The US February inflation data were posted during the previous week, and with 0,2% for the month, was in line with market expectations. However, the negative effects of the US Administration related to tariffs were reflected in the Michigan Consumer Sentiment Index, which dropped in March below market estimate. What is concerning is that consumers are now...

Tariffs-on, tariffs-off game of the US Administration brought a lot of uncertainty among inventors during the previous period. Two weeks ago the price of gold had some short relaxation in order to continue its move toward the targeted $3K levels, which occurred during the previous week. The price of gold started Monday around levels of $2.880, while the highest...

The negative market sentiment on the US equity markets continued during the previous week, where Friday brought some relief. A lot of mixed economic news, as well as stories regarding new trade tariffs continued to shape the market sentiment. The US inflation in February was in line with market expectations of 0,2% in February. New jobs openings of 7,74M in...

Inflation figures in the US were in the market spotlight during the previous week. Posted data shows an inflation rate of 0,2% in February, bringing the yearly inflation to the level of 2,8%. The core inflation was also at the level of 0,2%, while its yearly level was standing at 3,1%. The new job openings in the US in January reached 7,74M which was above the...

There has been a higher volatility on the crypto market during the previous week. The markets are still making shiny steps toward the upside, influenced by the macro sentiment and potential negative effects of the trade tariffs. Uncertainty is still strong on financial markets, where BTC also belongs as now part of mainstream markets. During the week, BTC was...

Last week in the news Tariffs-on, tariffs-off continues to shape market sentiment. The US equity markets tried to cover some weekly losses, where S&P 500 ended the week at the level of 5.638, after the index reached its lowest weekly level at 5.508. Considering uncertainty, the price of gold reached another all time highest level at $3K. The US Dollar continues...

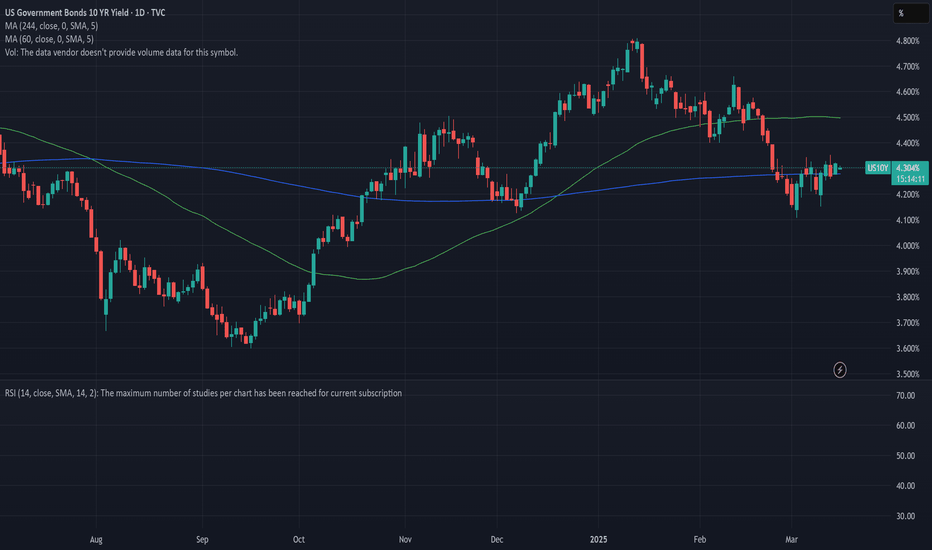

The roller coaster continues to be in the heart of financial markets during the previous period. The uncertainty over the trade tariffs, mixed macro data, Fed President Powell`s notes, all contributed to the strong shift in prices of assets across financial markets during the last few weeks. Previous week the 10Y US benchmark started with a lowest level of 4,10%...

Weakening US Dollar gave some space for gold to slow down its road toward the higher grounds. The uncertainty over the US Administration trade tariffs was a fuel for the price of gold to reach all time higher grounds in the previous period, but as the time of its final implementation is uncertain, as well as the level of tariffs, the gold took some time for a...

Since the establishment of financial markets there has been a market separation on bullish and bearish markets. Traders just invented the third option called the kangaroo market, in an attempt to describe recent developments of price movements. It refers to rare development of the price movements when the price of an asset goes strongly in one direction and then...

The Non-farm payroll figures were the ones that the market closely watched, posted on Friday. The NFP for February was 151K in February. The figure was slightly below the market estimate of 160K. The unemployment rate in February was 4,1%, by 1 pp higher from the previous month. The average hourly earnings increased by 0,3% for the month and 4% on a yearly basis....

In line with the general market sentiment, the price of BTC continues to move in a roller coaster mood. On Monday, BTC tried for one more time to reach the $95K resistance line, but was rejected, so the price reverted back. The lowest weekly level was $ 82K, where the price touched the MA200 level. For the rest of the week, BTC tried to sustain the $90K level, but...

Last week in the news The February US NFP data were below market expectations, however, the market sentiment is still highly under the influence of US trade tariffs. The US equity market had a correction during the previous week, with S&P 500 closing the week at the level of 5.770. The weakening of the US Dollar stopped further surge in the price of gold, but it...

Geopolitics were once again in the spotlight of market sentiment during the previous week. The uncertainty over the potential future increased tensions within the geopolitical sphere, pushed the US Treasury yields further to the lower grounds. Increased demand started with uncertainty over trade tariffs and currently is affected by politics. The funds from US...

The uncertainty is the one which brought almost all asset classes to the down side during the previous week. The price of gold was also the one that was hit by geopolitical uncertainty, trade tariffs and expectations on interest rate levels. The price of gold entered into a short term correction, when only on Friday’s trading session gold was down by 1%, ending...

The game of nerves could be one of descriptions of developments on the US equity markets during the previous week. It was a heavy week due to a significant drop in the value of the S&P 500 but also other US equity indexes. The index declined about 1% during the previous week, and 1,4% since the beginning of February. Friday brought back significant buyers, where...

The release of PCE data was the one closely watched by markets during the previous week. Released data show that the PCE Price Index reached 0,3% in January for the month and 2,5% on a yearly basis, which was in line with market expectations. The core PCE also reached o,3% in January. The personal income was higher by 0,9% for the month and personal expenditures...

As BTC entered into the mainstream markets, it was expected that the coin would start to react to all the news which affected the mainstream markets. As geopolitical risks arose again during the previous week, the price of BTC finally broke the side trading during the past period, and followed the market sentiment toward the downside. The first part of the week,...

Last week in the news Markets continue to be in an uncertain mood, impacted by geopolitics, trade tariffs, inflation and interest rate levels. A major correction occurred during the previous week, where the majority of financial assets ended the week with a stronger weekly loss. The US equity markets finished the week in red, with S&P 500 losing 1,4% since the...