either side of the channel act as support and resistance. Price has respected the 4H trend line to the...

Following the rules of supply and demand, we are waiting for a clear break of the indecision zone before entering our trade. Bullish break: Enter at the 136.500 level and take profit at the previous consolidation right before our daily support zone Bearish break: We wait for price to fall outside of indecision zone to the downside. We will enter at the 134.500...

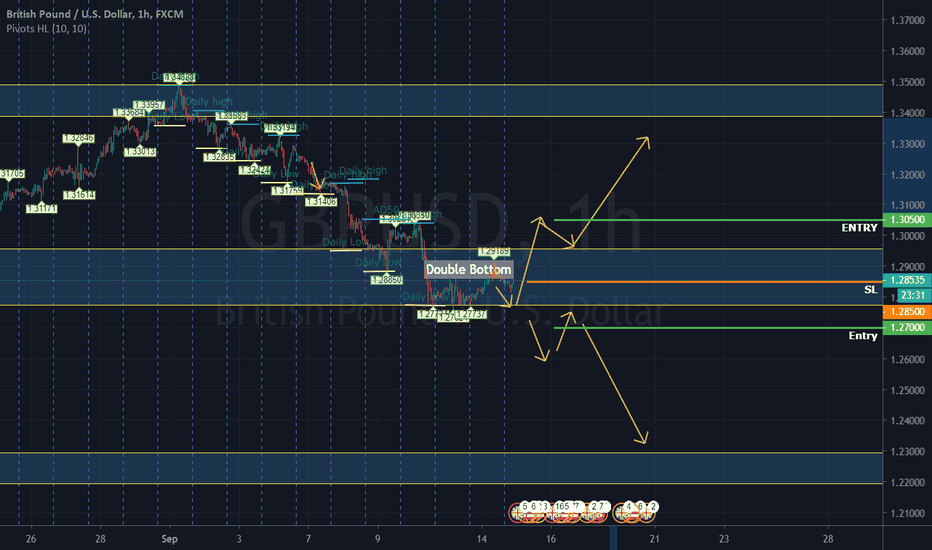

These are our two outlooks on GBPUSD 1) Bearing Continuation: Price falls outside of our indecision zone to the downside, retest the zone then continues the move to the downside. For this outlook our entry would be the bottom of the zone around 1.27000 Take profit at 1.23000 Our SL will be set at half of the zone in the 1.28500 area 2) Bullish Reversal: If price...

Market structure is creating higher highs and higher lows indicating an uptrend We got our break and retest: Price is reaching the top of our indecision zone, retraced and now we're waiting on the move back to the upside. Classic supply and demand move from zone to zone. Entry is 1970 which is above our previous consolidation zone's wicks (indicated by red...

Market structure is creating higher highs and higher lows indicating an uptrend We got our break and retest: Price has hit the top of our indecision zone, retraced and now we're waiting on the move back to the upside. Classic supply and demand move from zone to zone. Entry is 1970 which is above our previous consolidation zone's wicks (indicated by red eclipses)...

Trade confluences: -Broke 4H trendline to the upside -Creating market structure to the upside -Broke previous daily high -Left the demand zone and entered the indecision zone. Price is currently retracing before continuing to the upside. Enter above the zone per our rules for the sandwich and enter above the previous wicks which is also the golden zone at the...

Rejection at indecision zone Previous rejections at same zones in previous days Slightly above 61.8 lvl on fib, looking to enter at 61.8 golden zone, below previous consolidation TP: 1930 SL:1969 <- Albove previous wick

waiting for a rejection of the midfigure at .72500 for a continuation of seller's momentum. Take profit 1 @ .71500 Take profit 2 @ .71000

If GU is able to break this hourly consolidation zone, I see it returning to the 1.1050 area.

EU just bounced off a major key level around the 1.7700 area. We are now looking for it to retrace to the 50 area, which is coincidentally a institutional level banks play off of. After price finishes the retracement we will be looking for price to move to our mid-figure (1.17500)

Outlook on Gold: Gold is looking to leave the indecision area and sell off into the demand zone. Before entering we want to be looking for an area where price has consolidated and we want price to break that area before entering the trade. The consolidation area we are looking to get past is the area around 1915. once we are able to see price push below this we...

Missed the sell move on USDCAD from last night but now we have to prepare for the next move. As USDCAD continues to fall, we are looking for price to respect our demand area and bounce off the resistance zone to go back to our 50% area/indecision zone. Entry: 131.650 SL: 131.400 TP: 1.32400 This is the beauty of this strategy, we are able to monitor time and...

2 looks on GU 1) Price will reject the 50% area and continue to the demand area for a win of 50 pips. RRR ratio is 1.33. 2) Price will go to the upside and return the supply zone at the 1.325 area. RRR Ratio 1.57 for another win of 50 pips. This is the beauty of this strategy, we are able to monitor time and price to see what direction price will go in and...

GJ has come into previous highs and now will look for correction, just as it has before. We will wait for price to come down below previous consolidation zones to enter at the 139.650 area. According to the Rules of the sandwich stategry, we will take this trade from ourside our zone below consolidation zones and ride it back to the resistance zone that served...

We have 60 pips til we reach the bottom of the zone before we can consider looking for more buys off the bounce of the bottom of the supply zone. On a higher time frame look, we are currently in a daily range and if we see price break outside our resistance zone then we will be looking for entries below previous consolidation zones wicks that came outside the...

Basic supply and Demand/ Sandwich strategy move Two things can happen. 1) Price hits the bottom of our resistance zone and bounces off of it to go back to the upside. 2) Price falls through our resistance zone and continues to fall to the 137 area.

GA is bouncing off the 50 zone and is heading back to the supply zone. Classic back and forth Find entries at consolidation zones or at the top or bottom of zones.

Yesterday Price was above 2000 and today we broke the 2000 level and as price entered back into the supply zone, we entered the market. As the strategy entails, after entering the zone, we enter the market then we take profit at the next zone which is the 50% area (Green zone). Price is now reacting to the 50 zone and is retracing and is closing on the hour as...