WorthlessViews

PremiumAdvanced Auto Parts NYSE:AAP has gone through an exquisite shakeout of shareholders. Currently trading near $64, the stock is currently testing my "stock crash" simple moving average (seen green SMA lines). From a technical analysist standpoint, it's in a personal buy zone. This stock has tested this simple moving average level a few times in the past and...

TVC:VIX , the great "fear" index, has two looming price gaps on the daily chart. Every gap has always been filled in the history of the $TVC:VIX. Given the 90-day tariff pauses and forever world turmoil, there will (undoubtedly), be a spike in the TVC:VIX to close these open gaps. It's just a matter of timing... I've chosen to go 6 months out on the option date...

Hain Celestial Group $NASDAQ:HAIN. I've had this organic food company on my watchlist for some time as it has dropped massively since 2021. Today, it dropped over 50% post-earnings call after the announcement of weaker sales/earnings and the exit of its CEO (much needed). The company is going to do a "strategic review" of its business moving forward and this is...

Green Plains NASDAQ:GPRE , a company involved in the production of fuel-grade ethanol and corn oil, and grain handling/storage has seen a significant decline in stock price since 2023. Analyzing the company's historical stock performance shows it is highly cyclical and goes through "boom and bust" cycles every 4-8 years - whereby during booms the price has...

It definitely should get everyone's attention when a US Senator (David McCormick) is willing to dish out up to $600,000 in a Bitcoin ETF ( AMEX:BITB ): Feb. 27: Bought $50,000 to $100,000 Feb. 28: Bought $15,000 to $50,000 March 3: Bought $50,000 to $100,000 March 5: Bought $15,000 to $50,000 March 10: Bought $50,000 to $100,000 March 11: Bought $15,000...

Rockwell Automation NYSE:ROK appears to be gaining upward momentum once again. With two price gaps above (highest near $333+) and the historical simple moving average lines showing a positive change, this company could be poised to fill the gaps soon. A strong billion-dollar company with rising revenue, but stay cautious of the slightly high debt, insider...

UnitedHealth Group NYSE:UNH currently has a P/E near 15x, steady rising revenue (2024 = $400+ billion), EPS of 6.24x, dividend of 2.2%, and earnings are forecast to grow by 10.8% per year. The stock, however, has plummeted recently due to negative news, rising healthcare costs, CEO changes, and suspension of 2025 outlook. Every company has bumps, but I view...

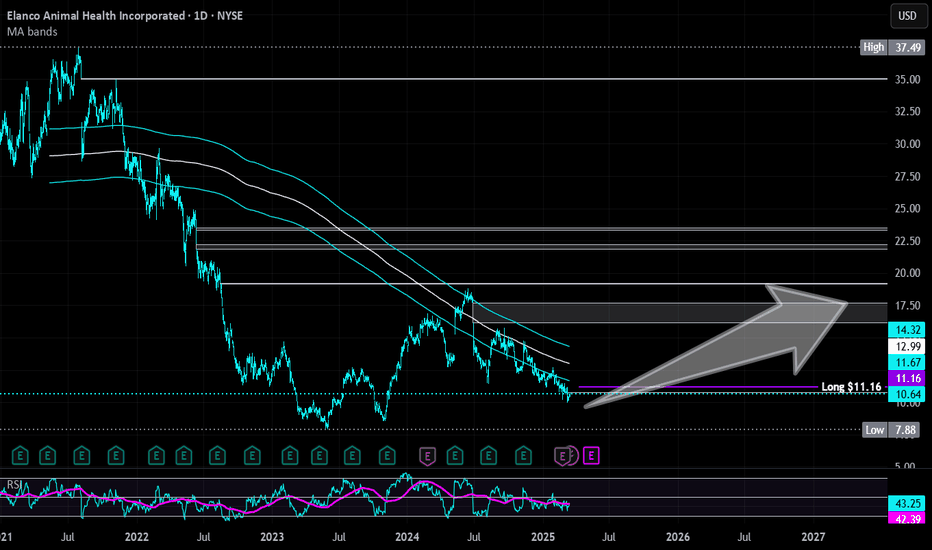

Elanco Animal Health NYSE:ELAN is riding my historical simple moving average and likely to make a move up soon. Insiders have recently been awarded options and bought $483,000+ worth of shares. Became profitable this year, low debt, P/E = 15x. Long at $11.16 Targets: $12.50 $14.50 $16.00 $17.50

TopGolf NYSE:MODG finally closed the last price gap on the daily chart from the 2020 pandemic crash. All price gaps (as of this analysis) are now above the current price. While I am not stating this is bottom (high $6's or even low $5's are not fully off the table given the downward momentum), there is a lot of growth still on the table for this company. The...

Celanese Corp is another chemical company (like Dow Inc) crushed by tariffs and economic headwinds. It's dropped -78% in one year.... However, this is a very strong company with strong credit market interest and no immediate liquidity crisis. From a technical analysis perspective, this... like in 2008 and 2020... is the time to gather shares given it has reached...

NYSE:WEX Inc has a 40.8M float and recently initiated a $300 million share buyback. The stock has been in consolidation mode for some time and is playing "nicely" along my selected historical simple moving average (SMA). Recently, it may have double-bottomed off this SMA and, given the buyback, may move progressively up toward the $230's where there is a large...

WM Technology NASDAQ:MAPS provides ecommerce and compliance software solutions to retailers and brands in cannabis market in the United States and internationally. After it's de-SPAC in 2020, it soared to $29.50 and now can be found for around $1.00. It's been consolidating at these lows for almost two years, and it may be gaining algorithmic traction for a move...

Charter Communications NASDAQ:CHTR has hit the bottom of my historical simple moving average band. It may consolidate for a while around the current price or dip in the near-term (potentially in the $270's), but dropping interest rates will be extremely beneficial for telecommunication companies in the long-term. There are two open price gaps on the daily chart...

StoneCo NASDAQ:STNE revenue rise is staggering. Position started at $8.76. Chart looks ready for a move up, but nothing is guaranteed. Price Targets into 2027: $10.00 $12.00 $14.00 $16.00 $30.00 (long-term view)

GE Healthcare Technology $NASDAQ:GEHC. An aging and unhealthy population will only create an increased need for healthcare imaging services. Add AI to the diagnostic mix, and imaging will be imperative for routine health maintenance and screening. With a P/E of 15x, debt-to equity of 1x, earnings forecast growth of 8.36% per year, and bullish analyst ratings, this...

Acadia Healthcare's NASDAQ:ACHC stock has fallen nearly -76% in a year, primarily due to weak 2024 results, missed revenue and EPS expectations, and a soft 2025 revenue guidance. Ongoing federal investigations into billing practices and lawsuits have further eroded investor confidence. However, it is currently trading at a price-to-earnings ratio of 7.42x and...

Dollar Tree NASDAQ:DLTR has taken a massive hit to its stock price as low-income spenders are cutting back (recession red flag, anyone?). It recently touched my selected "crash" simple moving average area (white lines on the chart) and may take many years before true recovery occurs. However, the Director recently bought $150k+ in shares after this recent drop,...

Ishares 20+ Treasury Bond NASDAQ:TLT are particularly sensitive to interest rates: the price moves up when they are lowered and down when they rise. Locally, I'm witnessing banks lower their interest rates for CDs and shorten the duration for those with high-yielding returns. The general political rhetoric, especially due to the election cycle, is a push for the...