There has been another pullback in the 10Y US Treasury yields during the previous week. It comes as a result of investors' anticipation that the trade war between the US and China might soon be finalized. However, this sentiment is again based on mixed signals coming from the US Administration during the previous week. What will be the final result, no one...

Investors are perceiving that the US-China trade war tensions are easing, in which sense, the price of gold lost some of the value as of the end of the previous week. The gold lost some 2%, and was last traded at the level of $3.318. It should be also considered that during the several few weeks, the price of gold was continuously reaching new all time highest...

Finally some positive sentiment on the US equity markets. The S&P 500 marked a weekly gain of 4,6%, while investors are waging the relaxation of the ongoing trade tariffs war. Regardless of estimates of the future impact of imposed tariffs, the US tech companies are still posting relatively good results. The S&P 500 ended the week at the level of 5.525, which was...

The previous week was the relatively calmer one, when it comes to economic news. The S&P Global Composite PMI Flash for April reached the level of 51,2 slightly above market expectation of 51. At the same time, the S&P Global Manufacturing PMI Flash for April was standing at 50,7, above market consensus of 49,1. The US new home sales were higher by 7,4% in March...

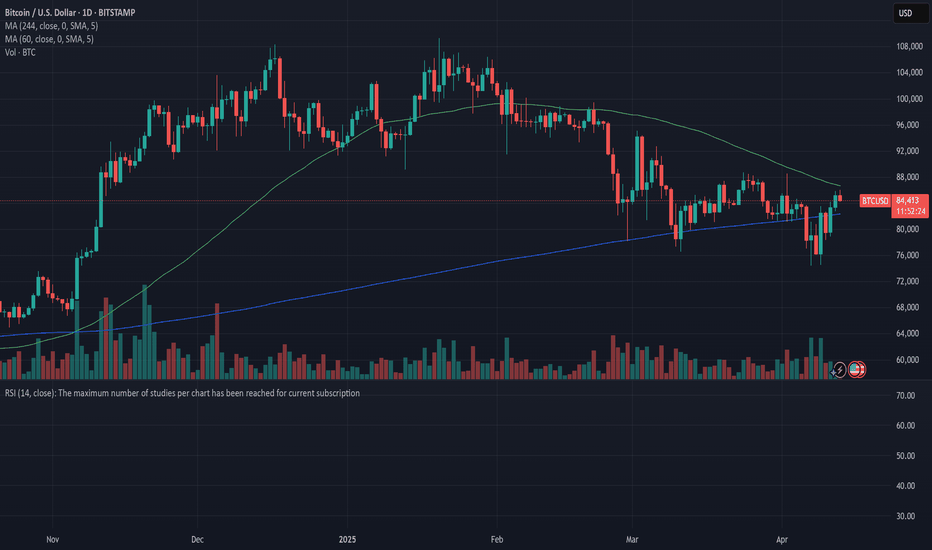

During the previous week BTC finally made a break-through from previous levels, reaching the highest weekly level at $95,5K. This move was supported by fundamentals. On one side there was a sort of relaxation of the US-China trade war, at least based on comments from the US Administration, which continues to be highly mixed. In addition, the Federal Reserve...

Last week in the news The market is currently perceiving that there is sort of relaxation in the US-China trade war. This was the major premise which boosted US equity markets. The S&P 500 gained around 4,6% on a weekly level. A positive market sentiment and short relaxation on uncertainty brought the price of gold lower by 2% on Friday, ending the week at the...

Tariffs continue to be the major market concern, considering its potential impact on inflation, and at the last distance - the decision of the Fed to cut interest rates during the course of this year. The US Administration continues to urge the Fed to cut interest rates, noting that this is the right moment for such a move, while Fed Chair Powell refuses to...

The price of gold continues its way up to higher grounds, supported by high uncertainty caused by trade tariffs imposed by the US Administration to the rest of the world countries. Certainly, the most important tariffs are related to China, as the US major trade counterparty, which is currently in a wait-and-see phase. The price of gold reached a new all time...

The S&P 500 index tried very hard to sustain a bit of market optimism, however, it ended the trading week at almost the same level, where it started it. Monday was a positive day, where the index managed to open higher from Friday's close, reaching 5.450, however, through the rest of the week, it was traded with a negative sentiment. Thursday closed at the level...

Previous week was the relatively calmer one on financial markets, to some extent due to lack of new information regarding trade tariffs. In addition, Friday was a holiday on Western markets, and was a non-working day, same as Monday in the week ahead. Usually, the pre-holiday period is a relatively calmer one on markets. As for macro data posted for the US, the...

As markets continue to be highly concerned regarding trade tariffs imposed by the US Administration to the rest of the world, supporting the price of gold, the BTC continues to be somehow left behind the attention of investors. Considering high volatility on other financial markets, and general negative market sentiment, this might actually be good news for BTC....

Last week in the news Tariffs and inflation continue to be the major two words on the financial markets, shaping investors sentiment. The S&P 500 tried to start the week with a positive sentiment, but the two scary words spoiled the game, so the index ended the week almost flat, at the level of 5.282. On the other hand, the word “tariff” continues to strongly...

Market uncertainty continues to be supported with tariffs-narrative induced by US Administration and other world governments. The tariffs-war intensified between the US and China, bringing them to the level of absurdity. The fear of stagflation is for one more time active on financial markets. The 10Y Treasury yields ended one more week at higher grounds. They...

Tariffs is currently the only word that occupies investors' sentiment. Tariff- induced rhetoric of the US Administration and other world governments is strongly impacting market uncertainty, bringing high volatility to traditional markets. During this period, the price of gold significantly gained in value, strongly supported by tariffs-paradox. During the...

Tariffs-narrative continues to shape the sentiment of investors on the US equity markets. The high volatility continues to be the predominant way of price movements, ranging from deep pessimism to higher optimism. The reality is that no one is sure what to trade and in which direction. Markets are extremely unhappy in times of high uncertainty, like the...

Trade tariffs continue to be in the focus of the current market sentiment. A modest optimism was evident on the market, after the US Administration announced that for the majority of countries tariffs will be delayed for the next 90 days. China is not included in the list of countries with delayed tariffs. As for macro news posted during the previous week, some of...

During the first week of the general market sell-off, two weeks ago, the crypto market was sort of left behind investors' attention. However, the previous week brought some negative movements at the beginning of the week, which were diminished as of the weekend. The problem of margin calls from other traditional markets affected the crypto market at the start of...

Last week in the news Tariffs rollercoaster continued also during the previous week, with a glimpse of improved market sentiment. However, analysts are now questioning whether optimism is sustainable at this moment? The US Dollar significantly lost in value during the week, bringing the price of gold to its fresh, new all time highest level at $3.240. The US...