Zeiierman

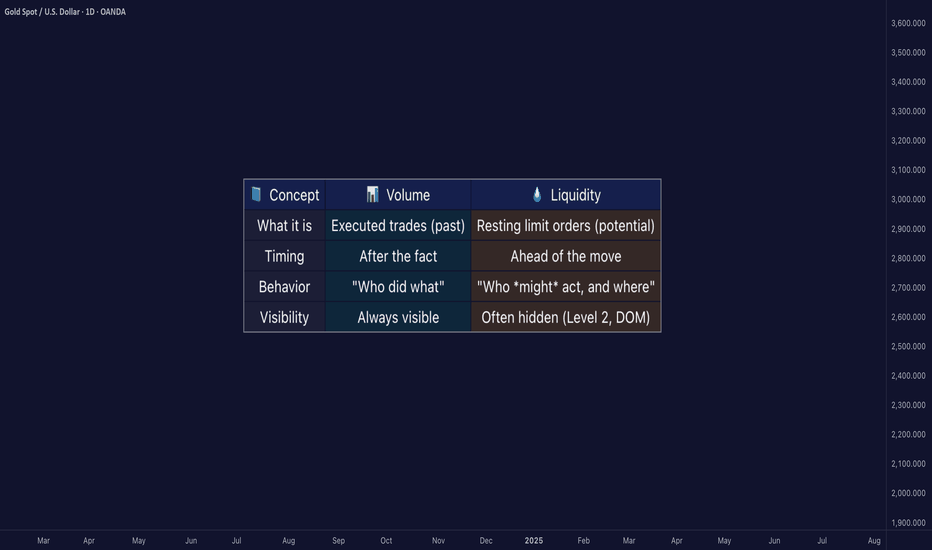

Premium█ Liquidity ≠ Volume: The Truth Most Traders Never Learn Most traders obsess over volume bars, but volume is the footprint, not the path forward. If you’ve ever seen price explode with no volume or fail despite strong volume, you’ve witnessed liquidity in action. █ Here’s what you need to know ⚪ Volume Is Reactive — Liquidity Is Predictive Volume...

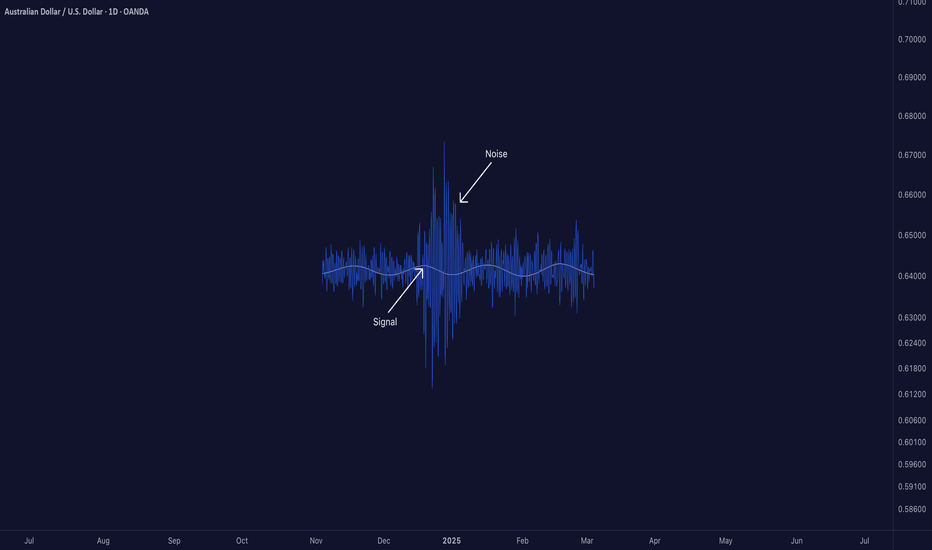

█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading Most traders obsess over indicators, signals, models, and strategies. But few ask the one question that defines whether any of it actually works: ❝ How strong is the signal — compared to the noise? ❞ Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why...

█ Why Your Backtest Lies: A Quant’s Warning to Retail Traders As a quant coder, I’ve seen it time and again: strategies that look flawless in backtests but fall apart in live markets. Why? One word: overfitting. Compare the signals in the images below. They’re from the same system, but one is overfitted, showing how misleading results can look when tuned...

