Zorroreny

PremiumCAKE is still in accumulation range. When looking at pattern we see similarities with BTC where CAKE has completed 1st impulse from the bottom and as long as we stay above fibb 0.236 S range we are ready for next impulse moving price higher, going for test of fibb 0.886 range where a bit of consolidation and then wick to new ATH to complete bigger impulse up.

BNC is oversold, has bullish divergence and pattern similar to XRP prior a reversal. Once we bounce and break local diagonal resistance line expect a strong push up to ATH range, with likely wick to fibb 1.272 extension. Rule as always - DCA secure profits on the way up, once you see confirmed bearish signals (divergence, overbought) be sure to be out and observe...

AUDIO is oversold, near longterm RSI support line and with pattern similar to AIOZ before it reversed and tested November 2021 pivot. I expect same move from AUDIO where next bounce up should break major diagonal resistance line and speed up toward fibb 0.886 range.

ACE is peforming poorly in last 3 years, hitting new lows but when comparing with some other alts (XPR for example) we see similar pattern in play where we can expect bounce up back to major diagonal resistance line aka fibb 0.5 range, consolidate a bit and then breakout to test November 2021 pivot (test which many alts have already done), possible even wick to...

ZEE is oversold, has longterm bullish divergencee and developed megaphone pattern were we bounced from the support line. Expecting push to test neckline and if we break trough it + quick test it from above we open path to test November 2021 pivot at 0.80$ range. That move would be similar to move that some other alts (example AIOZ) already did.

WNXM made a nice push from bottom and has now finally corrected. Question is - did we finish correction? Looking at indicators we see that we are oversold, we did ABC corrective structure after breaking diagonal resistance line - similar move to XRP. Currently we are sitting at old fibb 0.5 S/R range. Also we have inverted H&S pattern in the making. As long as...

WILD created megaphone pattern and dipped out of it. We are oversold and sitting at RSI support line. Whole pattern is similar to XRP where we had upward channel, dipped out of it and then created strong bounce leading to new ATH. I expect similar move from WILD but we need to bounce up asap to keep the power for strong impulse up. If we are to copy XRP move then...

WEST did initial impulse from the bottom and correction which seem to be complete. Pattern is similar to TARA before it reversed and tested last pivot high. If West is to do the same move then we can expect push to fibb 0.886 range, possible wick to ATH level followed by correction back to fibb 0.382 S/R range.

VELO dropping out of rising wedge. I expect one more capitulation dip, at least test of 2nd support line at fibb 0.236 range if not slightly bellow it. Similar move to one that XRP did. Once we do that we are ready to start next leg up which will lead to test of ATH range but can very well also push to fibb 1.272 extension.

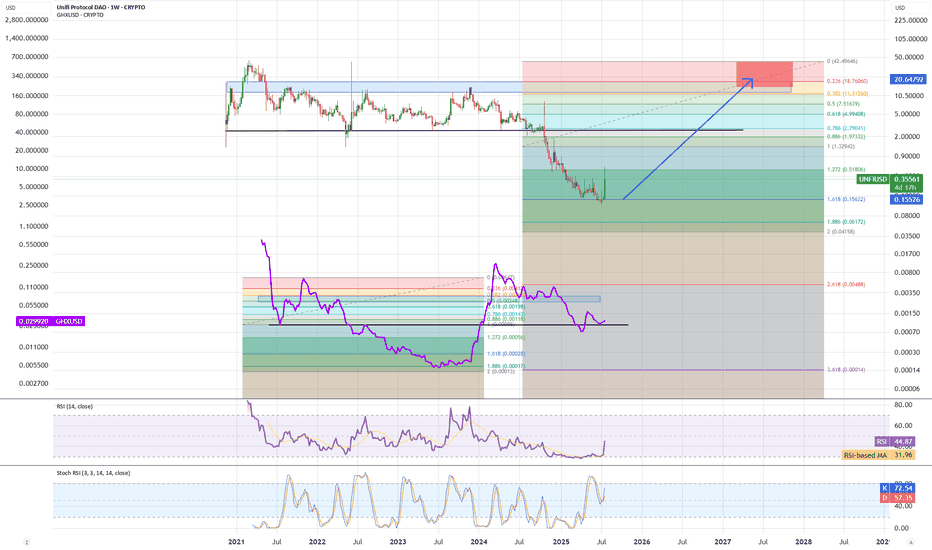

UNIFI started bouncing. Bottom is near if not already in. If whole crypto market goes crazy we can expect also these small alts to pop up. Looking at pattern there is similarity with GHX which once it reversed went to test October 2021 pivot, if UNIFI is to do the same move then we can expect push toward 20$ range where we have strong S/R zone, possible even wick...

TLOS made new local low and likely triggered lower targets. Indicators signaling oversold conditions so bounce up incoming but do not think this will be a reversal. I expect volatility in both directions from here and eventually we should get again test of fibb 0.236 pivot range.

