WhiskeyTangoFoxtrot3

Havn't made a comment on GBPUSD in a bit mainly since just needed to sit back and see what the developments were. As expected, nothing new has happened while the odds of a no deal Brexit on April 12th are now noticeably higher according to the betting markets. The pound hasn't reflected this reality yet mainly because a deal is priced in. Dramatic volatility will...

SPX has trended at a 57 degree angle since the 2008 financial crisis. While trend line theory suggests any stock above a 45 degree angle is troublesome, perhaps the SPX is an exception. However, the current trend we are witnessing is at a 67 degree angle, suggesting a significant pullback is warranted. Take this with the global fundamentals (slowing Europe,...

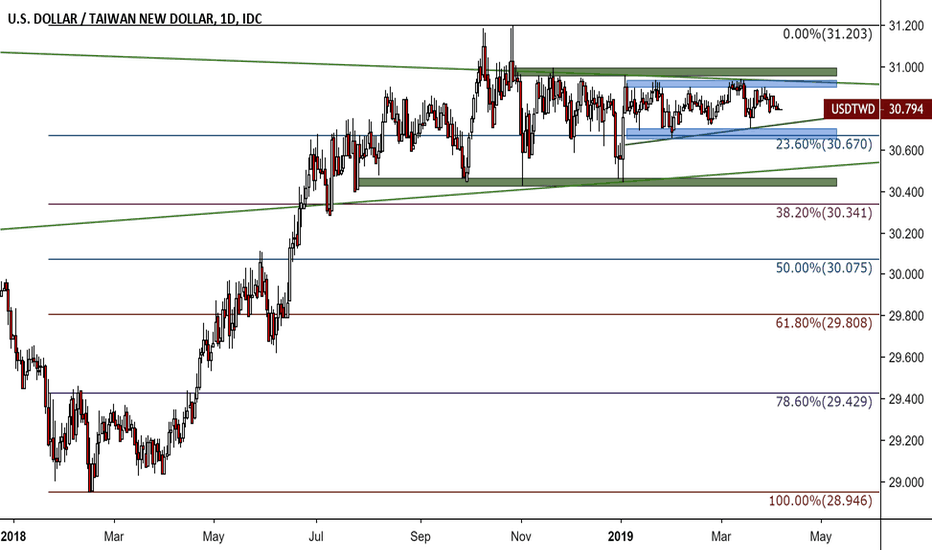

The already incredible low volatility of the US dollar to the Taiwan dollar somehow over the past few weeks managed to drop volatility even lower than before. The range trading has tightened further from 30.42 to 31 by a tighter range of 30.65 to 30.94. This is truly incredible, even for the foreign exchange market which has suffered (or enjoyed given your...

So many more problems in Europe beyond the fundamentals, mostly political risk. But first and foremost, the fundamentals still trend down. Price action still trends down. Never trade against the trend. This is probably not an inflection point. It could be only if good data continues to come from the EU which the end of the week it did not. If we continue to see...

We are basically exactly where we were at in October 2018. About the same things for US equities. But why the divergence with US equities outperforming oil? Look what happened last time stocks become too zealous in January 2018. Correction downward to a near parity in percentage gains. Either stocks are going to readjust or oil is just going to go crazy in the...

While the CAC40 gave traders an almost perfect technical upward channel for January February and most of March, that channel was broken last week only to be somewhat regained over the past few sessions. It still does not know however if that channel support line is now resistance or still support. Moving averages all signal upward momentum while bull bear...

Oil edged up earlier in the week on the news that Saudi Arabia is focused on cutting output and petroleum-rated assets rose across the board in spite of the fact that a report came out asserting the Russian's weren't cutting as much as they previously suggested. Breaking the upward risking wedge is a really bullish sign as rising wedges tent to be reversal...

The ten year yield peaks about 6 months to 14 months before two consecutive quarters of negative growth (a technical recession). Right now, from our peak in this current cycle we are 6 months divorced from a peak in the yield. Moreover, 3 year over 10 year yields inverted recently a signal that a recession is in the not too distant future. However, massive...

I just wrote a bit of a thesis on potential head and shoulders pattern forming in the SPX500. This is basically that same information, but without the head and shoulders pattern in addition to two moving averages, 200 MA and 200 EMA. Also, I have added a moving average on the volume. As you can see, it has significantly declined over the past year since volatility...

Not a perfect pattern, but few are. If the SPX500 does not reach record highs and does not go beyond those record highs with strong conviction, then it will suffer from the exact same chart pattern DJI did right before the 2008 Financial Crisis. If price action starts to move down then we would be witnessing a large head and shoulders pattern right into a...

This is such an interesting technical channel that we saw stemming back from December 2018. While, it failed to continue and broke through, it seems like now price action wants to use that former lower section of the channel that was support as resistance. However, this one is not as perfect as the channel that had formed as price action is creeping back into the...

The US dollar has rallied significantly during the trading day on Thursday this week, reaching towards the ¥111.50 price level. Resistance range from this level goes all the way to the ¥112 meaning it will be very interesting to see whether or not the market can break out above that 50 pip range. If in fact it does, that could send this market significantly, at...

Brexit. Its kind of like a bad tattoo in that it never goes away, yet was almost immediately regrettable. Unfortunately that continues to be the case this week with Prime Minister May meeting with opposition leader Jeremy Corbyn to etch out a deal for the House of Commons to pass her bill which has already been rejected three times. Much ink has been spilled and...

I guess one of the only non-political comment that you could make on this chart is to look for those former levels of resistance as support. But also though, to what degree is a deal priced in? Are Brexit deal fully priced into the cable? Staying clear of this pair. No hedgefund algos on my side. Good luck to Blackrock since they probably have the edge on this one...

Clearly, moving averages show that MPC is headed towards increased gains. However, it is having a difficult time convincingly breaking through downward short-term resistance. Moreover, oscillators at the monthly chart suggest a sell as do oscillators for the daily chart, primarily RSI and momentum. However, if you look at the comparison between other ways to...

I foresee either two scenarios. 1 is the price moves to upward resistance. Or 2a and 2b where the price drops further to support and then rebounds up to maybe below resistance or at it. www.anthonylaurence.wordpress.com

Could reach resistance lines as RSI and bull bear indicators suggest EURUSD short is overdone. However, if there is a deal then we will probably breakout above these resistance levels.

Purely based on technical oscillators, BTCUSD is overbought. Moreover, the massive increase in price action variance underscores how volatile and uncertain BTCUSD is. Short- and medium-term could see previous resistance as support, but in the long term it still doesn't make sense to invest in this alternative asset class.