ameyadeshpande555

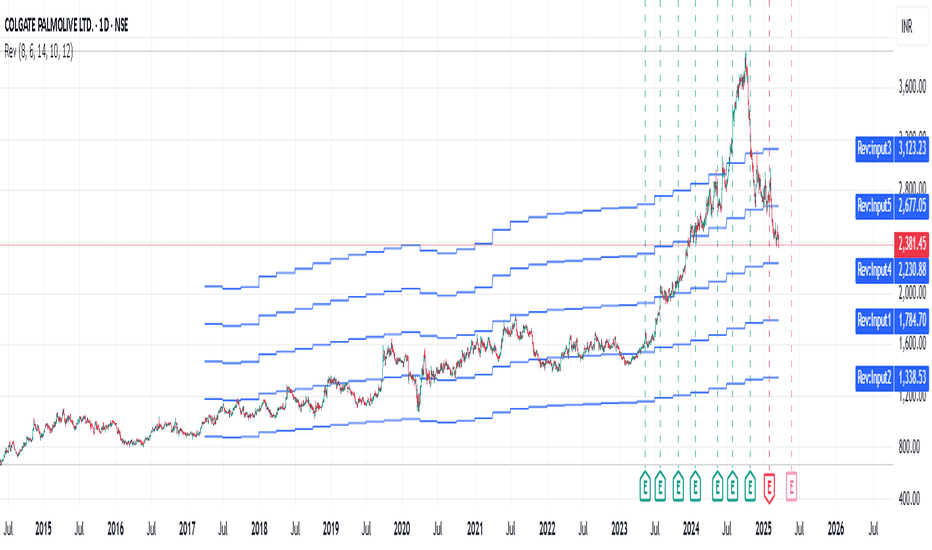

This is a clear case of raised valuations across most of the stocks. As seen in the Revenue Grid indicator, this stock was trading at 8 to 10 of Price to Revenue ratio, but from July 2023 it suddenly started going up and went to 18 times it's Revenue per share. Why? God knows! :) Now naturally coming back to it's historic valuation. To get to it's fair price,...

Nestle is trading at a little discount as compared to it's historic valuation for last 6-7 years. This is a growing stock, so it will be good to buy some shares now. Some details of it's strategies and products portfolio below - Happy Trading :) Over the past six to seven years, Nestlé India has demonstrated consistent revenue growth, driven by a combination of...

As seen in the Revenue Grid indicator, stock is currently trading at 2 to 2.5 times it's Revenue per share, which is a very low valuation historically. It crossed below this valuation, only at covid pandemic crash. Given the consistent Revenue increase, this is a fair value to buy for a long term view.

As per the Revenue Grid indicator, SBI is trading exactly at it's Revenue per share value. That means current price of 1 share is same as that of the revenue it is generating per share. Historically it has traded around this valuation. But given the steady growth of SBI over the years, This is a good price to buy for long term. Happy Trading :)

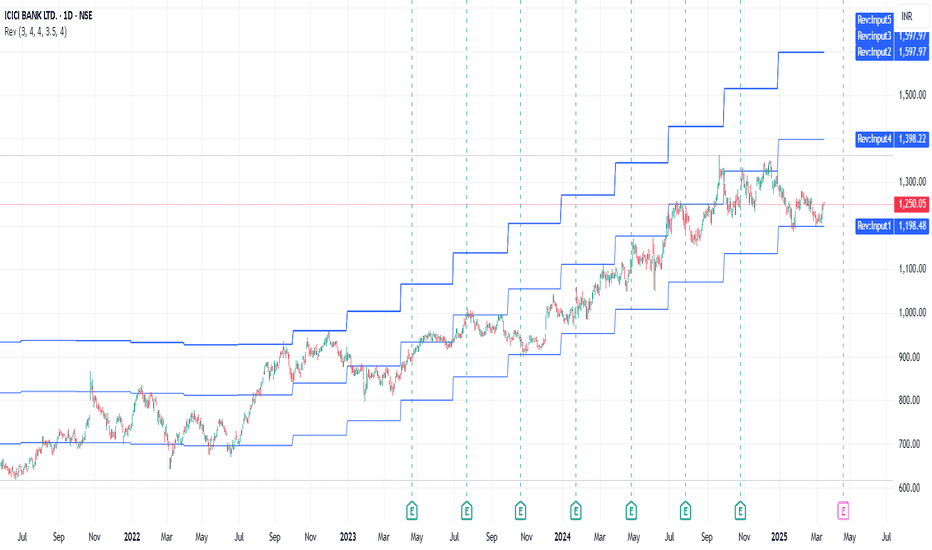

Since August 2021, ICICI Bank stock has been trading nicely between Revenue/share multiple of 3, 3.5 and 4. That means it is trading at 3 to 3.5 times it's revenue per share. It is clearly visible using Revenue Grid Indicator applied on daily chart. As per that, this is a good time to buy for a long term view. We can wait for 21 Apr 2025 for it's next earnings...

According to the Revenue Grid indicator, stock is trading around the revenue per share of 5.5. It went above this valuation level around Oct, 2017, never to return back to it. It crossed it only at the time of market crash caused by Covid virus pandemic in 2020. So this is definite buy here.