WallStreetWale1

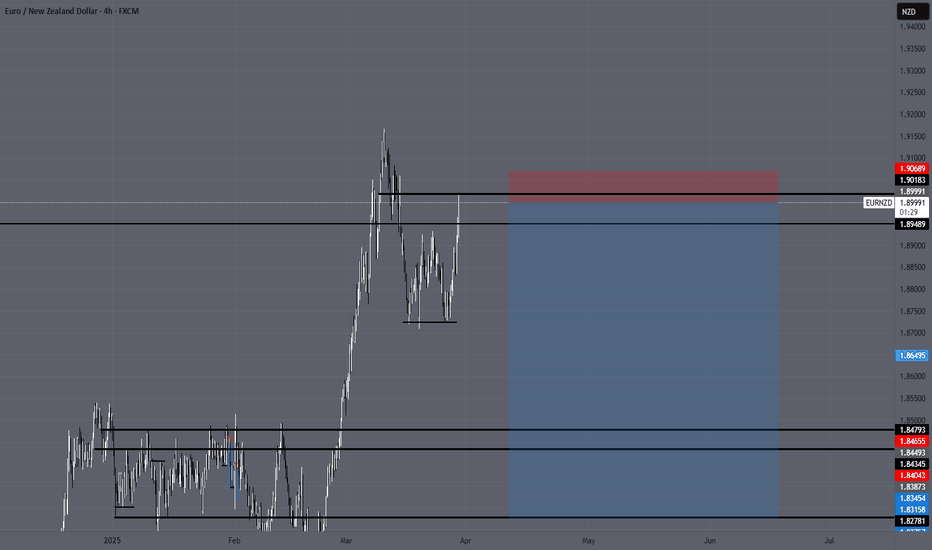

eurnzd has left a massive imbalance that will need to be mitigated. Sell may continue but a pullback would be healthy

Looking for another long term sell opportunity on EURNZD after rejecting from 2.00

Potential Opportunity. I have not entered yet but i have closed my buys

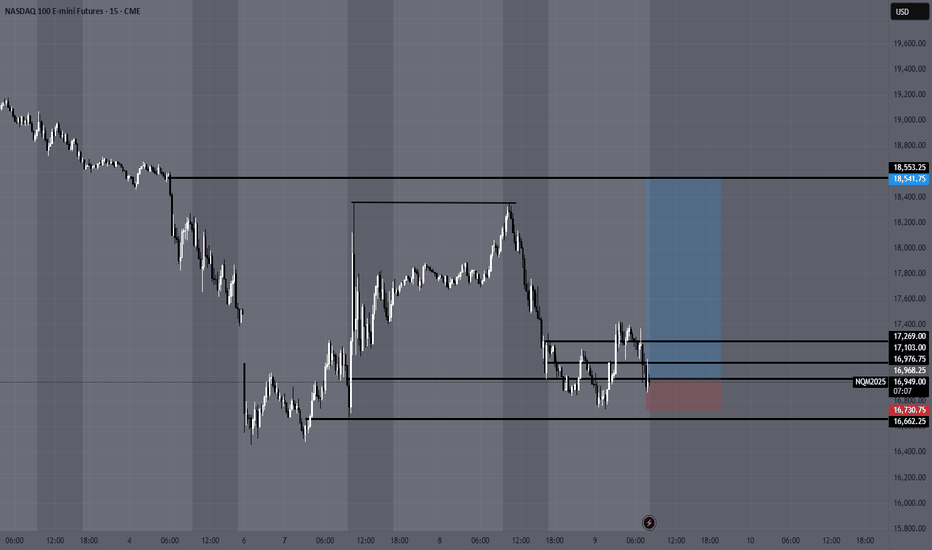

We are looking to go long on NQ from the 17000 level. On the daily time frame Tuesdays candle seems to have created the higher low i was looking for. The most recent 4H candle was also a bullish engulfing. I am looking to enter this trade here.

Long term i am looking at sells on EURNZD but it is possible we find support at these levels and trade higher to mitigate the imbalances above

Great Risk:Reward Sell Opportunity on EURNZD from the high

EURNZD is trading at a psychological level and i can see price targeting the lows. Should have a decent swing trade here.

Tesla has traded back to fill the gap that was left in October 2024 based on fundamental news and protests against the company. Low risk opportunity at these levels.

Expecting dollar strength coming into Wednesdays CPI news. GU currently testing structure

market structure trend analysis dollar correlation buy opportunity

EURNZD has completed its pull back and is ready to continue buying to the highs

Taking buys on EURNZD at the current price. EURNZD is trading at the bottom of its range creating a great risk to reward trade set up

Buying USDCAD at 1.3280 with a 30 pip sl at 1.3250. USD is currently testing key structure. a rejection from these levels should send price higher.

Looking at shorts on USDJPY with the 30 pip SL. Trading UJ at the highs of its current range.

We are taking another shot at our NAS100 buys. After our last 700+ point run NAS has pulled back to our entry. I would like to see if we can buy out of structure from this level.

Taking a secondary position on NZDUSD at 0.5940. Observing price action and expecting about a 1:7 trade

We are entering swing buys on Nas100 with a final target of 16300. Thursday's move retraced last weeks buys. Price has created a higher high and broken the August downtrend

NAs100 has finally achieved our buy-side targets. There was a gap and an imbalance to be filled. We can take some great R:R sells at this level. Entry 13400