SHAK - sector: services The stock marked a significant increase toward 60 level, At the moment 60 is a resistance level, but it is expected to become a support. The indicators (MACD&OBV) which are viewed on the chart as well as the volume support the proposed idea. I am waiting for a breakout above 60 with high trading volumes and an an approval candle before...

PEG – sector: utilities The stock marked a significant increase toward 60 level, resistance level:60 support level: 58.5 If the support level holds,I'll examine a long entry above the resistance level after an approval candle and and ofcourse a good volume. If/when the stock crosses this level, its face may be heading toward all the time high. This is not a...

XYL sector – industrial goods The stock jumed as a result of news about Jorge Gomez who's been elected to company’s board of Directors. jorge is highly experienced in managing money and extensive international business experience, and it seems that members of the board have high hopes for the development of the company. Following it for a long play above 80...

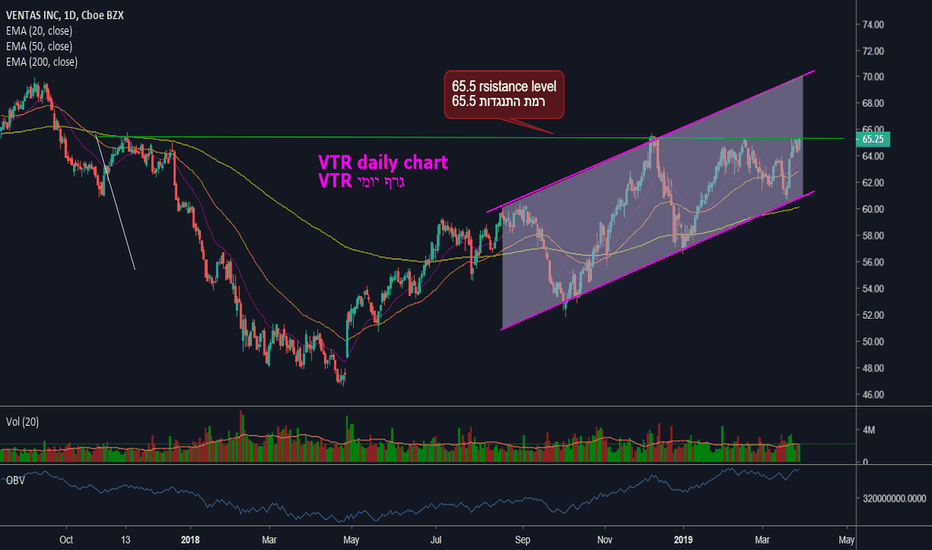

VTR – finance sector moving averages support the proposed direction: a moving average 20 is accompanies its up trend and a moving average 50 is below it resistance level at 65.50 first target would be 69 the volume is good, still, it wouldnt hurt to see more volume coming in. obv is high. in my opinion its worth following it above 65.5 if a breakout occurs, at...

CCEP - sector: consumer goods Is on a clear upward trend. level of resistance 50, first target would be 54 It can be seen that the upward trend is strengthening, meaning…money comes in… RSI is a bit high and obv is still low, so it might take some time. Without a doubt the market support and high trading volumes are needed here in order to breakout the round...

PII - consumer goods sector dealing in manufacture and marketing of a variety of SUVs and extreme sports The OBV signifies that money is getting out… also, it's just broke the lower bollinger band. planning short under 79.5 toward 75 level as a first target. following it for tomorrow. This is not a recommendation. as always, you are welcome to enlighten me, goodluck...

HRL - consumption industry Last month it released very positive financial statements. A clear level of resistance at each interval is at 44 The stock is on a major upward trend. RSI is not oversold, OBV is still low. also, note that the stock is trying to cross the upper bollinger strap. Following it for breaking the 44 level after I see a confirmation candle...

Abbv healthcare sector, is on a major upward trend the secondary trend is downward we see a double bottom at 77.5 which is a support area for now.. it has stopped at moving average 200 following it for a short play after an approval candle. will it break the resistance area with the help of the market? earnings - 29 april this is not a recommendation, as always,...

The main trend – consolidation. We can see a begin of an uptrend, looks like we have a strong resistance line at 48.5 area is forming a bull flag (triangle one). As said before, a critical point at 48.5 level. If we see a breakout, a supporter OBV and an appropriate RSI It is possible to examine an entery to a Long play after receiving a confirmation...

Companhia vale was in a downward trend that broke out. In other words, it has been upward trend in recent weeks. currently it is at a significant level around 12.5. we can see the gap down due to earnings. also, looks like buyers coming in given the fact that the volume is getting a bit higher. the suggested direction after approval candle shows up would be...

A nother critical week ahead we saw the market brokeout the 280 level - a false breakthrough arrived at a resistance area he had not met for over three months. Note, this time the market closed above the breakout candle. At the moment it is not possible to draw conclusions so why don't we keep follow it and mainly… lets stick to the trend.

InterXion Holding – Technology sector The company's earnings date is on March 6 clearly the major trend is upward OBV supports the proposed direction although RSI is relatively high.. The weekly (as well as the daily) chart has a strong resistance at 66.5 level (level of support – 64) waiting for march 6 (or sooner?) this week there is a chance of breaking out...

NRG a double top can be seen at 43 level so Its only a question of time till it'll breakout 43. the current support is at 40 level. Waiting for volume to come in… Moving average 20 accompanies its upward movement RSI isn't too high. following it for an entry above 43 after we see an approval candle. On my opinion…worth following its movement. this is not a...

Masco corporation - industrial goods sector reported positive quarterly results last month. Also, gapped up following good news about the company's operations. OBV supports the proposed direction, I need to see volume coming in...following it next week, looks like that over 40.5 might be a rellevant entry. hoping 39.5 will become a support level. the first...

NIO - a car manufacturer engaged in the design and development of electric and autonomous vehicles. already called "Tesla of China", looks promising to most opinions. OBV supports the proposed direction also, we have nice volume coming in. level 8.5 was resistance, now it is directed upwards, and will interest me especially above 10 towards 14 and beyond to the...

Spy …where to? (what a boring headline…) we are in an intermediate area clearly… the main trend is up in september we saw a the main trend being strengthened a secondary trend is declining the market stopped at a moving average 200 and since then has only gone up if the spy breaches the 280 level, there is a great chance of seeing a new high let's just wait for...

Alcoa published positive financial reports on 17.1.19 above expectations with a 5% increase in revenues. 30.5 area is a resistance – weekly and daily charts. If it crosses this level I'll consider an entry for a long play. The first target will be 34. increasing volume, OBV supports the proposed direction, RSI is still not in oversold area. this is not a...

AER - services sector 48.5 level is currently a clear resistance area yet, Increasing volume and a weekly chart shows a nice Bull Flag. If AER will cross the 48.5 level with high volume, its next target will be 50. note that in recent weeks it has been supported on a moving average 200 also, OBV currently supports the proposed direction, and the Bollinger bands...