Chart patterns are visual formations created by the price movements of a financial asset—like a stock, currency, or cryptocurrency, on a price chart. Traders use these patterns in technical analysis to predict future market direction based on historical behavior. The main chart patterns are the reversal and continuation patterns....

Over the past week, Bitcoin (BTC) has shown notable strength, forming an ascending triangle pattern, a typically bullish structure that often resolves to the upside. True to form, BTC has now broken out above the triangle's resistance, pushing higher with strong momentum. ------------------------------- Price target ascending triangle This breakout sets a...

In the past two days, Bitcoin has experienced an impressive surge in price, exploding from around 85k to over 94k, showing strong bullish momentum. This rapid movement has certainly caught the attention of many traders and investors. However, while the price action has broken through previous lower highs, signaling a potential shift in market sentiment, it's...

Gold has been in a strong and consistent uptrend, supported by macroeconomic uncertainty and a favorable risk environment. However, on the lower timeframes, price action is showing signs of temporary weakness following a sharp sell-off a few days ago. Currently, on the 4h chart, Gold appears to be forming a bearish continuation pattern, specifically a pennant....

About a week ago, Ethereum (ETH) saw a strong upward move, pushing the price up with notable momentum. Since then, it has entered a period of consolidation, trading within a tight range as the market awaits the next decisive move. ------------------------------- Which Direction Will ETH Break? After such a strong rally, this kind of consolidation is normal. It...

The British pound is currently moving towards the upside, showing a gradual but steady climb. However, it is approaching a significant resistance area that could pose a challenge to further gains. ------------------------------- Double top This resistance zone was previously a strong support level before the market formed a double top pattern and subsequently...

When it comes to trading, price action often takes the spotlight, but volume is the quiet force behind the scenes that tells the real story. Volume bars show how much trading activity occurs during a given time period and can offer valuable insight into the strength or weakness of a price move. In this guide, we’ll break down how to read volume bars, what the...

Since the end of October, the price of silver has been trading within a relatively tight consolidation range, fluctuating between $35 and $28.50. This range has now been tested multiple times on both ends, with the price touching the upper resistance and lower support levels twice, creating a well-defined horizontal structure in the market. During the most recent...

Introduction Ethereum has been in a sustained downtrend over the past weeks, struggling to gain any real bullish traction. After a sharp decline last Sunday, the market remains under pressure, and although we’ve seen short-term attempts to recover, the broader trend still points downward. Technical indicators and price structure suggest this may not be over, with...

Gold has been in a strong and sustained uptrend, showing impressive momentum with minimal pullbacks along the way. At the moment, Gold is forming a rising wedge pattern, which could indicate potential short-term downside price action. If we see a retracement from current levels, I’ll be watching closely for a long opportunity. A break below this rising wedge...

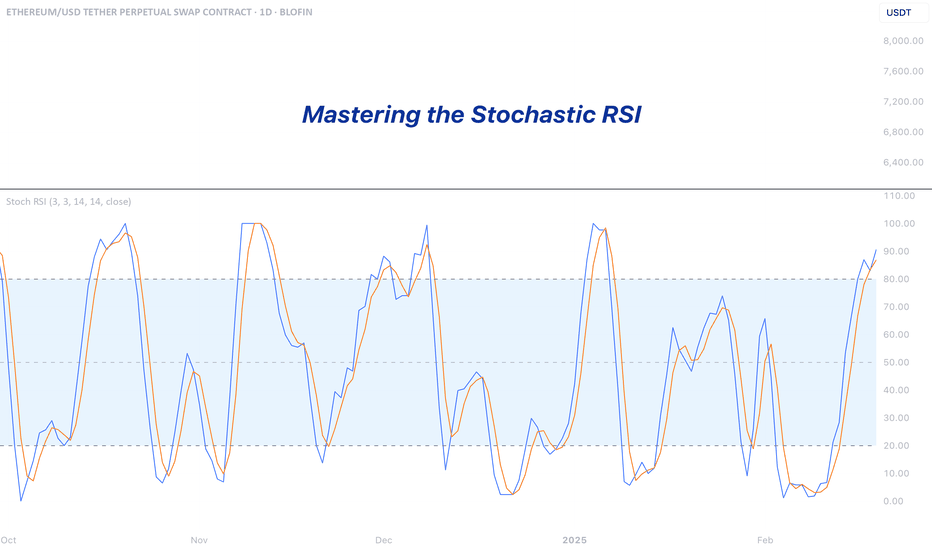

In todays overview, we will discuss the price action of BTC and what we could expect in the short-term. What will we discuss? - Bitcoin approaching key resistance - Daily trendline break - But no higher high yet - Stochastic RSI overbought on the daily timeframe - Defining the daily range - Downside targets within the range - Final...

