YavuzAkbay

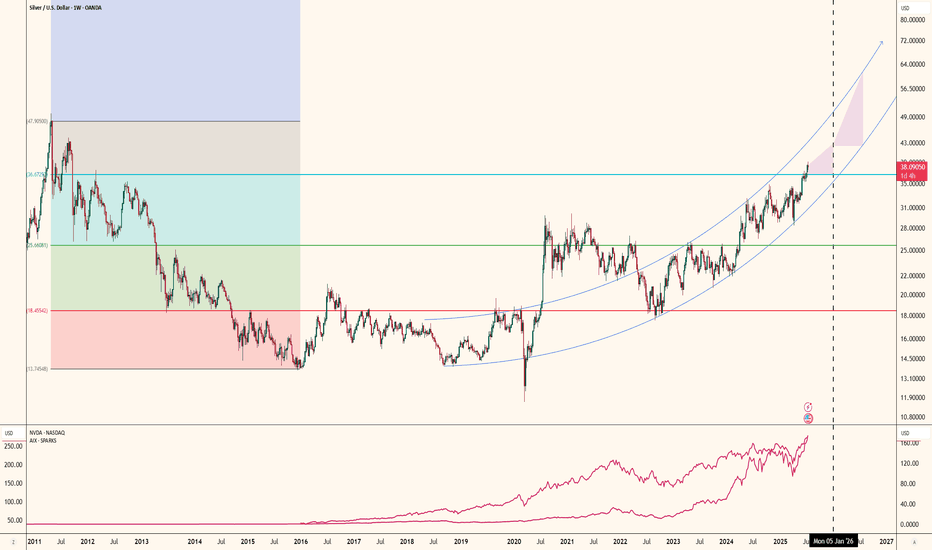

EssentialThe rise of artificial intelligence isn’t just shaking up tech companies it’s quietly transforming the global silver market in a big way. As major players like NVIDIA, Google and others ramp up their AI infrastructure silver is becoming more critical than ever. Why? Because silver, thanks to its unmatched electrical conductivity, plays a key role in powering the...

As Bitcoin continued its rise, altcoins couldn't keep up. This isn't the first time; the market has experienced this many times. The general pattern is as follows: 1. Global liquidity increases, providing a kind of spark to the market. 2. Bitcoin catches fire, and a bull market begins. If global liquidity increases during this time, great. 3. For various reasons,...

I have been trading for a long time using the DCA strategy indicator that I have developed and I have recently published the indicator on my Tradingview page. According to this indicator, I have been buying DOGEs at support levels with more money than I would have thrown away so far. This support level is generally seen at $0.056. In addition, I dumped some of...

Since 2013, the distance between each Bitcoin bottom and peak is approximately 205 weeks. Similarly, the distance between the peak and the bottom is approximately 52 weeks. In addition, when the Fibonacci correction is applied to each bear season, the new target appears to be the 1.618 region, so Bitcoin currently has the potential to run to 148k. As long as...

When a trend of the peaks that Bitcoin has made since 2016 is taken, we see that after each peak that uses this trend as resistance, Bitcoin enters a correction process up to the HP filter. Bitcoin, which has done this 3 times in history, is doing it right now. In addition, when I apply a Fibonacci analysis to each correction, I clearly see that Bitcoin is...

As an investor who likes to act with the DCA strategy, I have compiled the best buy zones for you by determining the support and resistance points for Solana on a weekly basis. I will explain why I named these buy zones in this way. $260 - $202.29 (Not Preferable): Since this level is the psychological resistance level where the previous ATH is located, I think...

Japan is a heavily regulated country in terms of the cryptocurrency market. Jasmy is a cryptocurrency that is seen as Japan's Bitcoin. A very clear cup and handle formation is seen in the weekly time frame. Jasmy, which rose after the handle breakout, still appears at the beginning of its rise. I think Jasmy needs to stay above the HP filter ($0.025) for this...

Fetch AI is doing a pretty good inverted head and shoulders pattern. As a big investor of FET I feel like we're going to hit $1.53 as long as we're not below $1.37.

In every analysis I have done over the years, I have said that I hold either gold or equities. I have never been in cash other than equities. These charts explain why. From 1884 to 1970, you could buy 1 SP500 share with an average of 0.74 gold or $14.75. So there is not much point in choosing between gold and the dollar during this period because the Bretton...

Whenever global liquidity increases, this liquidity increase fuels Bitcoin and supports Bitcoin's rise. This pattern has been continuing in the form of a sine wave since 2009. Global liquidity falls at certain times and rises at certain times. Since 2011, global liquidity has been rising in a low-speed trend, exceeding the previous peak each time it rose. Global...

In the long term, Bitcoin is in a logarithmic channel. The levels of this channel indicate how cheap and how expensive Bitcoin is. The aqua-colored channel represents the exceptionally cheap region that Bitcoin has never entered in history. The yellow channel has always represented times in history when Bitcoin has been cheap. Therefore, if the 62k level is broken...

If the $61,000 support is broken, there is a fair value gap down to $42.00. All traders should be cautious as volatility may reach maximum levels in this gap. This is also a sign that the double top pattern is working. The $61,000 support is very important.

In the long term, USDT dominance is in an uptrend. Within this trend, it often rises slowly, suppressing Bitcoin and altcoins, sometimes sideways, sometimes causing price declines. Then, with the sudden drops that follow, it puts Bitcoin and altcoins into a very sharp bull season. Right now, USDT is in an uptrend. I think that Bitcoin will enter a sideways channel...

I think that the indicator I have developed is working really well in sugar futures. From this point of view and due to the fact that sugar futures have a wedge, I think that there is an initial upside potential of 7% and then if the wedge is broken, I think that sugar futures can go up to $23.

The Nvidia share price has never risen so steeply. Each rise lasted about 30 months and was followed by an average correction of 50%. I think we are getting close to the next correction. It will be an excellent buying opportunity. But until then we can even see $160 because of the FOMO and the new investors who came after stock split.

As I always say, when I look at the ALT/BTC parity, not the Bitcoin price, I see a downward break in the 40th week of 2019. This breakdown may happen again, it is possible. After this breakout, I expect to see a scenario in which Bitcoin becomes in a channel. (70 - 50k) This scenario would also not be contrary to the macro perspective of the markets globally....

Near Protocol broke the upward trend and entered a negative mood. It also fell below the moving average. There is potential for a pullback to $4.66. Manage your risk well.

Home Depot is a stock that loves bull and bear divergences in technical terms. There have been 3 bullish divergences since 2022, all of which have brought an average return of around 25%. The last divergence is now in place and a potential 25% return would push the stock over $400.