Over the years, I’ve built strong connections with traders on the institutional side of the market. One of the most interesting individuals I met was a former trader at Lehman Brothers. After the collapse, he transitioned into an independent quant. I flew to Boston to meet him, and the conversations we had were eye-opening, the kind of insights retail traders...

█ My Story from the Inside I worked at a hedge fund in Europe, where I served as a Risk Advisor. One thing I never expected before joining the institutional side of the market was this: They didn’t treat the current day’s close as the "true" close of the market. Instead, they looked at the first hour of the next day — once all pending flows had settled,...

█ When Gut Feeling Beats the Bot: How Experience Can Improve Algorithmic Trading In today’s world of fast, data-driven trading, we often hear that algorithms and rules-based systems are the future. But what happens when you mix that with a trader’s intuition, the kind that only comes from years of watching charts and reading price action? A recent study has...

█ The Truth Behind Volume Bars — What Do Green and Red Actually Mean? Most traders learn early on that green volume bars mean bullish activity, and red bars mean bearish pressure. But is it really that simple? What does volume truly reflect, and are we making assumptions that can mislead us? █ What Volume Actually Is Volume represents the number of...

█ Head and Shoulders Pattern: Advanced Analysis for Beginners The Head and Shoulders pattern is one of the most widely recognized and reliable patterns in technical analysis. And today, I am going to teach you how to use it as efficiently as an experienced trader would. Learning to spot and trade this pattern can be a great asset in your tool belt —whether...

█ Mastering Volatile Markets Part 4: Why the Trend is Your Best Friend In Part 1 , we covered reducing position size. In Part 2 , we explored liquidity and execution strategies. In Part 3 , we discussed the power of patience over FOMO. Now,we're diving into one of the most important principles of all — especially in volatile, fast-moving markets: ...

█ Mastering Volatile Markets Part 3: Why Patience is Your Biggest Edge If you've read Part 1 about position sizing and Part 2 on liquidity , then you already know how to adapt to the mechanics of volatile markets. The next great tool in your arsenal will be patience. Your biggest opponent in wild markets is your own mind. In volatile markets, your...

█ Mastering Volatile Markets Part 2: Why Liquidity Makes or Breaks Your Trades If you've read the first part of this four-part series, you know that reducing position size is a key strategy for surviving volatile markets. The second crucial factor that determines success or failure in wild markets is understanding liquidity. In volatile markets, liquidity...

█ Mastering Volatile Markets Part 1: Why Reducing Position Size is Key Trading is always challenging, but how do you navigate today's markets? That's a whole different level. Today, we'll move away from the usual "Trump's tariffs are horrendous" discussions. We'll instead focus on how experienced traders profit in the current volatile market. Right now, we're...

█ Order Imbalance and Change Point Detection Trading might sometimes seem like magic, but at its core, the market operates on simple principles, supply and demand, and the flow of information. Recent academic work shows that retail traders can gain an edge even without expensive data feeds by understanding some fundamental ideas, like order imbalance and change...

█ The Final 15 Minutes: How Closing Auctions Determine Market Pricing Every trading day ends with one of the most crucial events in financial markets — the closing auction. While many traders focus on intraday price movements, understanding the dynamics of closing auctions can provide valuable insights and profitable trading opportunities. █ What Are Closing...

In today’s digital age, social media has become a cornerstone of information for nearly every aspect of our lives. From lifestyle tips to financial advice, influencers wield significant power over public sentiment. Among them are financial influencers, or "finfluencers," who share investment tips, stock picks, and market analyses. But how reliable is their advice?...

█ Understanding Short Sellers: Liquidity Providers or Market Disruptors? Short sellers often have a controversial reputation, viewed by many as market manipulators who profit from falling stock prices. However, recent research sheds light on an unexpected and valuable role they play: providing liquidity to the market, especially during critical moments like news...

█ Understanding Window Dressing: What It Is and Why It Happens At the end of every quarter or year, especially in December, some fund managers engage in a practice called window dressing. While it may sound like a holiday tradition, it’s actually a financial strategy designed to make a portfolio look more attractive to investors. Here's what you need to...

A Beginner-Friendly Guide to How Short Sales Indicate Buying Activity █ What is a Short Sale? A short sale is when someone sells a stock they don't actually own, usually because they believe the price will drop. They borrow the stock, sell it at the current price, and hope to buy it back later at a lower price to return to the lender. However, not all...