Since February, the EUR/USD currency pair has been in a strong and sustained uptrend, signaling a significant shift in market sentiment. What began as a recovery from the 1.02 level has quickly turned into a strong bullish movement, with the pair already reaching as high as 1.15 in just a matter of two months. This impressive rally marks a clear change in...

Introduction Candlesticks are one of the most popular and widely used tools in technical analysis. They offer a visual representation of price movements within a specific time period, providing valuable insights into market trends, sentiment, and potential future price movements. Understanding candlestick patterns is crucial for traders, as these formations can...

The US Dollar Index (DXY) has been in a clearly defined downtrend over the recent period, showing consistent lower highs and lower lows. During its latest downward move, the DXY formed a 4-hour Fair Value Gap (FVG), which aligns with a significant gap in price action. This confluence of technical factors marks a strong rejection area, and from a trading...

Introduction The USD/JPY pair has been in a clear daily downtrend, marked by a bearish market structure and strong downside momentum. Sellers remain firmly in control, consistently driving prices lower as the pair respects the prevailing trend. Each failed recovery attempt only reinforces the bearish structure, suggesting that the path of least resistance...

Introduction In the world of technical analysis, momentum indicators are essential tools for understanding market sentiment and potential price movements. One such tool is the Stochastic RSI (Stoch RSI), a unique and highly sensitive variation of the traditional Relative Strength Index (RSI). While the standard RSI focuses on price, the Stoch RSI takes it a step...

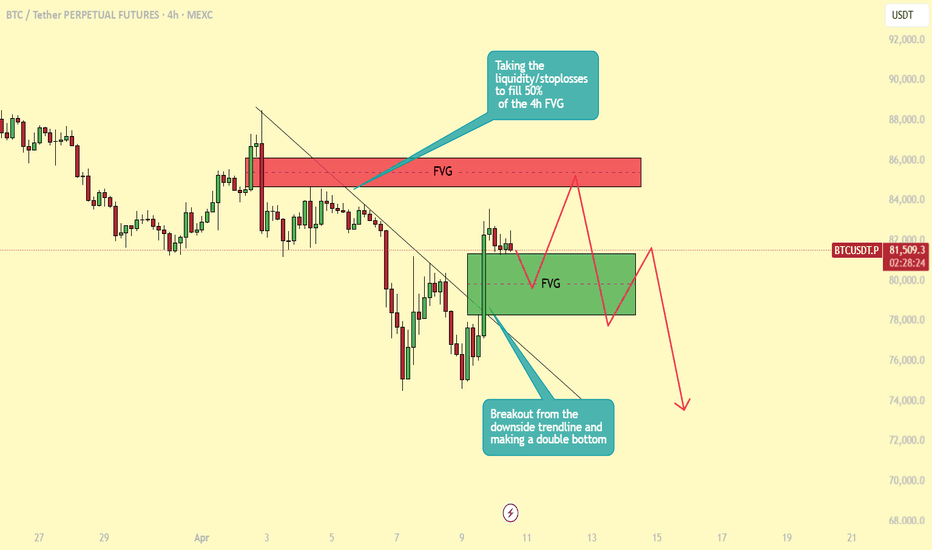

Yesterday, Bitcoin broke out of the descending trendline it had been respecting for several days, forming a clear double bottom in the process — a classic reversal pattern suggesting bullish intent. Since then, price action has shifted into a consolidation phase, hovering just beneath a key liquidity zone filled with stop-loss orders from prior short...

The AUD/USD pair has been in a clear and consistent downtrend on both the 4-hour and daily timeframes. Sellers have maintained firm control over price action, driving the pair lower while it continues to respect the prevailing bearish market structure. Each failed bullish attempt further validates the dominance of the bears, reinforcing the narrative that the path...