Tata Motors (TATAMOTORS) Technical Analysis: - Recent high break and strong trade line support at 618. - EMAs divergence on daily timeframe, indicating potential bullish trend continuation. - Immediate support at 572-579, target levels at 641, 674, 710, and 731. Tata Motors is currently trading at 618, and there are several technical factors worth considering...

Tata Chemicals on Daily Chart: Triangle Pattern Breakout: The stock has seen a triangle pattern breakout on the daily time frame, which may indicate a potential price move in either direction. Mean (EMA) Diversion on Hourly time frame: The mean (EMA) has diverged on the hourly time frame, which may indicate a change in the trend of the stock...

CANARA BANK Time Frame: 2hr Observation: * Cup and Handle formation * Mean (EMA) Diversion on Hourly time frame * Parallel channel breakout. Resistance/Target: 351 375 399 414 Support: 310 287

*Godrej Consumer* Time Frame: Daily Observation: * Rounding Bottom Formation * Mean (EMA) Diversion Resistance/Target: 967 1076 1181 1251 Support: 793 750

*Hindustan Unilever* Time Frame: Daily Observation: * Rounding Bottom Pattern Formation * Mean (EMA) Diversion Resistance/Target: 2901 3190 3485 3661 Support: 2428 2109

*Au Small Finance* Time Frame: Daily Observation: * Rounding Bottom Pattern formation * Mean (EMA) Diversion on Daily time frame Resistance/Target: 742 848 958 1024 Support: 567 525

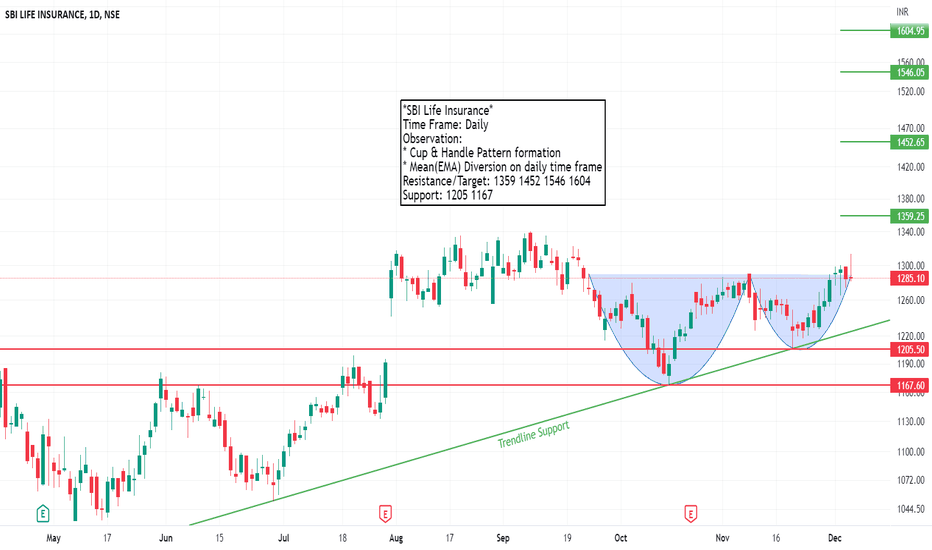

*SBI Life Insurance* Time Frame: Daily Observation: * Cup & Handle Pattern formation * Mean(EMA) Diversion on daily time frame Resistance/Target: 1359 1452 1546 1604 Support: 1205 1167

*Bosch Ltd* Time Frame: Daily Observation: * Trendline Resistance Break * Cup & Handle Pattern Formation Resistance/Support: 18507 20425 22398 23659 Support: 16309 15393

*PVR LTD* Time Frame: Daily Observation: * Supply Zone Breakout * Swing high Break Resistance/Target: 1975 2092 2214 Support: 1711 1630

*Hindustan Copper* Time Frame: Daily Observation: * Rounding Bottom Formation * Mean (EMA) Diversion on Daily time frame Resistance/Target: 134 155 175 187 Support: 108 102

*UPL LTD* Time Frame: Daily Observation: * Rounding Bottom formation * Trendline Resistance Break Resistance/Target: 851 922 997 1046 Support: 721 663

*Dalmia Bharat Ltd* Time Frame: Daily Observation: * Cup & Handle Pattern Formation * Swing High Break Resistance/Target: 1938 2121 2304 Support: 1642 1476

*Apollo Hospitals* Time Frame : Daily Observation : * Supply zone 4630 - 4750 Breakout. * Mean (EMA) diversion on daily time frame Resistance/Target: 5257 5870 6501 6885 Support: 4250 3995

*L&T Finance Holdin* Time Frame: Daily Observation: * Triangle Pattern Breakout * Breakout on 86 - 89 Supply Zone. Resistance/Target: 100 111 123 131 Support: 80 72

*Radico Khaitan* Time Frame: Daily Observation: * Breakout on Supply zone 1107-1143 * Mean (EMA) diversion on daily time frame. Resistance/Target: 1293 1464 1665 1797 Support: 979 908

*Ultratech Cement* Time Frame: Daily Observation: * Rounding Bottom formation. * Supply Zone Breakout * Swing High Breakout Resistance/Target: 7675 8675 9678 10291 Support: 6402 6060

*HDFC Bank* Time Frame: Daily Observation: * Rounding bottom formation * Mean (EMA) Diversion Resistance/Target: 1585 1677 1768 1827 Support: 1434 1365

*Shipping CP India* Time Frame: Daily Observation: * Rounding Bottom formation * Swing High Break Resistance/Target: 144 163 181 193 Support: 115 104