alxiv

Rising wedge one month after breakout, if it breaks the resistance line that has been forming -- watch out below.

ENR showing three big rejections at resistance YTD. Dip coming again. ↘

$AMD has been in a downward trend since the beginning of '22. Reaching the its nadir in the beginning of July. As we approach that low again, confirmed by oversold RSI, look for a possible rebound back to 0.382 on the fibonachi ($84) off the August high.

Double bottom in AMD. The company is doing great, beating earnings estimates and chugging along. The macro turmoil has created a great buying opportunity for long term investors.

Since the turn of the year, everything has been dropping heavily in the wake of inflation, rates and worries of WWIII. RIOT reached levels it has not seen since late 2020. Comparing to BTC price.

A textbook double bottom is forming in AMC . With no particular news coming out today regarding the stock, this is a opportunity to add to your long position. Some good news could see this stock back to $33.05.

RIOT blockchain is one of the biggest publicly traded bitcoin mining operations and are approaching the lows we saw in May earlier this year, after breaking through support at $23. This is an attractive price to get in on for a long position. In the short term,if it reaches the may low, might see a retracement to 0.382 fib level

The favour of Bitcoin mining companies has been growing together with the increased adoption and recognition of CRYPTOCAP:BTC worldwide. Big whoop. See the accumulation/distribution since the May earnings report. What's interesting here is how tightly it follows the VIX . For the purpose of emphasis on this, the VIX chart at the top is inverted . At the...

A bullish wedge has been forming this year. With a positive earnings report first time in the company's history being made in November, the price is looking to break out of the wedge in the coming months. Bullish.

With AMC beating quarterly expectations twice in a row now, it is set for a further rally. We see a cup and handle forming inside the wedge that has been forming during the past quarter. Looking to bounce off the Fib levels and back above the 40s.

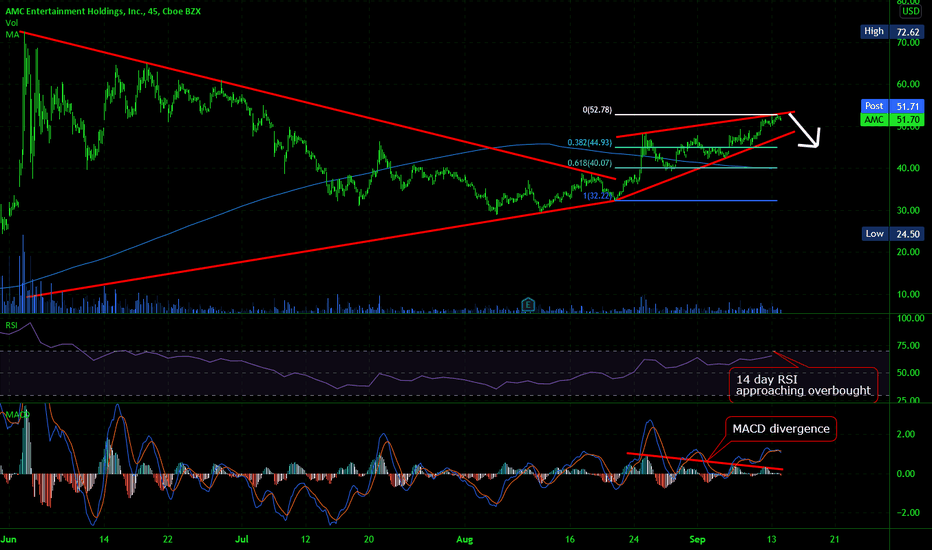

Since $AMC broke out of the huge wedge on the 20th of Aug, it has been forming a rising wedge approaching the low 50s. However, you can see the 14-day RSI is approaching overbought territory and there is a divergence in the MACD. This is a time to take profit or stock up on more once it reaches 45USD (0.382 fib level)

After Pfiser's booster shot approval this month, $MRNA will surely follow. Today, they announced a combined flu and COVID shot, as well as signing a multi-year deal with a manufacturer, National Risilience Inc, which will help reach its 2021 goal of delivering 800M-1B doses of its vaccine. This has got the stock soaring and the rim of the cup is forming as you...

A cup and a handle if I ever saw one! Diamyd has been reporting some great news lately: the Diamyd vaccine showing great results in clinical trials conducted in January this year , as well as getting their manufacturing plant ready for production of the vaccine! Notice the rising trend in accumulation/distribution, following along with the price action....

With the recent scare with the contaminated vials in Japan turning out to be bogus (black particles in the vial turned out to be pieces of rubber broken off from the rubber stopper on the vial when improperly inserting the needle before dosing the syringe), the stock is primed to break out of the wedge that has been forming since the early august all time high.

$NET has been in an uptrend since September '20, consolidating during October - April '21. In May it started forming the rising wedge pattern we see here, with the RSI being overbought and MACD forming a cross. Cloudflare made a lackluster Q2 report, which could trigger a reversal.

Since Q1'21 earnings, $NET has been ripping upwards, climbing steadily along the trendline and staying above the 30-day MA. Chaikin money flow indicating heavy buying pressure starting as of late May. Last week I observed a rising wedge forming in the chart: I'll be Looking to accumulate during the dips as the price breaks out of that wedge and bounces off...

With all the recent hype surrounding $MRNA coming from delta-variant and booster shots, coupled with a great Q2 report, the stock is now overbought and forming a head and shoulders pattern. Notice the RSI being overbought and MACD forming a cross, too.

Here we can see AMC repeating the descending wedge pattern, like it did two weeks ago. Note the MACD crossing and rising Chaikin money flow just like two weeks ago, slightly lower volume however. Could there be a breakout next week?