WorthlessViews

PremiumFor the patient, one of the "safest" investments is in long-term treasury bonds (specifically NASDAQ:TLT ). For those who may not understand why, bond prices move inversely to yields. If interest rates drop (which the Federal Reserve has stated is going to happen this year), NASDAQ:TLT will rise. If interest rates rise (like what happened in early 2022), ...

The United Postal Service NYSE:UPS finally closed out the last remaining price gap on the daily chart (since 2020) and entered my "crash" simple moving average zone. With a P/E of 15x, earnings forecast growth of 8.12% per year, and a dividend over 6%, NYSE:UPS "may" be a good buy and hold through these tumultuous economic/trade war times. I wouldn't place a...

Baidu NASDAQ:BIDU - the Google of China. This one is being ignored by AI investors, and may be an opportunity. Maybe... nothing is certain (especially with the "risks" of Chinese investments). P/E = 9x Debt/Equity = 0.27x Price/Sales = 1.55x Price/Book = 0.80x Price/Cash flow = 7.59x Thus, at $82.50, NASDAQ:BIDU is in a personal buy zone. ...

NYSE:DOW Inc is a strong company with good fundamentals currently trading at a good value (it just may take time for the value to truly show). P/E = 18x Dividend Yield = 7.74% Price/Cahs Flow = 6.9x Debt/Equity = 0.94x Price/Book = 1.14x Insiders buying and awarded options Thus, at $27.59, NYSE:DOW is in a personal buy zone. Targets: ...

Medical Properties Trust NYSE:MPW is a beaten down medical facility REIT currently in a price consolidation phase. The company's stock price is at a level not seen since the 2008-2009 financial crisis - but this doesn't mean it's a "steal" right now for investors. Here's why (from Wiki): "In 2022, The Wall Street Journal reported that Medical Properties Trust...

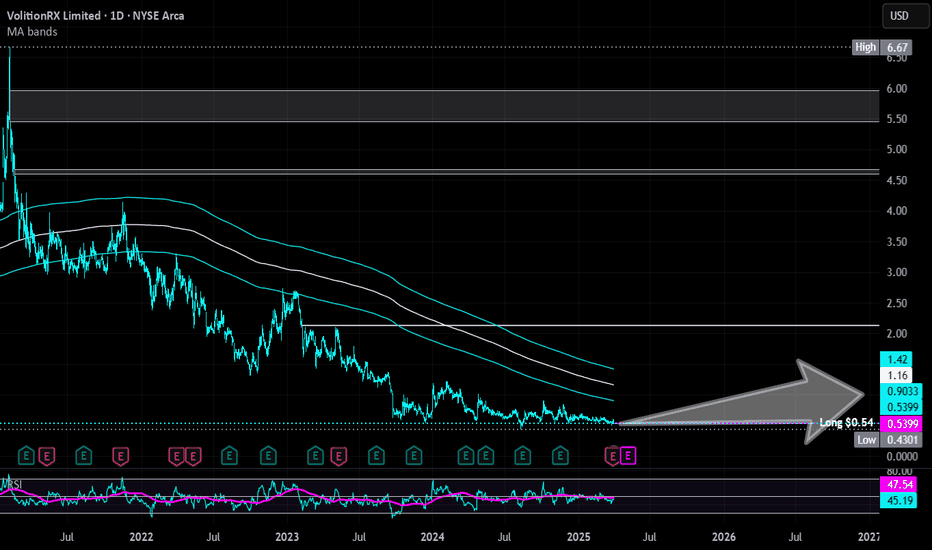

***Stay away if you are risk averse (small cap with 300-400k daily volume and could go to $0). VolitionRX AMEX:VNRX is a U.S.-based, multinational epigenetics company focused on developing blood tests for early disease detection, primarily targeting cancer and sepsis. Its Nu.Q blood tests are primarily for humans, focusing on early detection of diseases like...

NYSE:HCA Healthcare: P/E of 13x, earnings are forecast to grow 6.01% per year; earnings have grown 10.6% per year over the past 5 years, and trading at good value compared to peers and industry. From a technical analysis perspective, it dipped to my selected historical simple moving average area and may represent a buying opportunity to fill the daily price gap...

***New analysis / price targets given the recent 1/10 split:** The historical simple moving average (SMA) I've selected for Angi (formerly Angie's List Inc) NASDAQ:ANGI is starting to enter stock price. This often means a directional change in price: up in this case. The price drop after the last earnings, I believe, was an algorithmic move for price...

The historical simple moving average (SMA) I've selected for Angi Inc NASDAQ:ANGI is starting to enter stock price. This often means a directional change in price: up in this case. The price drop after the last earnings, I believe, was an algorithmic move for price entry/further consolidation. If true, the two large gaps above may be filled "soon". 70M float,...

Across the US, there is a pent-up demand for housing (for the vast majority of locations). While the media likes to selectively report home sales dropping for certain regions, it is more due to mortgage rates and seasonality than demand. Mortgage rates are anticipated to come down over the next 1-2 years and home builders will step in to pick-up the lack of...

Like my predictions for AMEX:TNA , I believe midcap stocks will likely rise as interest rates are lowered over the next few years (probably a little too early given the looming economic situation). While it may be a bumpy ride and everything truly depends no announcement of an "official" economic recession (by which all stock expectations would change to the...

Target NYSE:TGT Strengths: P/E: 11.82x Earnings are forecast to grow 4.95% per year Dividend: 4.24% Better "value" compared to others (i.e. NYSE:WMT ) Insiders recently awarded options May have double-bottomed (see weaknesses below...) Weakness Economic headwinds / recession concerns Debt-to-equity: 1.09x (slightly high) Several...

In anticipation of interest rates going lower, a large number of regional bank insiders are buying a significant number of shares of their own stock. Such lowering will likely increase regional bank revenue and move ETFs like AMEX:DPST higher. Thus, at $84.89, AMEX:DPST is in a personal buy zone. Targets: $106.00 $120.00

Wayfair $NYSE:W. Recession fears are valid. But long-term, once this company becomes truly profitable, this will be a multi-bagger. I won't go on much about the fundamentals because there are too many economic unknowns ahead, but from a technical analysis perspective, the historical simple moving average lines/area is repeatedly converging with the price and...

Sleep Number Company $NASDAQ:SNBR. Closed all existing open price gaps on the daily chart below its current rice. The overall downward trend is starting to flatten. They make all their products in the US and have minimal exposure to international markets (reduced risk around tariffs). Understandably, recession risks are high and such a company would be impacted....

Redfin $NASDAQ:RDFN. Yes, housing is starting to finally slide as mortgage rates remain high, housing inventory increases, and pending sales drop. I can see an argument to wait to enter NASDAQ:RDFN and I can't truly argue against it for 2025 (a dip is possible into the $4's if things really take a bad turn). But what I like about Redfin is they do not invest in...

As the Great American Wealth Transfer happens, people are using that money to travel more (after all, few can afford to transfer that wealth into real estate). Airline data show passenger counts are increasing rapidly and with airfares expected to rise, this sector is likely to go through a long-awaited boom cycle. Those following me know I am heavily long in...

Contrarian view, despite tariffs. I don't think this rodeo is over - but I could always be wrong. Even if individual consumption drops (which I think it has for some time now), rising prices will continue to mask it. Many, but not all, companies will profit and until there is a "bigger" catalyst... bullish. AMEX:HIBL is a personal buy at $30.86 (also noting the...