TCP is oversold, with bullish divergence on local level. Whole pattern is similar AIOZ before it reversed and tested November 2021 pivot. Similar move from TCP would mean that we bounce here and start strong impulse leading to test of ATH range.

SUN did a correction of first impulse from the bottom and has formed Cup and Handle formation. For conformation we need to break out of handle formation. Technical target for this pattern is at 0.50$ range.

STRONG is getting ready to break out of falling channel. We have seen similar pattern on OM which resulted in run to new ATH. Expecting strong run once we break out of channel leading to test of ATH range and possible wick to fibb 1.272 extension.

STND did full impulse to downside, was oversold and created bullish divergence from which it started bouncing up. I expect further move up to develope zigzag pattern leading to test of fibb 0.886 range.

STMX is oversold with bullish divergence and pattern similar to XRP before it pumped to ATH. I expect strong bounce from STMX to break local diagonal resistance line and open path to major diagonal resistance line. Move can be violent and break in one go also major diagonal resistance line (like XRP did). DCA profits slowly on the way up - targets of interest are...

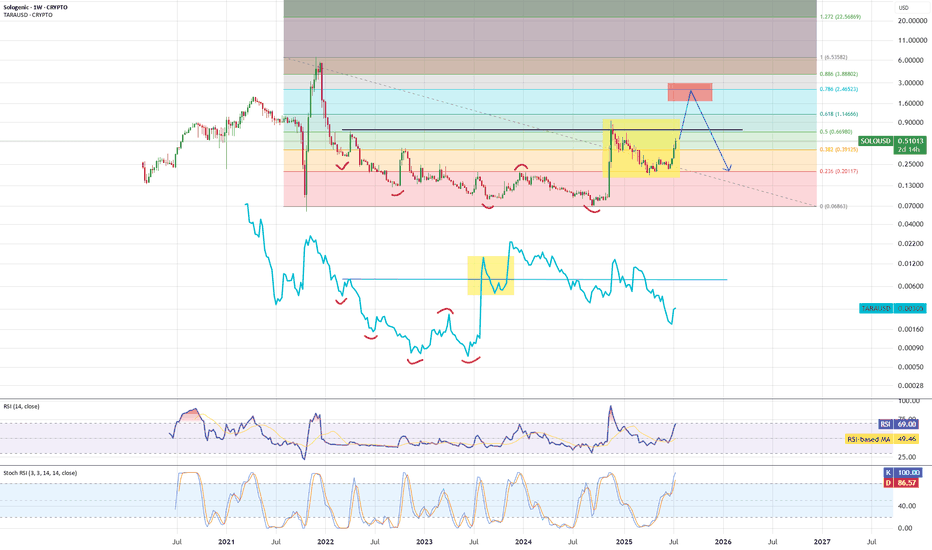

SOLO is using same algo as Tara and is now in last impulse up to reach fibb 0.786 range. Aftert that we will get a bigger correction - likely testing fibb 0.236 range so secure profits on time.

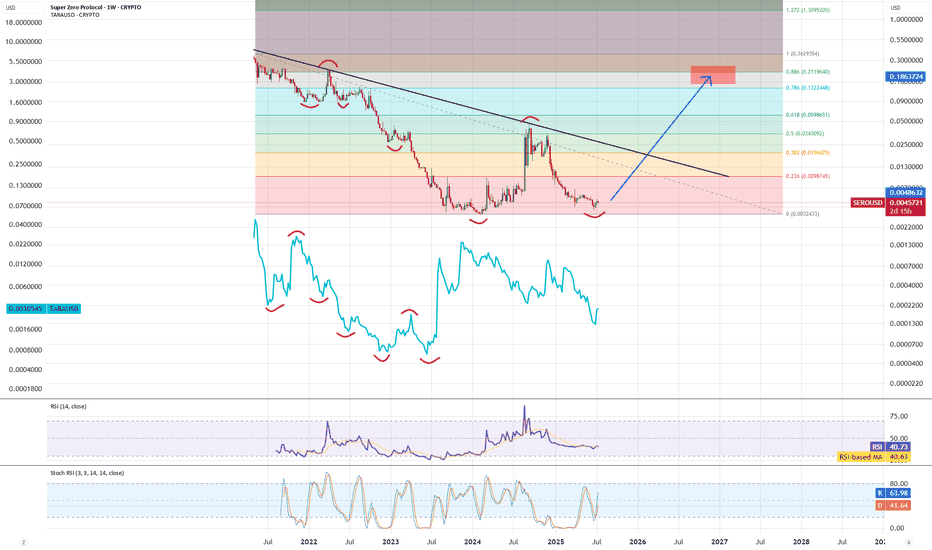

SERO did double bottom correction and has pattern similar to TARA. What should follow is strong impulse up leading to test of March 2022 pivot at fibb 0.886 range and then again bigger pullback.