ZAR_Republic

EssentialThere seems to be huge demand for USD especially on the USDZAR pair. The pair has printed the lowest prices it will reach during the month of May 2025, and probably June 2025 as well. As such, we will be trading upwards from hereon.

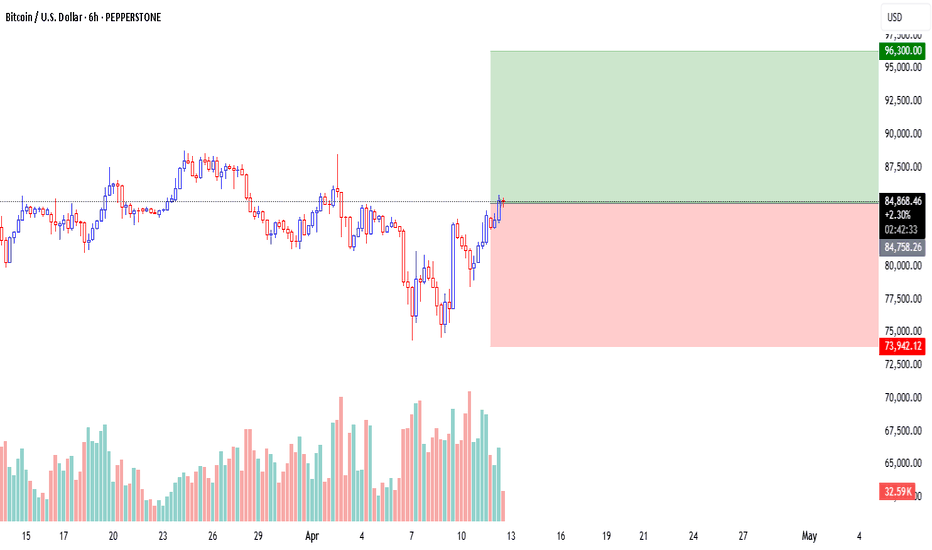

Buyers have stepped in and are absorbing all sales by shorts. BTC should trade higher during the following weeks.

Today's session marks the beginning of the bullish move higher to test the April 2024 WTI highs. The ultimate target seems to be around the 85.00 - 87.00 region. This move begins now and may possibly extend to the end of June or early July. The stop loss should be around the at least be 77.90. Stay tuned for updates.

Today's session marks the beginning of the retest of the April 2024 high. The ultimate target seems to be around the 162.215 level. This move begins now and may possibly extend to the end of June or early July. The stop loss should be around the 154 level. Stay tuned for updates.

Today's session marks the beginning of the second up-wave in soybeans. The ultimate target seems to be around the 1305–1310 level. This move begins now and may possibly extend to the end of June or early July. A wide stop is recommended to allow the trade to play out. A close beyond 1189 would nullify this trade, and losses should thus be taken. Stay tuned for updates.

Today's session marks the beginning of the second down-wave in lean hogs. The ultimate target seems to be around the 0.8300 level. This move begins now and may possibly extend to end of June or early July. The stop loss should be around the 0.92 level. Stay tuned for updates.

The unemployment rate and the federal funds effective rate are two important economic indicators that provide insights into the health of an economy, but they represent different aspects of economic activity. Unemployment Rate: The unemployment rate is a measure of the percentage of the labor force that is unemployed and actively seeking employment. It is a...

Please use the position tool to guide your entry and/or exit into the position. I will update the idea whenever necessary. Look forward to more profitable trading signals. Happy trading: You're welcome!

Please use the position tool to guide your entry and/or exit into the position. I will update the idea whenever necessary. Look forward to more profitable trading signals. Happy trading: You're welcome!

Please use the position tool to guide your entry and/or exit into the position. I will update the idea whenever necessary. Look forward to more profitable trading signals. Happy trading: You're welcome!

GBPUSD is possibly pricing in a pull-back to the 1.2150 level due to US Dollar weakness, and bullish market sentiment due to improvements in the Ukraine-Russia war and decreases in commodity prices due to slowing global economic activity, especially in China. Entry: any where above the stop Key level: observe trading @1.1800 - that is, increase the position if...