WiseLeoTrading

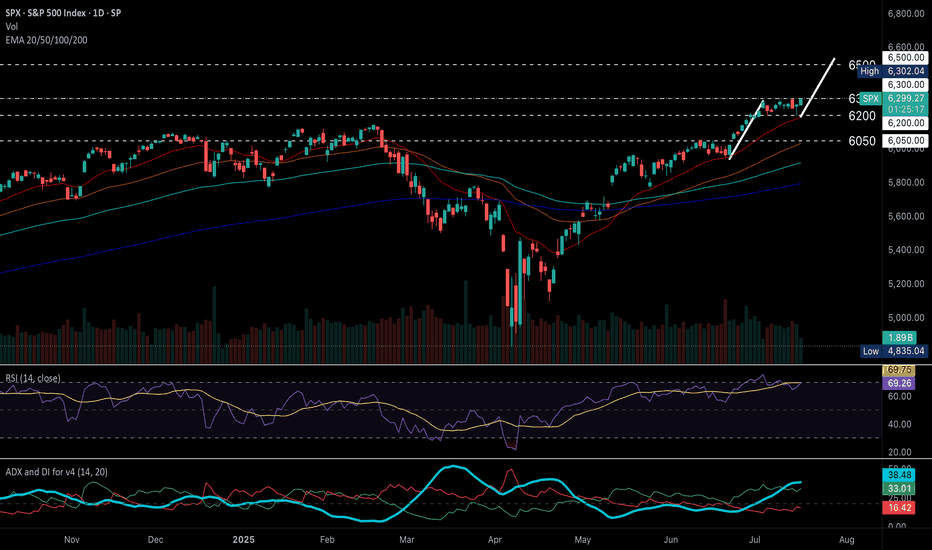

PremiumS&P 500 (US500) maintains strong bullish momentum. Technical Outlook S&P 500 (US500) holds a strong bullish structure, continuing to print higher highs and higher lows above diverging EMAs, signaling sustained upward momentum. RSI has eased from overbought levels, now hovering below 70, while price consolidates sideways near recent highs, a typical pause...

Fundamental view: Total US natural gas consumption rose 0.8% to 75.1 Bcf/d. Power sector demand increased 1.0% to 43.8 Bcf/d, driven by higher temperatures and increased air conditioning use. While total supply averaged 112.5 Bcf/d, down 0.6% from the previous week. Dry production decreased 0.6% to 106.2 Bcf/d. Net imports from Canada fell 1.4% to 6.3 Bcf/d. Rig...

Fundamental US500 is pushing higher as the US 2nd quarter earnings season gains momentum under President Trump's second administration amidst tariffs. Big tech earnings will have a significant impact on the index price action. Technical Bullish momentum is gaining as the uptrend remains strong. The RSI is approaching the overbought region however a break above...

Tesla Q2 2025 Delivery fell, but could it rebound in 2H? Key Figures Q2 2025 Deliveries: 384,122 vehicles Year-over-Year Change: Down approximately 13–14% from Q2 2024 Wall Street Expectations: Around 385,000–387,000 vehicles Production vs. Deliveries: 410,244 vehicles produced, indicating a build-up in inventory Fundamental analyst Sales Decline:...

Fundamental Oil prices remain under pressure. Volatility is expected to remain elevated as traders digest inventory data, watch for geopolitical shifts, and anticipate the upcoming OPEC+ meeting on July 6, where supply policy could change. Technical Technical indicators remain strongly bearish with RSI favouring further downside below pivot level 65.53...